Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:K

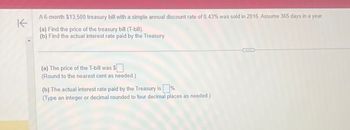

A 6-month $13,500 treasury bill with a simple annual discount rate of 0.43% was sold in 2016. Assume 365 days in a year.

(a) Find the price of the treasury bill (T-bill).

(b) Find the actual interest rate paid by the Treasury

(a) The price of the T-bill was $

(Round to the nearest cent as needed.)

(b) The actual interest rate paid by the Treasury is%.

(Type an integer or decimal rounded to four decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Godoarrow_forwardThe following table shows annual rates for various types of loans in 2015. Assume monthly payments and compounding periods. HINT [See Examples 5 and 7.] LoanType 30-YearMortgage 15-YearMortgage 5-YearCar Loan 4-YearCar Loan CreditCards OctoberRate (%) 3.93 3.14 4.30 4.24 13.10 NovemberRate (%) 4.09 3.31 4.31 4.26 13.10 DecemberRate (%) 4.09 3.34 4.34 4.29 13.10 Ten years into your 15-year $400,000 mortgage begun in October 2015, you inherit your rich uncle's estate and decide to pay off the outstanding principal on your mortgage. What is that amount? (Do not round the payment amount to the nearest cent. Round the final outstanding principal to the nearest cent.) $arrow_forwardOn April 2014, you could buy a 3030-year U.S. Treasury note for $50005000 that pays 5.235.23% simple interest every year through November 15, 2044. How much total interest II would it earn by then?I=$arrow_forward

- In January 2020, three-month (91 - day) Treasury bills were selling at a discount of 1.48 %. What was the annual yield? Assume 365 days in a year. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardA 3-month $5000 Treasury bill with discount rate 5.785% was sold in 2009. Find a. the price of the T-bill, and b. the actual interest rate paid by the Treasury. a. The price of the T-bill is $ (Round to the nearest dollar as needed.)arrow_forward7arrow_forward

- A 3 month $19,000 treasury bill with a simple annual discount rate of 0.27% was sold in 2016. Assume 365 days in a year a) the price of the T bill was ? b) the actual interest rate paid by the treasury is ?arrow_forwardThe interest charged on a $234000 note payable, at the rate of 6%, on a 90-day note would be (Use 360 days for calculation.)arrow_forwardIn October 2008, six-month (182-day) Treasury bills were issued at a discount of 1.42%. What was the annual yield? Assume 365 days in a year. (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places.)arrow_forward

- On May 3, 2020, Leven Corporation negotiated a short-term loan of $660,000. The loan is due October 1, 2020, and carries a 5.40% interest rate. Use ordinary interest to calculate the interest. What is the total amount Leven would pay on the maturity date? (Use Days in a year table.) Note: Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardThe average rate of return on a 182-day Government of Canada treasury bill sold on June 18, 2021, was 1.02%. A client sold the $25,000 T-bill after 53 days. What rate of return (per annum) did the client realize while holding the T-bill, if the short-term interest for this maturity had risen to 1.11% by the date of sale? Do not include the dollar sign in your answer. Do not include the comma usually used to denote thousands. Do not include the percent sign in your answer. a.) How much did the client pay for the T-bill on its issue date? b.) How much did the client sell the T-bill for? c.) What rate of return did the client realize on the T-bill? (Correct to exactly 4 decimal places.) Checkarrow_forwardCalculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.) (Use 15.5% for table lookup.) (Use the loan amortization table.) (Round your answers to the nearest cent.) Purchase priceof a used car Downpayment Number ofmonthly payments Amountfinanced Total of monthlypayments Total financecharge APR $4,415 $85 60 $4,330 $6,164.00 $1,834.00 15.5% Monthly Payment By table By formulaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education