Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

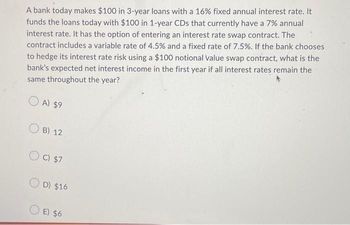

Transcribed Image Text:A bank today makes $100 in 3-year loans with a 16 % fixed annual interest rate. It

funds the loans today with $100 in 1-year CDs that currently have a 7% annual

interest rate. It has the option of entering an interest rate swap contract. The

contract includes a variable rate of 4.5% and a fixed rate of 7.5%. If the bank chooses

to hedge its interest rate risk using a $100 notional value swap contract, what is the

bank's expected net interest income in the first year if all interest rates remain the

same throughout the year?

A) $9

OB) 12

OC) $7

OD) $16

OE) $6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The current interest rates for 1-year T-strips and 1-year B-rated corporate strips are 3% and 6%, respectively. The rates for their 2-year strips are 6% and 10%, respectively. If the recovery rate is 40% for the bank, what is the marginal default probability on a B-rated loan in year 2? A. 4.72% B. 7.39% C. 4.43% D. 7.13%arrow_forwardCurrent USD Interest rates are 7% per annum and AUD rates are 9% per annum, flat for all terms. Current value of AUD is 0.62 USD. Under a FX swap agreement, a financial institution pays 8% per annum in AUD and receives 4% per annum in USD. Notional principals are 12 Million USD and 20 Million AUD. Payments are exchanged every year, with one exchange having just taken place. The swap will last 5 more years. What is the value of the swap to the financial institution?arrow_forwardVijayarrow_forward

- If you are the floating-rate payer in an interest rate swap, paying LIBOR + 40bp with a notional value of $1,000,000 and LIBOR turns out to be 0.72%, 0.83%, 0.91% and 1.03% at the four annual payment dates, what are your dollar payment obligations at those dates?arrow_forwardPlease explain all calculations and actions please: You are about to sign an interest swap to pay fixed and receive floating. The quote is 4.5-4.7% against LIBOR flat. The principal is 100,000. What is the value of the swap? (please use a fixed rate to discount the cash flows.) Round to the nearest US cent (2 decimal places).arrow_forwardThe small firm wants a 1-year fixed-rate loan. A bank's base rate is 6.14 percent. Adjustment for default risk for this firm is 4.4 percent. Competitive risk factor adjustment is 1.8 percent. The bank's money market manager reports that 1-year Treasury securities sell for 0.85 basis points above a 3-month Treasury bill. Given this information, calculate the bank's loan-pricing for this firm. Round the answer to two decimal places. Please write % sign in the units box. Your Answer: Answer unitsarrow_forward

- A bank’s position in OTC options on the dollar-euro exchange rate with a current Delta of -400 and a current Vega of 771. The exchange rate (dollars per euro) is 1.16 and the volatility of the exchange rate is 23.8% per annum. If the volatility of the exchange rate was to suddenly change to 27.4% per annum, what would be your best estimate of the change in the value of the bank’s position in OTC options? Your answer should be a number without any currency sign and if the change is a decrease then there should be negative sign at the front (i.e., if the value goes up by $100 you should write 100, but if it goes down by $100 you should write -100).arrow_forwardIn September 2020, swap dealers were quoting a rate for five-year euro interest-rate swaps of 4.5% against Euribor (the short-term) interest rate for euro loans). Euribor at the time was 4.1%. Suppose that A arranges with a dealer to swap a €10 million five-year fixed- rate loan for an equivalent floating-rate loan in euros, answer the following: (Leave no cells blank - be certain to enter "0" wherever required.) a. Assume the swap is fairly priced. What is the value of this swap at the time that it is entered into? Swap value b. Suppose that immediately after A has entered into the swap, the long-term interest rate rises by 1%. Who gains and who loses? Dealer gains; A loses O A gains; Dealer loses c. What is now the value of the swap to A for each €1,000 of par value? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Swap valuearrow_forwardYou are thinking about entering into a 3 year plain vanilla swap with annual payments and a notional principal of $5,000,000. If you plan to pay the fixed rate on the swap what would you expect to pay if annual interest rates are listed below per annum with continuous compounding? Year Rate 1 3.00% 2 3.50% 3 4.50% A) $53,221.46 B) $150,000.00 C) $183,333.33 D) $227,411.44 E) $372,407.89 The answer is D. Show all work to reach D, no Excel.arrow_forward

- a) Suppose you see Citibank’s USD-denominated 5-year interest rate swap numbers quoted at 4.25% bid and 4.45% ask. Mary tells you that the relevant fixed-rate cash flow of the swap she just entered is 4.25%. Did Mary buy or sell the IRS she just entered? b) IF Mary (from a) is a speculator, is Mary betting on/forecasting a decline in interest rates or betting on/forecasting a rise in interest rates?arrow_forward28. Consider a bank dealer who faces the following spot rates and interest rates. What should he set his 1- year forward ask price at? Bid So(S/E) S1.42 = €1.00 F360(S/E) A. $1.4324/€ B. $1.4358/€ C. $1.4662/€ D. $1.4676/€ Ask $1.45 = €1.00 Borrowing 4.25% APR is je 3.10% APR Lending 4% APR 3% APRarrow_forwardSuppose that the term structure of risk-free interest rates is flat in the United States and Australia. The USD interest rate is 5.9% per annum and the AUD rate is 5.7% per annum. The current value of the AUD is 0.57 USD. Under the terms of a swap agreement, a financial institution pays 2.0% per annum in AUD and receives 5.0% per annum in USD. The principals in the two currencies are $12 million USD and 20 million AUD. Payments are exchanged every year, with one exchange having just taken place. The swap will last two more years. What is the USD value of the swap to the financial institution? Assume all interest rates are continuously compounded. Enter your answer rounded to the nearest integer,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education