ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

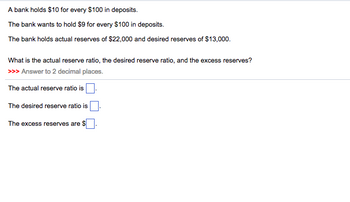

Transcribed Image Text:A bank holds $10 for every $100 in deposits.

The bank wants to hold $9 for every $100 in deposits.

The bank holds actual reserves of $22,000 and desired reserves of $13,000.

What is the actual reserve ratio, the desired reserve ratio, and the excess reserves?

>>> Answer to 2 decimal places.

The actual reserve ratio is

The desired reserve ratio is

The excess reserves are $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Helen deposits $10,000 of currency into her checking account deposit at Bank A and that the required reserve ratio is 20%. As a result of her deposit, Bank A can make a maximum loan of ____ . Checking account deposits in the banking system as a whole (including the original deposit) could eventually increase up to _____ . Select one: a. $10,000 , $100,000. b. $2,000 , $10,000. c. $8,000 , $50,000. d. $50,000 , $100,000. e. $9,000 , $40,000.arrow_forwardDecisions for Tomorrow Suppose a person who is developing a card game crowdfunds $25,000 and holds this as cash for future expenses. If this $25,000 comes from donors' checking accounts, by how much will the money supply fall if the reserve ratio is 5 percent? Instructions: Enter your response as a whole number. The money supply will decrease by $arrow_forwardPlease show equation: If the required reserve ratio (RRR) in the U.S. is 40 percent and Allen gathers $10,000 from cash sales and deposit the money into his U.S. National Bank checking account, then the change in the U.S. money supply should be Answers: A. No change B. A $4,000 increase C. A $15,000 increase D. A $25,000 increasearrow_forward

- Homework: Chapter 13 Suppose the economy's entire money supply equals checkable deposits in the amount of $900,000 held in First Main Street Bank. The required reserve ratio is 10% with no excess reserves and no cash leakage. Reserves Loans First Main Street Bank's balance sheet Assets Reserves Loans $810,000 $90,000 Checkable Deposits $900,000 Suppose the Fed sells $3,000 worth of government securities to First Main Street Bank. Complete the following table to reflect the Fed's sale on the balance sheet for First Main Street Bank. Liabilities Assets STEP: 1 of 3 Checkable Deposits O The bank has zero excess reserves. Liabilities Based on its balance sheet, how can you characterise First Main Street Bank? O The bank has $3,000 in excess reserves. O The bank has $81,000 in excess reserves. The bank is reserve deficient.arrow_forwardou just deposited $4,000 in cash into a checking account at the local bank. Assume that banks lend out all excess reserves and there are no leaks in the banking system. That is, all money lent by banks gets deposited in the banking system. Round your answers to the nearest dollar. If the reserve requirement is 1212%, how much will your deposit increase the total value of checkable bank deposits? $ If the reserve requirement is 44%, how much will your deposit increase the total value of checkable deposits? $ Increasing the reserve requirement the money supply.arrow_forwardNonearrow_forward

- Assume no change in currency holdings as deposits change. A banking system with target reserve ratio 0.20 starts with no excess reserves. If the central bank purchases $210 in government bonds from commercial banks, what will be the ultimate change in money supply (when banks return to having no excess reserves)? Round to two decimal places and do not enter the $ sign. If your answer is $6.114, enter 6.11. If your answer is $6.115, enter 6.12. If appropriate, remember to enter the - sign.arrow_forwardto calculate the money multiplier at each of the following values for the reserve requirement. 3. RR = 0 (no reserve is necessary) RR = 0arrow_forwardIn Macroland there is $6,000,000 in currency. The public holds 60% of the currency and banks hold the rest as reserves. If banks' desired reserve/deposit ratio is 25.0 percent, deposits in Macroland equal and the money supply equals Multiple Choice $24,000,000; $24,000,000 $14,400,000; $16,800,000 $14,400,000; $20,400,000 $16,800,000; $16,800,000 Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism. Answer completely and accurate answer. Rest assured, you will receive an upvote if the answer is accurate.arrow_forward

- The reserve requirement, open market operations, and the money supply Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is checkable deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the simple money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 5 10 A lower reserve requirement is associated with a ______(SMALLER/LARGER) money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to _____(BUY/SELL)$ ________ worth of U.S. government bonds. Now, suppose that, rather than…arrow_forwardsuppose the required reserve ratio is 11%. How much additional money can BBB lend out at a maximum? suppose the required reserve ratio is lowered to 8%. What is the Maximum amount of additional money that BBB can lend out? Is this different than the maximum amount of new money BBB can create by itself? 3. suppose the required reserve ratio is raised to 15%. What is the maximum amount of additional money BBB can lend out?arrow_forwardThe bank plans to hold $6 for every $100 in deposits. The bank holds excess reserves of $14,000 and desired reserves of $11,000. What is the bank's desired reserve ratio and its actual reserves? >>> Answer to 2 decimal places. The bank's desired reserve ratio is percent. The banks actual reserves are $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education