Question

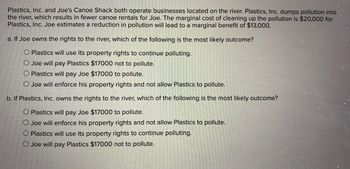

Transcribed Image Text:Plastics, Inc. and Joe's Canoe Shack both operate businesses located on the river. Plastics, Inc. dumps pollution into

the river, which results in fewer canoe rentals for Joe. The marginal cost of cleaning up the pollution is $20,000 for

Plastics, Inc. Joe estimates a reduction in pollution will lead to a marginal benefit of $13,000.

a. If Joe owns the rights to the river, which of the following is the most likely outcome?

O Plastics will use its property rights to continue polluting.

O Joe will pay Plastics $17000 not to pollute.

O Plastics will pay Joe $17000 to pollute.

O Joe will enforce his property rights and not allow Plastics to pollute.

b. If Plastics, Inc. owns the rights to the river, which of the following is the most likely outcome?

Plastics will pay Joe $17000 to pollute.

O Joe will enforce his property rights and not allow Plastics to pollute.

O Plastics will use its property rights to continue polluting.

O Joe will pay Plastics $17000 not to pollute.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Value Chain A factory owner in Bangladesh, Tipu Munshi, manufactures clothing for Walmartand other retailers around the world. One of Tipu’s products is a pair of jeans sold to Asda, a Walmartsubsidiary in Britain, which sells the jeans for $US 22.12. Asda Stores Ltd. is the third-largest retailerin the UK, focusing on food, clothing, and general merchandise. Tipu completes each set of jeansat an average cost for materials, labor, and other factory costs plus $0.26 profit, for a total of $7.29each to Asda. The jeans are then shipped to Asda by Li & Fung, a Hong Kong company, for $4.33 perpair. Finally, Asda adds an additional $10.50 of cost and profit, thus arriving at the selling price of$22.12 per pair of jeans.Required Identify the value chain for the Asda jeans. As a manager at Asda, explain how you would usethe value chain to improve the competitiveness and profitability of the business.arrow_forwardProblem 2. An electric switch manufacturing company has to choose one of three different assembly methods. Method A will have first cost of $ 40,000, an annual operating cost of $9,000 and a service life of 2 years. Method B will cost $80,000 to buy and will have an annual operating cost of $6,000 over its 4 year service life. Method C will cost $130,000 initially with an annual operating cost of $4,000 over its 8-year life. Methods A and B will have no salvage value, but method C will have some equipment worth an estimated $12,000. Which method should be selected? Use present worth analysis at an interest rate of 10% per year.arrow_forwardEmissions of heat-trapping carbon dioxide (CO2) reached an all-time high of 36.9 gigatons in 2014, a 2.5% increase over 2013. The International Energy Agency said this further reduces the chance that the world could avoid a dangerous rise in global average temperature by 2020. (a) If the discharge of CO2 continues at the same 2.5% rate per year for the next 6 years, how many gigatons will be released in 2020, and (b) what will be the total percentage increase between 2014 and 2020?arrow_forward

- Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a probability of 0.40 that the ATR Co. will come out with a competitive product. If Weiss adds an assembly line for the product and ATR Co. does not follow with a competitive product, Weiss's expected profit is $40,000; if Weiss adds an assembly line and ATR follows suit, Weiss still expects $20,000 profit. If Weiss adds a new plant addition and ATR does not produce a competitive product, Weiss expects a profit of $600,000; if ATR does compete for this market, Weiss expects a loss of $100,000. a) Expected value for the Add Assembly Line option = $ (enter your answer as a whole number).arrow_forwardBuild New plant option=arrow_forwardHungry Henry's is a take-out pizza chain owned by Dominic Stevens that operates several locations in a city of 45,500 people with an additional 21,500 college students attending the local community college. A specific Italian concept has opened in the area and is offering their pizzas at a 21% lower price than Hungry Henry's pizzas, despite lower quality and quantity of ingredients. As a result, Dominic has identified a decrease in business, particularly among students. What is the effectiveness of the pricing strategy used by the new competitor? What recommendations would you give Dominic to compete with the new rival? What are three techniques you recommend that restaurants can utilize to convey the value of their products in terms of quality, rather than just low cost, to potential customers?arrow_forward

- Use excel and show formulas Benson Enterprises is deciding when to replace its old machine. The machine’s current salvage value is $1.2 million. Its current book value is $1 million. If not sold, the old machine will require maintenance costs of $420,000 at the end of the year for the next five years. Depreciation on theold machine is $200,000 per year. At the end of five years, it will have a salvage value of $220,000. A replacement machine costs $3.5 million now and requires maintenance costs of $160,000 at the end of each year during its economic life of five years. At the end of five years, the new machinewill have a salvage value of $540,000. It will be fully depreciated using the three-year MACRS schedule. In five years a replacement machine will cost $4,000,000. Pilot will need to purchase this machine regardless of what choice it makes today. The corporate tax is 35 percent and theappropriate discount rate is 10 percent. The company is assumed to earn sufficient revenues to…arrow_forwardTo compete with XEROX which had a competitive advantage in technical service for copiers , canon a used the internet to substitute for xerox technical services capability by developing higher stronger and faster service line b did not try to beat xerox on its strong service capability but on the price of its copiers c substituted for xeroxs technical services capability by developing highly reliable copiers that needed little service d substituted for xeroxs technical services capability by developimh its own highly efficient capability of technical service , through an extensive bench marking of xeroxs processes and practicesarrow_forwardTechno Corporation is currently manufacturing an item at variable costs of $5 per unit. Annual fixed costs of manufacturing this item are $140,000. The current selling price of the item is $10 per unit, and the annual sales volume is 30,000 units. so Techno can substantially improve the item’s quality by installing new equipment at additional annual fixed costs of $60,000. Variable costs per unit would increase by $1, but, as more of the better-quality product could be sold, the annual volume would increase to 50,000 units. Should Techno buy the new equipment and maintain the current price of the item? Why or why not?arrow_forward

arrow_back_ios

arrow_forward_ios