Questions:

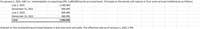

1. How much is the estimated purchase price of the bonds on January 1, 2021?

2. Compute the interest income for 2021.

3. Compute for the interest income for 2022.

4. Write all necessary

Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts for you. To get the remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.

The bonds can be defined as the units of corporate debt that it issued to raise the fund. The bond is tradable securities. The bonds carried a fixed coupon rate which is the interest rate for making interest payments. The companies issued bonds generally for the long term. The interest can be annually or semiannually etc.

Step by stepSolved in 4 steps with 6 images

- Calculate 2019 debt interest based on the information below. Opening Debt Balance Additions (Repayments) Interest Rate Closing Debt Balance Debt Interest 1,750 2,500 1,500 1,250 2018 Actual 25,000 0 5% 25,000 1,250 2019 Estimate 10,000 5%arrow_forwardCoulson Company is refinancing long-term debt. Accessed March 15, 2022. Its fiscal year ends December 31, 2021. The refinancing is scheduled to be completed on December 15, 2021. What if it's finished on January 15, 2022?arrow_forwardThe following section is taken from Oriole Ltd.s balance sheet at December 31, 2019. Non-current liabilities Bonds payable, 7%, due January 1, 2024 HK$ 1,585,000 Current liabilities Interest payable 110,950 Bond interest is payable annually on January 1. The bonds are callable on any interest date. Journalize the payment of the bond interest on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 1 eTextbook and Media List of Accounts Debit Credit Assume that on January 1, 2020, after paying interest, Oriole calls bonds having a face value of $503,000. The call price is 103. Record the redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 1 eTextbook and Media List of Accounts Debit Credit Prepare the entry to record the accrual of interest on December 31, 2020. (Credit…arrow_forward

- Need help with E.arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forwardPrepare all journal entries and adjusting journal entries necessary to record the information below for 2022: Red Robin holds corporate bonds with a face value of $218,500. It purchased these bonds on January 1 of the prior year (2021). The stated rate of the bonds is 4.85 %, but they were purchased at an effective rate of 7%. The bonds are 5-year bonds and pay interest on December 31 every year. Red Robin correctly classifies this investment as available for sale. This is the only AFS debt investment that Red Robin has ever had. The fair value of the bond on December 31 of the current year is $224,900.arrow_forward

- Question 5. On 1 January 2021 Corgi Ltd issued a £5m convertible bond at nominal value. There were no issue costs. The bond is redeemable at par on 1 January 2024 or bond holders can convert their bond into ordinary shares, with a nominal value of £1. The terms of the conversion are 2 shares for every £100 of bond. The coupon rate on the bond is 10%, payable annually in arrears. Bonds issued by similar entities without the conversion rights bear interest at 15%.arrow_forward(see attached image, kindly answer it based on your knowledge, thank you!) Determine the purchase price of the following debt securities that Ace Company intends to purchase: a. 10%, P5,000,000 face value, five-year bonds dated June 30, 2020, for purchase on July 1, 2020, interest payment dates are June 30 and December 31. b. 6% P10,000,000 face value, ten-year bonds, dated June 30, 2018, for purchase on July 1, 2020, interest payment date is June 30. The market rate of interest on July 1, 2020 is 8%.arrow_forward1. a) the amt of interest pd in cash every payment period, 1. b) the amt of amorization to be recorded at each interest payment date.(use the straight -line methodarrow_forward

- Subject: acountingarrow_forwardBlossom Company sold $3,300,000, 6%, 10-year bonds on January 1, 2022. The bonds were dated January 1, 2022 and pay interest annually on January 1. Blossom Company uses the straight-line method to amortize bond premium or discount. (a)arrow_forwardPlease answer all of the entries in the following photos, thank you! (do not mind my answers, they might be incorrect).arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education