Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

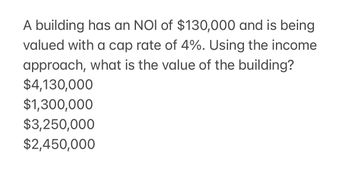

Transcribed Image Text:A building has an NOI of $130,000 and is being

valued with a cap rate of 4%. Using the income

approach, what is the value of the building?

$4,130,000

$1,300,000

$3,250,000

$2,450,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- PLEASE Make a decision tree diagram and show all payoffs!!! You are a logistics manager for Alphasmart, a smartphone manufacturer. You are trying to selecta single supplier for the raw materials for your product. Two companies can provide the necessarymaterials – Hunts and Madis.Hunts has sufficient capacity to meet your demand and charges $5.00 per unit. Madis is a smallsupplier with a limited capacity, can supply up to 36,000 units per year, and charges $4.50 perunit of the raw material. If you do not get raw material from your supplier, you buy from the spotmarket at $10 per unit.Alphasmart sold 30,000 smartphones last year and estimates demand for smartphones to go up by20% with a probability of 60 percent and to remain the same as last year with a probability of40% for the first year. The same percentage increase in demand and probability would apply forthe second year as well. Alphasmart uses a discount rate of 10 percent. Assume all costs areincurred at the end of the year and…arrow_forwardTyped plz and Asap thanksarrow_forwardThe local high school soccer club need to borrow to finance a new soccer field. Repayment of the loan involves payments of $10 000.00 at the end of every 3 months for 8 years. No payments are to be made during the development period of 5 years. If interest is 8% compounded quarterly, how much did the Achievers borrow? a) $162 064.83 b) $234 683.35 c) $157 935.17 d) $175.935.71 e) $320 000.00 .arrow_forward

- Thunderbird Manufacturing purchases a new stamping machine for $40,000. Its useful life is estimated to be 250,000 units with a salvage value of $5,000. Prepare a units-of-production (UOP) depreciation schedule based on the given annual usage (units produced) as shown below. chart attachedarrow_forward*please dont use excel to solve.*arrow_forwardA Company Is Considering Buying One Of The Following Two Machines. Show the complete solution for each question.arrow_forward

- Bill Padley expects to invest $15,000 for 5 years, after which he wants to receive $22,039.50. What rate of interest must Padley earn? (PV of $1. FV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Future Value Present Value Table Factor Interest Rate %arrow_forwardA flood control project at Pleasant Valley dam is projected to cost $1,870,000 today, have annual maintenance costs of $50,000, and have major inspection and upkeep after each 4-year interval costing $220,000. If the interest rate is 9%/year. ...... Determine the total capitalized cost.arrow_forwardDoctor J. is considering purchasing a new blood analysis machine to test for HIV; it will cost $60,000. He estimates that he could charge $25.00 for an office visit to have a patient's blood analyzed, while the actual cost of a blood analysis would be $5.00. What would be his profit if he were to perform 5,000 HIV blood analyses?arrow_forward

- Calculate the number of years until the book value of the boat is $43500arrow_forwardWhat is the future value of $50,000.00 invested this year @ 5%, for 15 years?arrow_forwardb. What is the expected value for the rezoned apartments, if the rezoning cost is included (but land cost is excluded)? Note: Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign. Expected value million c. If the land is rezoned, what should the contractor decide? O Build shopping center O Build apartments d. What is the expected revenue, if the land is not rezoned (excluding the land cost)? Note: Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign. Expected revenue million e. What is the expected net profit of entire project, including all applicable costs? Note: Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places. Negative amounts should be indicated by a minus sign. Expected net profit millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON