FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:I 2 91% 1 6:39 PM

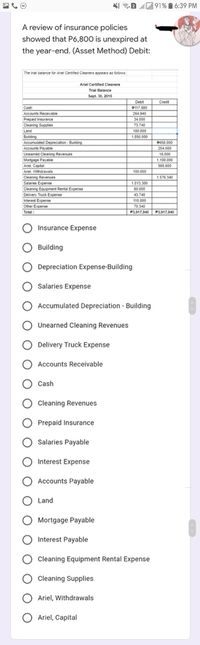

A review of insurance policies

showed that P6,800 is unexpired at

the year-end. (Asset Method) Debit:

The tral balance for Ariel Certifled Cieaners appears as folows

Ariel Certified Cleaners

Trial Balance

Sept. 30, 2015

Debt

Credit

Cash

Accounts Receivable

D117 880

264.940

Prepaid Insurance

Cleaning Supclies

34.000

73,740

Land

180.000

Building

Accumulated Depreciation Building

1,850.000

Accounts Payable

Uneamed Cleaning Revenues

204.000

16.000

1.100 000

Mortgage Payable

Ariel, Captal

Arel Withdrawals

565.600

100.000

Cleaning Revenues

Salaries Expense

1.576340

1.013.300

60.000

Cleaning Equioment Rental Expense

Delivery Truck Expense

Interest Expense

Oher Expense

Total:

43,740

110.000

70.340

P3917.940 P3917.940

Insurance Expense

O Building

O Depreciation Expense-Building

O Salaries Expense

O Accumulated Depreciation - Building

O Unearned Cleaning Revenues

O Delivery Truck Expense

O Accounts Receivable

O Cash

O Cleaning Revenues

O Prepaid Insurance

O Salaries Payable

O Interest Expense

O Accounts Payable

O Land

O Mortgage Payable

O Interest Payable

Cleaning Equipment Rental Expense

O Cleaning Supplies

Ariel, Withdrawals

O Ariel, Capital

ООО О о

Transcribed Image Text:I a La

91% i 6:39 PM

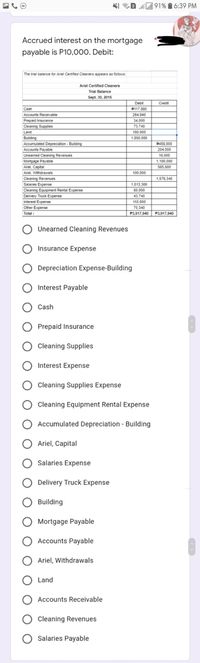

Accrued interest on the mortgage

payable is P10,000. Debit:

The trial balance for Ariel Certfied Cleanera appears as follows

Ariel Certified Cleaners

Trial Balance

Sept. 30. 201s

Debit

Credit

Cash

D117.880

Accounts Recevable

264.940

Prepaid insurance

34.000

Cleaning Supples

73,740

Land

180.000

Building

Accumulated Depreciation - Building

Accounts Payable

Lnearned Cleaning Revenes

Morigage Payable

Ariel. Capital

Ariel Wthdrawals

1,850,000

S6.000

204.000

16,000

1,100.000

565,600

100.000

Cleaning Revenues

1,576340

Salaries Expense

1,013.300

60.000

43.740

110,000

Cleaning Equipment Rental Expense

Delivery Truck Expense

Interest Expense

Other Expense

70.340

Total:

P3917940

P3,917,940

Unearned Cleaning Revenues

O Insurance Expense

O Depreciation Expense-Building

O Interest Payable

Cash

O Prepaid Insurance

Cleaning Supplies

O Interest Expense

O Cleaning Supplies Expense

Cleaning Equipment Rental Expense

O Accumulated Depreciation - Building

Ariel, Capital

O Salaries Expense

O Delivery Truck Expense

Building

Mortgage Payable

O Accounts Payable

Ariel, Withdrawals

Land

Accounts Receivable

Cleaning Revenues

O Salaries Payable

O O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chapter 5 Exercises i Saved 49 Required information Part 4 of 7 (The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Debit Credit 1 $ 26,100 14,700 Cash points Accounts Receivable Allowance for Uncollectible Accounts $ 3,000 Supplies Notes Receivable (6, due in 2 years) Land Skipped 3,600 15,000 80,000 Accounts Payable Conmon Stock Retained Earnings 7,900 95,000 33,500 eBook Totals $139,400 $139,400 Print During January 2021, the following transactions occur: 2 Provide services to customers for cash, $46,100. 6 Provide services to customers on account, $83,400. January January January 15 write off accounts receivable as uncollectible, $2,500. January 20 Pay cash for salaries, $32, 500. January 22 Receive cash on accounts receivable, $81,000. January 25 Pay cash on accounts payable, $6,600. January 30 Pay cash for utilities during January, $14,800. References…arrow_forwardonly 1c question photo thanks!arrow_forwardNonearrow_forward

- 2arrow_forward9:28 AM 0 0.1KB/s ll 86 PP - A:R_-106493777 目 At December 31, Banana Company reports the following results for its calendar year from the adjusted trial balance. I. Credit sales Cash sales Accounts Receivable Allowance for doubtful accounts (credit balance) Php 8,100,00o 2,350,000 412.000 13,000 Required: Prepare the adjusting entry to record Bad Debts Expense using the following independent methods: a. Sales Method, assuming estimated bad debts is 1% b. Accounts Receivable Method, assuming bad debts is 18% c. Aging of Accounts Receivable, assume the following: 50% are current accounts, estimated uncollectible for current accounts is 1% 30% are over 31 days to 90 days, estimated uncollectible accounts is 20% 20% are over 90 days, estimated uncollectible accounts is 50% 111. Lemon Company allows customers to make purchases on credit. The terms of all credit sales are 2/10, n/30, and all sales are recorded at the gross price. Other customers can use a bank credit card where the bank…arrow_forwardRequired information Exercise 9-21 Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Debit $ 11,700 35,000 152,500 72,300 125,000 Accounts Credit Cash Accounts Receivable Inventory Land Buildings $ 2,300 10, 100 23, 200 205,000 155,900 Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $396,500 $396,500 During January 2021, the following transactions occur: Borrow $105, 000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments Receive $31, 500 from customers on accounts receivable. January $2,030 are required at the end of ead onth for 6e months. January 4 January Pay cash on accounts payable, $16,000. 10 January Pay cash for salaries, $29,400. 15 January…arrow_forward

- ! Required information Problem 11-1A (Algo) Short-term notes payable transactions and entries LO P1 [The following information applies to the questions displayed below.] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $38,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 9%, $35,000 note payable along with paying $3,000 in cash. July 8 Borrowed $60,000 cash from NBR Bank by signing a 120-day, 11%, $60,000 note payable. _?____Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to NBR Bank at the maturity date. November 28 Borrowed $24,000 cash from Fargo Bank by signing a 60-day, 8%, $24,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 _______ Paid the amount due on the note to Fargo Bank at the maturity date. Problem 11-1A (Algo) Part 3 3.…arrow_forwardQS 9-7 (Algo) Reporting allowance for doubtful accounts LO P2 On December 31 of Swift Company’s first year, $51,000 of accounts receivable was not yet collected. Swift estimated that $2,100 of its accounts receivable was uncollectible and recorded the year-end adjusting entry.1. Compute the realizable value of accounts receivable reported on Swift’s year-end balance sheet.2. On January 1 of Swift’s second year, it writes off a customer’s account for $400. Compute the realizable value of accounts receivable on January 1 after the write-off.arrow_forwardBook Hint Ask Print References Mc Graw Hill % 5 At December 31, Folgeys Coffee Company reports the following results for its calendar year. $908,000 308,000 Cash sales Credit sales Its year-end unadjusted trial balance includes the following items. T Accounts receivable Allowance for doubtful accounts Prepare the adjusting entry to record bad debts expense assuming uncollectibles are estimated to be (1) 3% of credit sales, (2) 1 total sales and (3) 6% of year-end accounts receivable. View transaction list Journal entry worksheet prt sc ← ] delete backspace home num lockarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education