FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

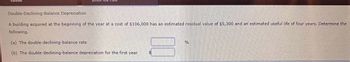

Transcribed Image Text:Double-Declining-Balance Depreciation

A building acquired at the beginning of the year at a cost of $106,000 has an estimated residual value of $5,300 and an estimated useful life of four years. Determine the

following.

(a) The double-declining-balance rate.

(b) The double-declining-balance depreciation for the first year

00

FA

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject :- Accounting Assume an asset with an original cost of $40,000, $6,000 salvage value, is depreciated using straight-line depreciation over 5 years. After year 2, the salvage value was modified to a $2,000 salvage value, with 5 years of depreciation remaining. What is the new yearly depreciation?arrow_forwardThe cost of an asset is $1,180,000, and its residual value is $260,000. Estimated useful life of the asset is five years. Calculate depreciation for the second year using the double−declining−balance method of depreciation.arrow_forwardA fixed asset has a useful life of 5 years is purchased on the first of January of a certain. The purchasing price of the asset is $3,017.15, and its residual value is expected to be $759.01.. Based on this information, the depreciation for year 1 will be equal to (in three digits):arrow_forward

- Consider a five-year MACRS asset purchasedat $80,000. (Note that a five-year MACRS propertyclass is depreciated over six years due to the half-yearconvention. The applicable salvage values would be$40,000 in year 3, $30,000 in year 5, and $10,000 inyear 6.) Compute the gain or loss amounts when theasset is disposed of in(a) Year 3.(b) Year 5.(c) Year 6arrow_forwardRevision of depreciation. Equipment with a cost of $698,500 has an estimated residual value of $63,500, has an estimated useful life of 25 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. $ b. Determine the book value after 13 full years of use. c. Assuming that at the start of the year 14 the remaining life is estimated to be 18 years and the residual value is estimated to be $53,300, determine the depreciation expense for each of the remaining 18 years.arrow_forwardStraight-Line Depreciation A building acquired at the beginning of the year at a cost of $134,200 has an estimated residual value of $5,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate % (c) The annual straight-line depreciationarrow_forward

- The cost of an asset is $1,170,000, and its residual value is $110,000. Estimated useful life of the asset is eight years. Calculate depreciation for the first year using the double-declining - balance method of depreciation. OA. $265,000 OB. $132,500 OC. $146,250 OD. $292,500 ***arrow_forwardDouble-Declining-Balance Depreciation A building acquired at the beginning of the year at a cost of $119,600 has an estimated residual value of $4,800 and an estimated useful life of four years. Determine the following. (a) The double-dedlining-balance (b) The double-declining-balance depreciation for the first year rate % ?arrow_forwardStraight-Line Depreciation A building acquired at the beginning of the year at a cost of $134,200 has an estimated residual value of $5,200 and an estimated useful life of 10 years. Determine the following: (a) The depreciable cost (b) The straight-line rate % (c) The annual straight-line depreciationarrow_forward

- A building acquired at the beginning of the year at a cost of $112,000 has an estimated residual value of $7,800 and an estimated useful life of four years. Determine the following. (a) The double-declining-balance rate (b) the double declining-balance depreciation for the first yeararrow_forwardHelp pleasearrow_forwardThe double-declining-balance method is to be used for an asset with a cost of $90.000. estimated salvage value of $ 12.000. and estimated useful life of five years.(a) What is the depreciation for the first three tax years, assuming that the asset was placed in service at the beginning of the year?(b) If switching to the straight-line method is allowed, when is the optimal time to switch?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education