Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

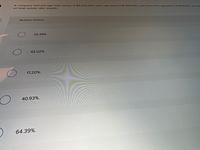

Transcribed Image Text:A company had average total assets of $3,225,000, total cash flows of $1,320,000, cash flows from operations of $554700, and ca

on total assets ratio equals:

Multiple Choice

26,36%.

42.02%.

17.20%.

40.93%.

64.39%.

Transcribed Image Text:h flows of $1.320.000, cash flows from operations of $554,700, and cash flows for plant assets of $850,000. The cash flow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the following financial information, this firm's total debt to total capital ratio is closest to: Cash $ 10,000 Accounts payable $ 30,000 Accounts receivables 50,000 Notes payable 20,000 Inventories 150,000 Total current liabilities $ 50,000 Total current assets $210,000 Long-term debt 50,000 Net fixed assets 90,000 Common equity 200,000 Total assets $300,000 Total liabilities & equity $300,000 Question 35 options: 8% 17% 67% 26%arrow_forwardIf a gain of $8,077 is realized in selling (for cash) office equipment having a book value of $59,041, the total amount reported in the investing activities section of the statement of cash flows is?arrow_forwardDillin Inc. reported the following on the company’s statement of cash flows in 20Y2 and 20Y1: Line Item Description 20Y2 20Y1 Net cash flows from operating activities $435,300 $416,000 Net cash flows used for investing activities (429,000) (380,000) Net cash flows used for financing activities (43,000) (60,000) Of the net cash flows used for investing activities, 70% was used for the purchase of property, plant, and equipment. a. Determine Dillin’s free cash flow for both years. Line Item Description 20Y2 20Y1 Free cash flow fill in the blank 1 of 2$ fill in the blank 2 of 2$arrow_forward

- The year-end balance sheet of Star Inc. shows total assets of $12,407 million, operating assets of $9,849 million, operating liabilities of $5,291 million, and shareholders’ equity of $5,532 million.The company's year-end net operating assets are: Select one: a. $9,849 million b. $17,698 million c. $15,140 million d. None of these are correct. e. $4,558 millionarrow_forwardPlease show working.arrow_forwardA company reported net income of $250,000. Beginning balances in Accounts Recelvable and Accounts Payable were $20,000 and $21,000 respectively. Ending balances in these accounts were $10,500 and $29,000, respectively. Assuming that all relevant information has been presented, what is the company's net cash flows from operating activities? Multiple Cholce $259,500. $232,500. $267,500. $250,000.arrow_forward

- 10. Umlauf Corporation had $237,190 of net operating cash inflows, total cash inflows of $866,010 and average total assets of $4,865,225. Its cash flow on total assets was: O A. 4.9% В. 17.8% ОС. 20.5% OD. 48.8% O E. 95.1%arrow_forwardThe following are excerpts from Hamburg Company’s statement of cash flows and other financial records. From Statement of Cash Flows: Cash flows from operating activities $433,104 Cash flows from investing activities -13,381 Cash flows from financing activities -221,035 From other records: Capital expenditure costs 18,547 Cash dividend payments 12,864 Sales revenue 465,762 Total assets 446,698 Compute free cash flow.arrow_forwardOgden Corporation has a projected balance sheet that includes the following accounts. What is the projected cash balance? Cash $ ? Marketable securities 405,000 Accounts receivable 980,000 Inventory 785,000 Non-current assets, net 2,110,000 Total liabilities 1,636,000 Total equity 3,220,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education