FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:9:41

V1.185G 19%

KB/s

expert.chegg.com/q

Chegg

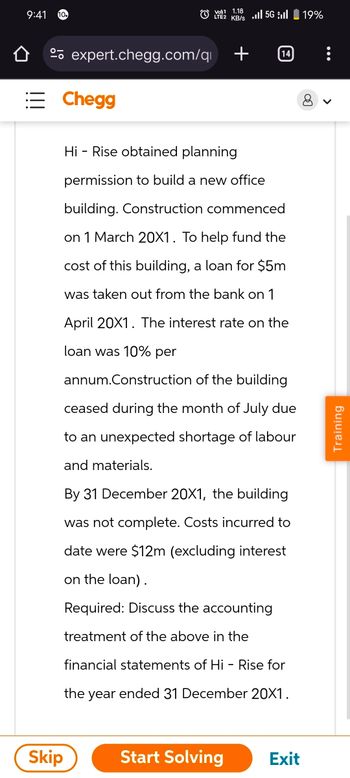

Hi Rise obtained planning

14

permission to build a new office

building. Construction commenced

on 1 March 20X1. To help fund the

cost of this building, a loan for $5m

was taken out from the bank on 1

April 20X1. The interest rate on the

loan was 10% per

annum.Construction of the building

ceased during the month of July due

to an unexpected shortage of labour

and materials.

By 31 December 20X1, the building

was not complete. Costs incurred to

date were $12m (excluding interest

on the loan).

Required: Discuss the accounting

treatment of the above in the

financial statements of Hi-Rise for

the year ended 31 December 20X1.

Skip

Start Solving

Exit

>

Training

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Good morning 5 mayo 11:00 amarrow_forwardEf 46.arrow_forwardQuestion Content Area Ralston Consulting, Inc., has a $48,000 overdue debt with Supplier No. 1. The company is low on cash, with only $13,440 in the checking account and does not want to borrow any more cash. Supplier No. 1 agrees to settle the account in one of two ways: Option 1: Pay $13,440 now and $45,600 when some large projects are finished, two years from today. Option 2: Pay $67,200 three years from today, when even larger projects are finished. Assuming that the only factor in the decision is the cost of money (10%). (Click here to see present value and future value tables) A. Calculate the present value of each option. Round your present value factor to three decimal places and final answer to the nearest dollar. Present value of Option 1 $fill in the blank 1 Present value of Option 2 $fill in the blank 2 B. Which option should Ralston choose?arrow_forward

- nkt.2arrow_forwardChapter 3 Financial Mathematics (Exercises) Future Value Calculations Exercise 1: (answers on page 347) 1) A factory purchases new equipment which costs R5,2 million. It depreciates at a rate of 12,5% per annum on a reducing balance. The replacement cost of the equipment escalates at a rate of 7,5% per annum. A sinking fund is set up to pay for the new machinery in 6 years' time. If the sinking fund earns 9% p.a. compounded monthly, determine: a) The book value of the old equipment in 6 years' time. b) The cost of the new equipment in 6 years' time. C) The value the sinking fund must attain, if the book value of the current equipment is used towards the cost of the new equipment. d) The monthly payments that need to be made into the sinking fund if payments commence one month after the current equipment is purchased and will continue until the new equipment is purchased. Thearrow_forwardQuestion 5arrow_forward

- Problem #5: A loan of $49,000 is paid off in 36 payments at the end of each month in the following way: Payments of $1225 are made at the end of the month for the first 12 months. Payments of $1225 + x are made at the end of the month for the second 12 months. Payments of $1225 + 2x are made at the end of the month for the last 12 months. What should x be if the nominal monthly rate is 11.8%?arrow_forward7:46 PM Ill WiFi 90 Suresh, a recently retired teacher, has requested you to help him select one from the following two proposals before him: Proposal A: To establish and run a primary school From the coming month, he could start a LKG class from a small vacant building owned by one of his relatives, by modifying the same at a cost of Rs.5 lakh. Thereafter at the end of each year, beginning from the first year, a fresh room would be added to the existing building to house the students of KG, first standard, second standard,, till the fifth standard. The estimated expenses for the same would be Rs.4 lakh at the end of the first year which would be rising per year by Rs.1 lakh. For all the years, the average net income per student would be Rs.10, 000 per annum as reckoned at the end of the year and their strength per class would be 20. Suresh is assured of getting a bank loan for all his project expenses at an interest rate of 12 percent. Once the fifth standard completes its first year,…arrow_forward7arrow_forward

- LO 13.3 Sub-Cinema Inc. borrowed $10,000 on Jan. 1 and will repay the loan with 12 equal payments made at the end of the month for 12 months. The interest rate is 12% annually. If the monthly payments are $888.49, what is the journal entry to record the cash received on Jan. 1 and the first payment made on Jan. 31?arrow_forwardProblem 25-6 (AICPA Adapted) Chum Company started construction of a new office building on January 1, 2020 and moved into the finished building. on July 1, 2021. Of the P25,000,000 total cost of the building, P20,000,000 was incurred in 2020. evenly throughout the year. The entity's incremental borrowing rate was 12% throughout 2020, and the total amount of interest incurred.was P1,020,000. S, What amount should be reported as capitalized interest on December 31, 2020? а. 1,020,000 b. 1,200,000 с. 1,500,000 d. 2,400,000 CS Scanned with CamScannerarrow_forwardProblem 6-12 (Algo) Long-term contract; revenue recognized over time vs. upon project completion; loss projected on entire project [LO6-9] Curtiss Construction Company, Incorporated, entered into a fixed-price contract with Axelrod Associates on July 1, 2024, to construct a four-story office building. At that time, Curtiss estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $4,120,000. The building was completed on December 31, 2026. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Axelrod under the contract were as follows: Percentage of completion Costs incurred to date Estimated costs to complete Billings to Axelrod, to date Required: At 12-31-2024 At 12-31-2025 At 12-31-2026 10% 60% 100% $ 361,000 3,249,000 722,000 $ 2,604,000 1,736,000 2,210,000 $ 4,392,000 0 4,120,000 1. Compute gross profit or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education