FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Answer for problem D and E

Transcribed Image Text:**Accounts Receivable Analysis for Luxury Cruises**

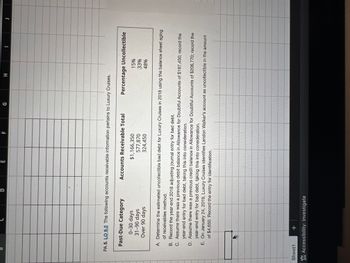

The following accounts receivable information pertains to Luxury Cruises, aiding in the assessment of uncollectible accounts for the year.

### Past-Due Category

1. **0–30 days**

- **Accounts Receivable Total:** $1,166,350

- **Percentage Uncollectible:** 15%

2. **31–90 days**

- **Accounts Receivable Total:** $577,870

- **Percentage Uncollectible:** 33%

3. **Over 90 days**

- **Accounts Receivable Total:** $324,450

- **Percentage Uncollectible:** 48%

### Tasks

A. **Determine the estimated uncollectible bad debt for Luxury Cruises in 2018** using the balance sheet aging of receivables method.

B. **Record the year-end 2018 adjusting journal entry for bad debt.**

C. **Assume there was a previous debit balance in Allowance for Doubtful Accounts of $187,450;** record the year-end entry for bad debt, taking this into consideration.

D. **Assume there was a previous credit balance in Allowance for Doubtful Accounts of $206,770;** record the year-end entry for bad debt, taking this into consideration.

E. **On January 24, 2019, Luxury Cruises identifies Landon Walker’s account as uncollectible** in the amount of $4,650. Record the entry for identification.

---

This structured analysis helps Luxury Cruises manage its accounts receivable effectively by recognizing potential credit risks and adjusting financial records accordingly.

Expert Solution

arrow_forward

Step 1

Journal entries refers to the entries which are passed by the companies at the end of the accounting year or period and it records all the business event or transactions into the books of account.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education