FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

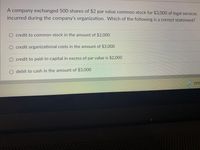

Transcribed Image Text:A company exchanged 500 shares of $2 par value common stock for $3,000 of legal services

incurred during the company's organization. Which of the following is a correct statement?

O credit to common stock in the amount of $2,000

O credit organizational costs in the amount of $3,000

O credit to paid-in-capital in excess of par value is $2,000

O debit to cash in the amount of $3,000

79°F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format ?arrow_forwardboard emaining Time: 1 hour, 12 minutes, 24 seconds. uestion Completion Status: OD.Does not affect total equity, but transfer amounts between the components of equity. QUESTION 4 What is the total amount of cash and other assets the corporation receives from its stockholders in exchange for its stock? O A. It always equal the stated value. O B. It always equal the par value. O C. It is referred to as paid-in capital. D. It is always below the stated value. QUESTION 5 Use the following company information to calculate net cash provided or used by investing activities: (1) Equipment with a book value of $131.250 and an original cost of $225,000 was sold at a loss of $12.750. (2) Paid $46,500 cash for a new truck. (3) Sold land costing $24,000 for $27.000 cash, realizing a $3,000 gain. LA Dchsend troseuncctock for SA5 750ench Click Save and Submit to save and submit. Click Save All Answers to save all answers. hparrow_forwardAn inexperienced accountant for Blue Spruce Corp. made the following entries. July 1 Sept. 1 Cash Date Common Stock (Issued 32,000 shares of no-par common stock, stated value $8 per share) Common Stock Retained Earnings Cash (Purchased 4,000 shares issued on July 1 for the treasury at $16 per share) Account Titles and Explanation 290,000 Debit 30,000 34,000 On the basis of the explanation for each entry, prepare the entry that should have been made for the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 290,000 64,000 Creditarrow_forward

- Ashviniarrow_forwardPURRFECT PETS, INC. Balance Sheet at June 30, Year 1 Assets Liabilities Cash $ 732,700 Accounts Payable $ 349,100 Accounts Receivable 419,300 Notes Payable due June 30, Year 3 268,900 Supplies 58,410 Total Liabilities 618,000 Equipment 118,600 Other Assets 69,410 Stockholders' Equity Common Stock 662,000 Retained Earnings 118,420 Total Stockholders' Equity 780,420 Total Assets $ 1,398,420 Total Liabilities & Stockholders’ Equity $ 1,398,420 How much financing did the stockholders of Purrfect Pets, Inc., directly contribute to the company?arrow_forwardThe following journal entries are found in a corporation's ledger: 11/15/17 Cash dividends 44,500 Cash dividends payable 44,500 1/15/18 Cash dividends payable 44,500 Cash 44,500 Which of the following statements is true? Select one: a. The date of record is 11/15/17. b. The date of payment is 11/15/17. c. The declaration date is 12/31/17. d. The date of payment is 1/15/18.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwarda. Journalize the following transactions: i. January 10. Received cash from three incorporators for 75,000 shares of common stock, $375,000.00. R1-3. ii. iii. iv. V. vi. vii. viii. ix. January 10. Paid cash to Aaron Lovell as a reimbursement for organization costs, $10,000. C1. Value of Preferred Stock January 10. Received a subscription from Amory Lin for 10,000 shares of common stock, $50,000.00. M1. Total Amount of Dividends January 15. Received cash for the face value of a 5-year, 10%, $1,000.00 par value bond issue, $50,000.00. R11. January 25. Received a subscription from Peter Lavine for 8,000 shares of common stock, $40,000.00. M2. February 14. Received cash from Amory Lin in partial payment of stock subscription, $25,000. R4. March 15. Paid cash to Peter Lavine for 500 shares of common stock at $10.00 per share. C112. March 20. Received cash from Amory Lin in final payment of stock subscription, $25,000.00. R5. b. At the end of the year, Al-Can Products, Inc. had issued…arrow_forwardThe following correctly prepared entries without explanations pertain to Corners Corporation. Event Number 1. 2. Credit 1,100,000 700,000 40,800 Treasury stock. 33,600 Paid-in capital in excess of cost of treasury stock 3,400 The original sale (Entry 1) was for 600,000 shares, and the treasury stock was acquired for $6 per share (Entry 2). 3. Cash Account Title Common stock Paid-in capital in excess of par value. Treasury stock Cash Cash Debit 1,800,000 40,800 37,000 Required a. What was the sales price per share of the original stock issue? b. How many shares of stock did the corporation acquire in Entry 2? c. How many shares were reissued in Entry 3? d. How many shares are outstanding immediately following Entries 2 and 3, respectively?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education