Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

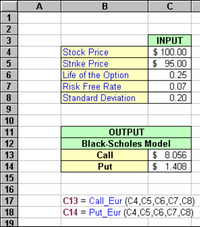

Can someone please show me the right formula on excel to do the European call and put options for the Black-Scholes model? The excel formula listed in the image doesn't work and I would love to be able to see how to make this work.

Thanks in advance!

Transcribed Image Text:A

B

1

2

INPUT

Stock Price

Strike Price

Life of the Option

Risk Free Rate

Standard Deviation

$ 100.00

$ 95.00

4

0.25

7

0.07

8

0.20

9

10

11

OUTPUT

12

Black-Scholes Model

$ 8.056

$ 1.408

13

Call

14

Put

15

16

C13 = Call_Eur (C4,05,C6,C7,C8)

C14 %3D Put_Eur (С4,C5,С6,С7, С8)

17

18

19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A Moving to another question will save this response. Quèstion 10 When evaluating mutually exclusive projects with different lives and different levels of risk, which of the following methods can be used? O IRR O None of the listed choices can be used in the evaluation. O PI O Payback O NPV O Each of the listed choices can be used in the evaluation. A Moving to another question will save this response. MacBook Air 20 F3 esc F2 F4 F5 # $ % 2 3 4 5 Q W E R T Sarrow_forwardis this statement true or false and explanation why. Please explain it as simple as possible. In order to decrease risks towards the use of fixed assets it is advised to use cellular production rather than line production for the manufacturing of innovative products like mobile phonesarrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forward

- Compute the Profitability Index (PI) for each project? Project A Project B Profitability Index (PI) 5- In light of your answers above, suppose that these two projects might be mutually exclusive or independent. According to these two assumptions, fill in the blanks in the table below with the suitable answer: Points Investment Criteria If A and B are mutually exclusive, then I would select If A and B are independent, then I would select PBP NPV IRR PIarrow_forwardWhen faced with a set of independent projects, one should select (choose the best answer) all projects with a PI greater than one. all projects with an IRR greater than the hurdle rate all projects with a positive NPV or an IRR greater than the hurdle rate or a PI greater than one. all projects with a positive NPV or an IRR greater than the hurdle rate. all projects with an IRR greater than the hurdle rate or a PI greater than one. all projects with a positive NPV or a PI greater than the one. all projects with a positive NPVarrow_forwardI have been working on the question below and I'm stuck on how to finish it up. I have provided what I've done so far. Is what I've done so far correct? And how do I finish up the problem? Here is the question: Suppose that C is the price of a European call option to purchase a security whose present price is S. Show that if C>S then there is an opportunity for arbitrage (i.e. risk-less profit). You may assume the interest rate is r=0 so that the present value calculations are unnecessary. My work so far: There is an opportunity for arbitrage if we can create a portfolio that initially (time t=0) generates a zero net cash flow or a cash inflow, but still produce a positive or zero cash inflow at the time of expiration. Assume we are going to short sell one call option C, and buy one stock S. Consider the cash flows at time t=0.Cash flow of selling one call option: +CCash flow of buying one stock: -STherefore, since C>S, we have an initial cash inflow of C-S>0. We will now…arrow_forward

- Why did Fama and French introduce three-factor model in place of CAPM?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education