FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:0:56 7

one

UNCC Canvas

McGraw Hill Connect Di

ezto.mheducation.com/ext/map/index.html

Google Calendar

pomework

0

Date of Purchase

January 10

January 18

Totals

Required information

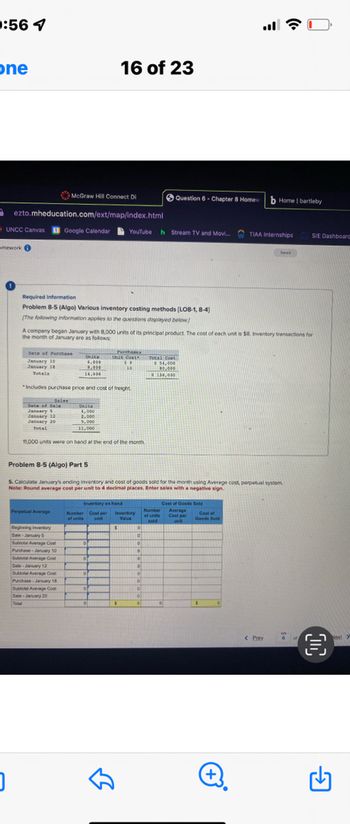

Problem 8-5 (Algo) Various inventory costing methods (LO8-1,8-4)

[The following information applies to the questions displayed below)

Total

Sales

Date of Sale

January 5

January 12

January 20

Total

Perpetual Average

Unita

6,000

1.000

14,000

Includes purchase price and cost of freight

A company began January with 8,000 units of its principal product. The cost of each unit is $8. Inventory transactions for

the month of January are as follows

Unita

4,000

2,000

5,000

11,000

Beginning Inventory

Sale January 5

Subtotal Average Cost

Purchase January 10

Sublotal Average Cost

Sale-January 12

Subtotal Average Co

Purchase January 18

Subtotal Average Cost

Sale-January 20

11,000 units were on hand at the end of the month

16 of 23

of

0

of

YouTube h Stream TV and Movi....

.

Problem 8-5 (Algo) Part 5

5. Calculate January's ending Inventory and cost of goods sold for the month using Average cost, perpetual system.

Note: Round average cost per unit to 4 decimal places. Enter sales with a negative sign.

Invertory es hand

Number Cost per Inventory

of units unit

Value

$

of

0

Purchases

Unse Couth

**

10

لك

$

Question 6 - Chapter 8 Homew

0

D

D

10

10

.

0

0

0

0

#

0

Total Coas

$ 54,000

100,000

$ 130,000

Number

of units

sold

Cost of Goods Sold

Average

Cost per

Cost of

Goods Sold

b Home I bartleby

TIAA Internships

+

Seved

< Prev

C

SIE Dashboard

6

O

Next Y

Expert Solution

arrow_forward

Step 1

Ending inventory refers to the value of the inventory which is remained at the end of the accounting year or period and it is a very vital metric for the company that indulge in selling the goods to the customers. In short, it is amount of stock which is remaining at the end of year.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Archer Industries prepares quarterly financial statements. During the fourth quarter the following occurred: Purchases: Quantity 9,000 units* 21,000 units 24,000 units 10,000 units 64,000 units Unit Value Total Value $ 54,000 168,000 240,000 160,000 $622,000 $6/u $8/u Oct. 1. Oct. 10 Nov. 20 $10/u Dec. 30 $16/u Available *Beginning Inventory Sales: Unit Value Quantity 11,000 units 10,000 units 31,000 units 52,000 units Total Value Oct. 18 Nov. 12 Dec. 21 Units Sold 18/u $198,000 200,000| 775,000 $1,173,000 20/u 25/u The tax Selling and administrative expenses for the period were $359, 000. rate is 30 percent. A. Calculate the value of ending inventory, the cost of goods sold, and determine reported income (after taxes) under the LIFO periodic method: Optional Work Space For Calculations Ending Inventory Cost of Goods Sold Net Income After Taxes B. If the company had been on the FIFO method, how much more or less would it have paid in income taxes? C. Determine the maximum amount Archer…arrow_forward[The following information applies to the questions displayed below.] A company began January with 4,000 units of its principal product. The cost of each unit is $7. Inventory transactions for the month of January are as follows: Date of Purchase January 10 January 18 Totals * Includes purchase price and cost of freight. Date of Sale January 5 January 12 January 20 Total Average Cost Total Sales Beginning Inventory Purchases: January 10 January 18 Units 3,000 4,000 7,000 Units 5,000 units were on hand at the end of the month. 4. Calculate January's ending inventory and cost of goods sold for the month using Average cost, periodic system. 2,000 1,000 3,000 6,000 Number of units Purchases Unit Cost* $8 9 Cost of Goods Available for Sale Unit Cost 4,000 $7.00 3,000 $8.00 4,000 $9.00 11,000 Cost of Goods Available for Sale $ 28,000 Total Cost $ 24,000 36,000 $ 60,000 24,000 36,000 $ 88,000 Answer is not complete. Cost of Goods Sold - Average Cost Number of units sold 77,000 X Average Cost…arrow_forwardA company began January with 6,000 units of its principal product. The cost of each unit is $8. Inventory transactions for the month of January are as follows: Date of Purchase Purchases Units Unit Cost* Total Cost January 10 5,000 $ 9 $ 45,000 January 18 6,000 10 60,000 Totals 11,000 $ 105,000 * Includes purchase price and cost of freight. Sales Date of Sale Units January 5 3,000 January 12 2,000 January 20 4,000 Total 9,000 8,000 units were on hand at the end of the month. 2. Calculate January's ending inventory and cost of goods sold for the month using LIFO, periodic system.arrow_forward

- A company began January with 4,000 units of its principal product. The cost of each unit is $7. Inventory transactions the month of January are as follows: Date of Purchase January 10 January 18 Totals * Includes purchase price and cost of freight. Date of Sale January 5 January 12 January 20 Total Perpetual Average Sales Beginning Inventory Sale - January 5 Subtotal Average Cost Purchase - January 10 Subtotal Average Cost 5,000 units were on hand at the end of the month. Sale - January 12 Subtotal Average Cost Units 3,000 4,000 7,000 Units 2,000 1,000 3,000 6,000 5. Calculate January's ending inventory and cost of goods sold for the month using Average cost, perpetual system. Note: Round average cost per unit to 4 decimal places. Enter sales with a negative sign. Number of units Purchases Unit Cost* $8 9 10,000 4,000 2,000 X 6,000 3,000 9,000 1,000 X Inventory on hand Cost per unit 7.0000 $ 28,000 0 8.0000 Answer is not complete. Inventory Value 28,000 24,000 52,000 Total Cost $…arrow_forwardAssume the following events for a month for Company X: Beginning Balance of Inventory is 400 Units and the cost is $ 200 per Unit. October 5 Company X purchases 400 Units at a cost of $220 per Unit. October 9 Company X sells 600 units for $500 per Unit. October 17 Company X purchases 200 Units at a cost of $230 per Unit. October 27 Company X sells 300 units for $500 per Unit. October 29 Company X purchases 200 units for $250 per Unit. Use this data to answer all questions. Using FIFO Periodic, what is the Gross Profit for October?arrow_forward! Required information [The following information applies to the questions displayed below.] A company began January with 8,000 units of its principal product. The cost of each unit is $9. Inventory transactions for the month of January are as follows: Date of Purchase January 10 January 18 Totals Total Date of Sale January 5 January 12 January 20 Total Includes purchase price and cost of freight. Perpetual FIFO: Sales Beginning Inventory Purchases: January 10 January 18 Units 5,000 8,000 13,000 11,000 units were on hand at the end of the month. Units 3. Calculate January's ending inventory and cost of goods sold for the month using FIFO, perpetual system. 3,000 3,000 4,000 10,000 5,000 8,000 21,000 Purchases Unit Cost* $ 10 11 Cost of Goods Available for Sale Cost of Number Unit Goods of units Cost Available for Sale 8,000 $9.00 $ 72,000 10.00 11.00 Total Cost $ 50,000 88,000 $ 138,000 50,000 88,000 $ 210,000 Cost of Goods Sold - January 5 Number of units sold 0 0 0 Cost per unit $…arrow_forward

- Required information [The following information applies to the questions displayed below.] A company began January with 7,000 units of its principal product. The cost of each unit is $6. Inventory transactions for the month of January are as follows: Date of Purchase Units Purchases Unit Cost* Total Cost January 10 6,000 $7 January 18 7,000 8 $ 42,000 56,000 Totals 13,000 $ 98,000 *Includes purchase price and cost of freight. Sales Date of Sale Units January 5 3,000 January 12 1,000 January 20 4,000 Total 8,000 12,000 units were on hand at the end of the month. 5. Calculate January's ending inventory and cost of goods sold for the month using Average cost, perpetual system. Note: Round average cost per unit to 4 decimal places. Enter sales with a negative sign. Answer is not complete. Inventory on hand Cost of Goods Sold Perpetual Average Cost Number per of units Inventory Value unit Number of units sold Average Cost per Cost of Goods unit Sold Beginning Inventory 7,000 6.0000 ( $…arrow_forwardDomesticarrow_forwardFrigid Supplies reported beginning inventory of 200 units, for a total cost of $2,000. The companyhad the following transactions during the month:Jan. 3 Sold 20 units on account at a selling price of $15 per unit.6 Bought 30 units on account at a cost of $10 per unit.16 Sold 30 units on account at a selling price of $15 per unit.19 Sold 20 units on account at a selling price of $20 per unit.26 Bought 10 units on account at a cost of $10 per unit.31 Counted inventory and determined that 160 units were on hand.Required:1. Prepare the journal entries that would be recorded using a periodic inventory system.2. Prepare the journal entries that would be recorded using a perpetual inventory system,including any “book-to-physical” adjustment that might be needed.TIP: Adjust for shrinkage by decreasing Inventory and increasing Cost of Goods Sold.3. What is the dollar amount of shrinkage that you were able to determine in (a) requirement 1,and (b) requirement 2? Enter CD (cannot determine) if…arrow_forward

- 3. Calculate January's ending inventory and cost of goods sold for the month using FIFO, perpetual system.arrow_forwardVikrambahiarrow_forwardLaker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 275 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning inventory. t 3 of 3 Date January 1 Activities January 10 January 20 kipped January 25 January 30 Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 175 units @ $ 10.00 = 130 units @ 275 units @ 580 units Units sold at Retail $ 1,750 135 units @ $ 19.00 $ 9.00 = 1,170 140 units $ 19.00 $ 7.00 = 1,925 $ 4,845 275 units eBook Record journal entries for Laker Company's sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and FIFO. All sales and purchases are made on account, and no discounts are offered. View transaction list View journal entry worksheet No 1 Date January 10 General Journal Accounts receivable Sales 2 January 10 Cost of goods sold…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education