ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:P

A

B

C

D

E

F

G

H

S

D

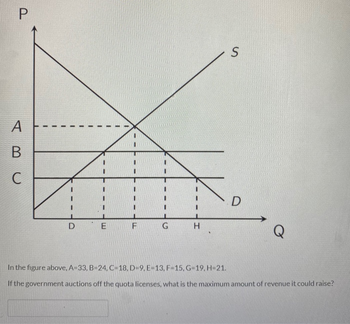

In the figure above, A-33, B=24, C-18, D=9, E-13, F-15, G-19, H=21.

If the government auctions off the quota licenses, what is the maximum amount of revenue it could raise?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- K Click on the icon to read the news clip, then answer the following questions The graph shows the market for milk in Venezuela when a price control is in effect Draw a shape that represents 1) consumer surplus Label it CS 2) producer surplus Label it PS 3) the deadweight loss Label it DWL Also draw a shape that show the resources lost from time spend in line Label it Loss Moving from a milk market with no price controls to a milk with price controls, surplus and producer surplus OA. increases, decreases OB. increases, increases OC. decreases, decreases OD. decreases, increases 60- 50- Price (bolivars per gallon) 40 40- 30- consumer 20- 10+ 0 100 200 S Price control D 300 300 400 500 600 700 Quantity (gallons of milk) >>> Draw only the objects specified in the questionarrow_forward1arrow_forwardDollars 10 10 8 5 Dumping by Monopolist 4 5 MRdom 10 Ddom MC Dfor= MRfor Quantity Refer to above figure. Given the opportunity to sell at world prices, the marginal (opportunity) cost of selling a ton domestically is what? Answer:arrow_forward

- In a perfectly competitive market for a good with a downward sloping demand curve and an upward sloping supply curve, the marginal social benefit is greater than the marginal social cost at the market equilibrium quantity. The government imposition of a new per-unit tax on the production of the good would a. increase consumer surpluses b. increase producer surplus c. increase deadweight loss d. have no effect on the price of the good e. increase the quantity sold of the good Please choose the best answer, explain why you chose that answer (include a graph as well), and justify why all the other answers are wrong.arrow_forwardState and local governments can tax interstate commerce provided certain conditions are met. True or False?arrow_forwarda.750 b.200 c.500 d.250arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forwardSuppose a monopoly firm in the short run experiences an increase in property taxes, a fixed cost. Using a clearly labeled figure, show the effect of this increase on the price, quantity, and profits of the monopoly firm. How will this increase in fixed cost affect the social deadweight loss? Explain carefully. A. Suppose a monopoly firm in the short run experiences an increase in the price of oil, a variable cost. Using a clearly labeled figure, show the effect of this increase on the price, quantity and profits of the firm В. B.arrow_forwardWith the information below and chart answer following questions. A Price Floor of $31 per ticket has been set by the Math ruling body for all games and is shown on the chart below. Q Ticket Price 36- 34- 32- 28- 26- 24- 22- 3200 4800 6400 Number of Tickets Sold 8000 With this price control in effect: What would be the market price?S What would be the number of tickets exchanged (Refer to Table 1)? tickets Is the market operating efficiently? Yes No Sometimes Cannot Determinearrow_forward

- Costs and Revenue MR MC D Quantity Based on the graph, you can answers. MR curve is defined as 20-2Q, MC curve is defined as 2Q, and Demand curve is definded as 20 - Q. What is the quantities that maximize a social benefit? Your answer should be 1 decimal points such as 2.1 or 3.1. Do not write ratio such as 10/3. Do not include $. Answer should be 200 instead of $200arrow_forwardWhen a quota is used with "cap and trade" to control an externality, the government must determine both _____ and _____. Select one: a. the socially optimal quantity; the socially optimal price b. how large a tax to use; which external impact to address c. how to bargain with companies; whether to use a subsidy d. the socially optimal quantity; how to distribute that quantity across suppliersarrow_forwardSuppose that the government instituted a per-unit tax on the output of a monopoly firm. A. graph this situation? B. On the same graph show what would happen to the market equilibrium after implementation of such a tax? C. On the same graph how would you show which economic actor pays most of the tax? You are to not only draw the graph but also explain the answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education