Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:=

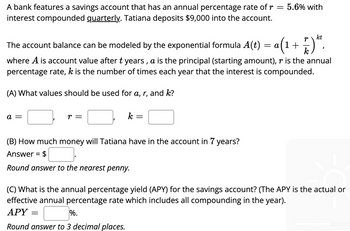

A bank features a savings account that has an annual percentage rate of r

interest compounded quarterly. Tatiana deposits $9,000 into the account.

The account balance can be modeled by the exponential formula A(t) = a (1 +

7-)kt,

where A is account value after t years, a is the principal (starting amount), r is the annual

percentage rate, k is the number of times each year that the interest is compounded.

(A) What values should be used for a, r, and k?

a =

r =

5.6% with

k =

(B) How much money will Tatiana have in the account in 7 years?

Answer = $

7.

Round answer to the nearest penny.

APY =

=

%.

Round answer to 3 decimal places.

(C) What is the annual percentage yield (APY) for the savings account? (The APY is the actual or

effective annual percentage rate which includes all compounding in the year).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bank features a savings account that has an annual percentage rate of r=3.4% with interest compounded weekly. Alfonso deposits $11,500 into the account. The account balance can be modeled by the exponential formula S(t)=P(1+r/n)^nt, where S is the future value, P is the present value, rr is the annual percentage rate, nn is the number of times each year that the interest is compounded, and tt is the time in years. What values should be used for P, r, and n?P= , r= , n= How much money will Alfonso have in the account in 10 years?Answer = $ .Round answer to the nearest penny. What is the effective annual rate for the savings account?effective rate = %.Round answer to 3 decimal places.arrow_forwardSophia invests $8,059 in a savings account that offers an annual percentage rate (APR) of 6.5%. Unlike typical savings accounts, this account compounds interest continuously. What is the effectiv annual rate (EAR)? O 6.50% 6.72% O 6.61% 106.72% 6.66%arrow_forwardYou have just deposited X dollars in your bank account that pays interest of 6 percent p.a. You discover that at the end of one year you have $ 10,044 in the account. What was X, that is, the amount of money that you deposited today? (Record your answer without a dollar sign, without commas and round your answer to 2 decimal places; that is, record $3,245.847 as 3245.85).arrow_forward

- Would love the help. 11arrow_forwardOnce per year Ritchie Rich deposits an amount of $800 in an account which pays 10% interest per year, compounded annually, with additional deposits of $800 continually made at the end of the year. If B, is the balance in the account, in dollars, immediately after Ritchie makes the nth deposit, then we can write B₁ = $800. (a) Complete the table to find the following. Report to the nearest $0.01. i) the balance, B, of the account on the day immediately after the second deposit. ii) the balance, B₁, of the account on the day immediately after the third deposit. iii) the balance, B₁, of the account on the day immediately after the fourth deposit 71 (Number of deposits) 1 2 OO B= $321158.22 (b) Suppose Ritchie makes 38 deposits. What is the balance of the account on the day immediately after the 38th deposit? 0 B$29923.47 B$29123.47 B= $264031.59 B, ($) $800 $ Number O B$291234.75 (It is more than $880.) $ Number S Number Q (c) Suppose Ritchie makes 438 deposits. Which is true about the…arrow_forwardThe following certificate of deposit (CD) was released from a particular bank. Find the compound amount and the amount of interest earned by the following deposit. $2500 at 6% compounded daily for 2 years. What is the compound amount? (Round to the nearest cent.)arrow_forward

- Find the equivalent present worth of the cash receipts in the accompanying diagram, where i = 8% compounded annually. In other words, how much do you have to deposit now (with the second deposit in the amount of $1,000 at the end of the first year) so that you will be able to withdraw $600 at the end of the second year through the fourth year , and $ 800 at the end of the fifth year , where the bank pays you 8% annual interest on your balance ?arrow_forwardYou deposited $250 in the bank for 5 years at 12%. If interest is added at the end of the year, how much will you have in the bank after one year? Calculate the compounded amount you will have in the bank at the end of year two and continue to calculate all the way to the end of the fifth year. Year Year Beginning Balance Interest Year End Balance 1 $250.00 2 3 4 5 PLEASE NOTE #1: All dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Present Value (PV) PV FV Factor Future Value (FV) PLEASE NOTE #2: All factors from the PV FV Tables are rounded to three decimal places (i.e. 1.234).arrow_forwardSuppose Jorge Otero has set up an annuity due with a certain credit union. At the beginning of each month, $130 is electronically debited from his checking account and placed into a savings account earning 6% interest compounded monthly. What is the value (in $) of Jorge's account after 16 months? (Round your answer to the nearest cent.)arrow_forward

- A bank features a savings account that has an annual percentage rate of r = 5.1% with interest compounded quarterly. Kimberly deposits $12,000 into the account. The account balance can be modeled by the exponential formula A(t) = a(1+ r kt where A is account value after t years , a is the principal (starting amount), r is the annual percentage rate, k is the number of times each year that the interest is compounded. (A) What values should be used for a, r, and k? k = = D (B) How much money will Kimberly have in the account in 10 years? Amount = $ Round answer to the nearest penny. (C) What is the annual percentage yield (APY) for the savings account? (The APY is the actual or effective annual percentage rate which includes all compounding in the year). АРY Round answer to 3 decimal places.arrow_forwardWhat would be the annual percentage yield for a savings account that earned $51 in interest on $750 over the past 365 days? (Enter your answer as a percent rounded to 1 decimal place.)arrow_forwardAssume Bill Jones invested $ 2,160.57 into an account exactly one year ago. The account has an interest rate of 5.9 % p.a. How much does Bill have in his account today (that is, exactly one year after the initial deposit)? (Round your answer to the nearest cent and record your answer without a dollar sign and without commas. For example, record $1,356.8382 as 1356.84).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education