ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

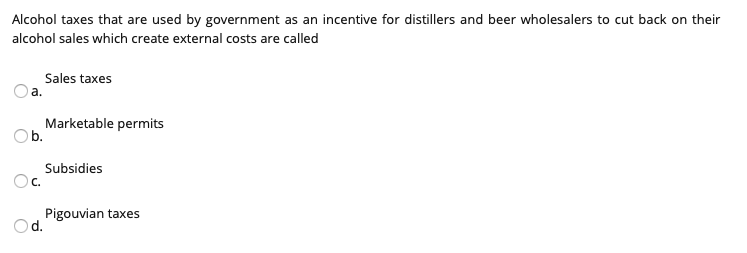

Transcribed Image Text:Alcohol taxes that are used by government as an incentive for distillers and beer wholesalers to cut back on their

alcohol sales which create external costs are called

Sales taxes

a.

Marketable permits

Ob.

Subsidies

C.

Pigouvian taxes

Od.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give some instances of environmental issues that the Pigovian tax can be used to resolve.arrow_forwardIn a perfectly competitive market for a good with a downward sloping demand curve and an upward sloping supply curve, the marginal social benefit is greater than the marginal social cost at the market equilibrium quantity. The government imposition of a new per-unit tax on the production of the good would a. increase consumer surpluses b. increase producer surplus c. increase deadweight loss d. have no effect on the price of the good e. increase the quantity sold of the good Please choose the best answer, explain why you chose that answer (include a graph as well), and justify why all the other answers are wrong.arrow_forwardUse Exhibit to answer question a. C + D + F. b. C + F. C. A + B + C + D. d. D. Price e. A + B + E. PB Po Ps AIBI В C Size of tax per unit w F Q₁ If there is no tax placed on the product in this market, producer surplus is the area Supply Demand Quantityarrow_forward

- how a tax on pollution affects the market equilibrium, consumer surplus, and producer surplus (Ctrl) ▼arrow_forwardWhat exactly is a Pigovian tax? Give some instances of how the Pigovian tax can be used to tackle environmental issues.arrow_forward21 24 P 500 300 250 50 50 M DE J F CH 91 ABG K S MSB D 50 80 90 100 Q Which of the following would lead to the allocatively efficient outcome? A subsidy A price floor of $250 A quota of 90 units A taxarrow_forward

- Nonearrow_forwardWhat is producer and consumer surplus AFTET tax?arrow_forwardDue to a firm generating external costs (a negative externality), the government decides to ________ the firm. In response, the firm will produce ________ units of output in order to continue maximizing profits and reach the new producer equilibrium. Question 4Answer a. tax; fewer b. subsidize; more c. tax; more d. subsidize; fewerarrow_forward

- Use this picture to answer the questions that follow 9.50 Supply 8.50 7.50 Demant 50 60 70 80 90 100 110 120 If the appropriate Pigouvian tax/subsidy is used, what is the new CS? 52.50 150 75 200 OOO 00arrow_forwardWhat is the tax burden on the buyer and seller?arrow_forwardWhich of the following types of goods and services should be taxed in order to discourage their production? Which of the following types of goods and services should be taxed in order to discourage their production? Goods and services with high inocme elasticities of demand Goods and services with negative externalities Goods and services with high price elasticities of demand Goods and services with positive externalitiesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education