FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

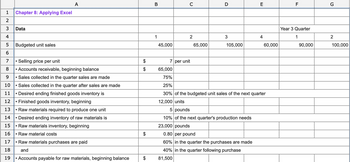

The company just hired a new marketing manager who insists unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget:

|

Year 2 Quarter |

Year 3 Quarter |

||||||

| Data | 1 | 2 | 3 | 4 | 1 | 2 | |

| Budgeted unit sales | 45,000 | 65,000 | 105,000 | 60,000 | 90,000 | 100,000 | |

| Selling price per unit | $7 |

What are the total expected cash collections for the year under this revised budget?

Transcribed Image Text:A

B

C

D

E

F

G

1

Chapter 8: Applying Excel

2

3

Data

4

Year 3 Quarter

1

2

3

4

1

2

45,000

65,000

105,000

60,000

90,000

100,000

5 Budgeted unit sales

6

7

• Selling price per unit

•Raw materials required to produce one unit

7 per unit

$

65,000

75%

00

8

• Accounts receivable, beginning balance

9

•Sales collected in the quarter sales are made

10

• Sales collected in the quarter after sales are made

11

• Desired ending finished goods inventory is

12

Finished goods inventory, beginning

13

14

15

16

• Raw material costs

17

• Raw materials purchases are paid

18

and

19

• Accounts payable for raw materials, beginning balance

$

Desired ending inventory of raw materials is

• Raw materials inventory, beginning

25%

30% of the budgeted unit sales of the next quarter

12,000 units

5 pounds

10% of the next quarter's production needs

23,000 pounds

0.80 per pound

60% in the quarter the purchases are made

40% in the quarter following purchase

81,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me with b, c, and d. Thanks!arrow_forwardCoronado Industries had sales in 2021 of $5,521,600 and gross profit of $893,200. Management is considering two alternative budget plans to increase its gross profit in 2022.Plan A would increase the unit selling price from $8.00 to $8.40. Sales volume would decrease by 101,500 units from its 2021 level. Plan B would decrease the unit selling price by $0.50. The marketing department expects that the sales volume would increase by 105,560 units.At the end of 2021, Coronado has 32,480 units of inventory on hand. If Plan A is accepted, the 2022 ending inventory should be 28,420 units. If Plan B is accepted, the ending inventory should be equal to 48,720 units. Each unit produced will cost $1.5 in direct labor, $1.3 in direct materials, and $1.2 in variable overhead. The fixed overhead for 2022 should be $1,538,740.arrow_forwardThe company just hired a new marketing manager who insists unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: Year 2 Quarter Year 3 Quarter Data 1 2 3 4 1 2Budgeted unit sales 45,000 65,000 120,000 65,000 80,000 90,000Selling price per unit $7 What are the total expected cash collections for the year under this revised budget?What is the total required production for the year under this revised budget? What is the total cost of raw materials to be purchased for the year under this revised budget? What are the total expected cash disbursements for raw…arrow_forward

- Can you help with Budget Drill #8?arrow_forwardCurrent Attempt in Progress * Your answer is incorrect. The controller is waiting on Blue's budgeted cash disbursements so the cash budget can be wrapped up for next month, but Blue has just received the DM purchases budget from production. That budget shows DM purchases of $96,300 in March and $62,500 in April Blue generally pays 30% of these purchases in the month of purchase, with the remainder paid the next month. How much should Blue budget for cash disbursements for the month of Aprit? What is the budgeted balance of A/P going into May? $ Total cash disbursements A/P balance at end of April $ eTextbook and Media 129910 86160 Attempts: 1 of 2 used Submit Answerarrow_forwardPlease dont give solutions image based thankuarrow_forward

- Do not give solution in imagearrow_forwardGive me correct answer with explanation.harrow_forwardThe company just hired a new marketing manager who insists unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: Year 2 Quarter Year 3 Quarter Data 1 2 3 4 1 2 Budgeted unit sales 45,000 65,000 105,000 60,000 90,000 100,000 Selling price per unit $7 What is the total cost of raw materials to be purchased for the year under this revised budget?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education