FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

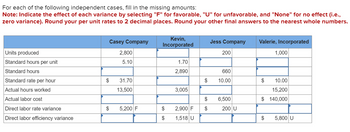

Transcribed Image Text:For each of the following independent cases, fill in the missing amounts:

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e.,

zero variance). Round your per unit rates to 2 decimal places. Round your other final answers to the nearest whole numbers.

Units produced

Standard hours per unit

Standard hours

Standard rate per hour

Actual hours worked

Actual labor cost

Direct labor rate variance

Direct labor efficiency variance

Casey Company

2,800

5.10

$

$

31.70

13,500

5,200 F

Kevin,

Incorporated

$

$

1.70

2,890

3,005

2,900 F

1,518 U

$

$

$

Jess Company

200

660

10.00

6,500

200 U

Valerie, Incorporated

$

1,000

10.00

15,200

$ 140,000

$

5,800 U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Meaning of Variance Analysis and its Advantages :

VIEW Step 2: Calculation of missing cells for Casey Company :

VIEW Step 3: Calculation of missing cells for Kevin Incorporated :

VIEW Step 4: .Calculation of missing cells for Jess Company :

VIEW Step 5: .Calculation of missing cells for Valerie Incorporated :

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward3. Compute the direct labor variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Rate per hour" answers to two decimal places.) The drop down options under "actual cost" "standard cost" and the middle box for the first row are: actual rate, standard rate The drop down options for the left bottom 3 rows are: total variable overhead cost variance, variable overhead efficiency variance, variable overhead spending variance, volume variance, direct material variance, Direct labor efficiency variance, direct labor rate variance, direct materials price variance, direct materials quantity variance. the drop down options for the right yellow 3 columns are: favorable, unfavorable, no variance please use the exact format as shown in photos. Thank you !arrow_forwardBest, Inc. uses a standard cost system and provides the following information. (Click the icon to view the information.) variable overhead, $3,800; actual fixed overhead, $3, 500; actual direct labor hours, 1,400. Read the requirements. Data table Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standardco \table [[,, Formula,Variance], [VOH cost variance, = , 1 = , ], [VOH efficiency variance, =,1 =, 0arrow_forward

- please do not Give image formatarrow_forwardA company reports the following information for its direct labor. Actual hours of direct labor used Actual rate of direct labor per hour Standard rate of direct labor per hour Standard hours of direct labor for units produced AH = Actual Hours SH = Standard Hours AR = Actual Rate SR Standard Rate 72,000 $ 15 $ 13 73,800 Compute the direct labor rate and efficiency variances and identify each as favorable or unfavorable. Actual Cost Standard Costarrow_forwardSelect all that were the source for the Indirect Costs favorable efficiency variance. a. Actual indirect costs per direct labor hour was less than budgeted indirect cost per direct labor hour. b. Actual indirect costs per direct labor hour was greater than budgeted indirect cost per direct labor hour. c. Actual number of jobs completed was less than budgeted number of jobs. d. Actual number of jobs completed was greater than budgeted number of jobs. e. Actual number of direct labor hours per job was less than budgeted direct labor hours per job. f. Actual number of direct labor hours per job was greater than budgeted direct labor hours par job. QUESTION 5 Select all that were the source for the Sales Activity favorable variance. a. Actual number of units completed was greater than budgeted number of units. b. Actual selling price per unit was less than budgeted. c. Actual number of units completed was less than budgeted number of units. d. Actual selling price per unit was greater than…arrow_forward

- Find the values of the missing items (a) through (x). Assume the actual sales volume equals actual production volume. Marketing and Administrative Sales Price Variance Variance Units Sales Revenue Less: Variable Manufacturing Costs Variable marketing and administrative costs Contribution margin Fixed manufacturing costs Fixed marketing and administrative costs Operating Profit PreviousNext Reported income statement (based on actual sales volume) Manufacturing variance (a) (g) (n) (q) (r) (t) $4,320 $3,600 (0) $1,800 U $ 400 F (u) (p) (s) (v) (w) $3,600 F (X) $3,600 F Flexible Budget (based on actual sales volume (b) (h) (m) Sales Activity Variance 4,000 F (1) $19,200 (i) $4,800 $800 U $12,000 (k) $3,000 $4,000 (1) Master Budget (based on budgeted sales volume) 20,000 $30,000 (c) (d) (e) (f) $16,000 $10,000arrow_forwardThe direct labor rate variance is calculated by multiplying the standard hours that should have been worked for the actual output by the difference between the standard labor rate and the actual labor rate. O True O Falsearrow_forwardPlease redo this problem and show me steps on how to get the following questions correct, its stating I am wrong. Please help Direct Labor Variances The following data relate to labor cost for production of 6,600 cellular telephones: Actual: 4,480 hrs. at $16.10 $72,128 Standard: 4,410 hrs. at $16.40 $72,324 a. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter all values as a positive number and then identify the variance (e.g. Favorable or Unfavorable) in the adjacent column. Rate variance $ Favorable Time variance $ Unfavorable Total direct labor cost variance $ Favorable b. The employees may have been less-experienced or poorly trained, thereby resulting in a lower labor rate than planned. The lower level of experience or training may have resulted in less efficient performance. Thus, the actual time required was more than standard. LIz Carrow_forward

- Print Item Acme Inc. has the following information available: Actual price paid for material $1.00 Standard price for material $1.10 90 Actual quantity purchased and used in production 110 Standard quantity for units produced Actual labor rate per hour $15 Standard labor rate per hour $16 Actual hours 200 230 Standard hours for units produced A. Compute the material price and quantity, and the labor rate and efficiency variances. Enter all amounts as positive numbers. Material price variance Material quantity variance Labor rate variance Labor efficiency variance 2$ B. What are some possible causes for this combination of favorable and unfavorable variances?arrow_forwardThorne Company has the following information available for the past year. They use machine hours to allocate overhead. NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F” (for Favorable) or "U” (for Unfavorable) - capital letter and no quotes. What is the variable overhead efficiency variance? Is it favorable or unfavorable?arrow_forwardDhapaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education