Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

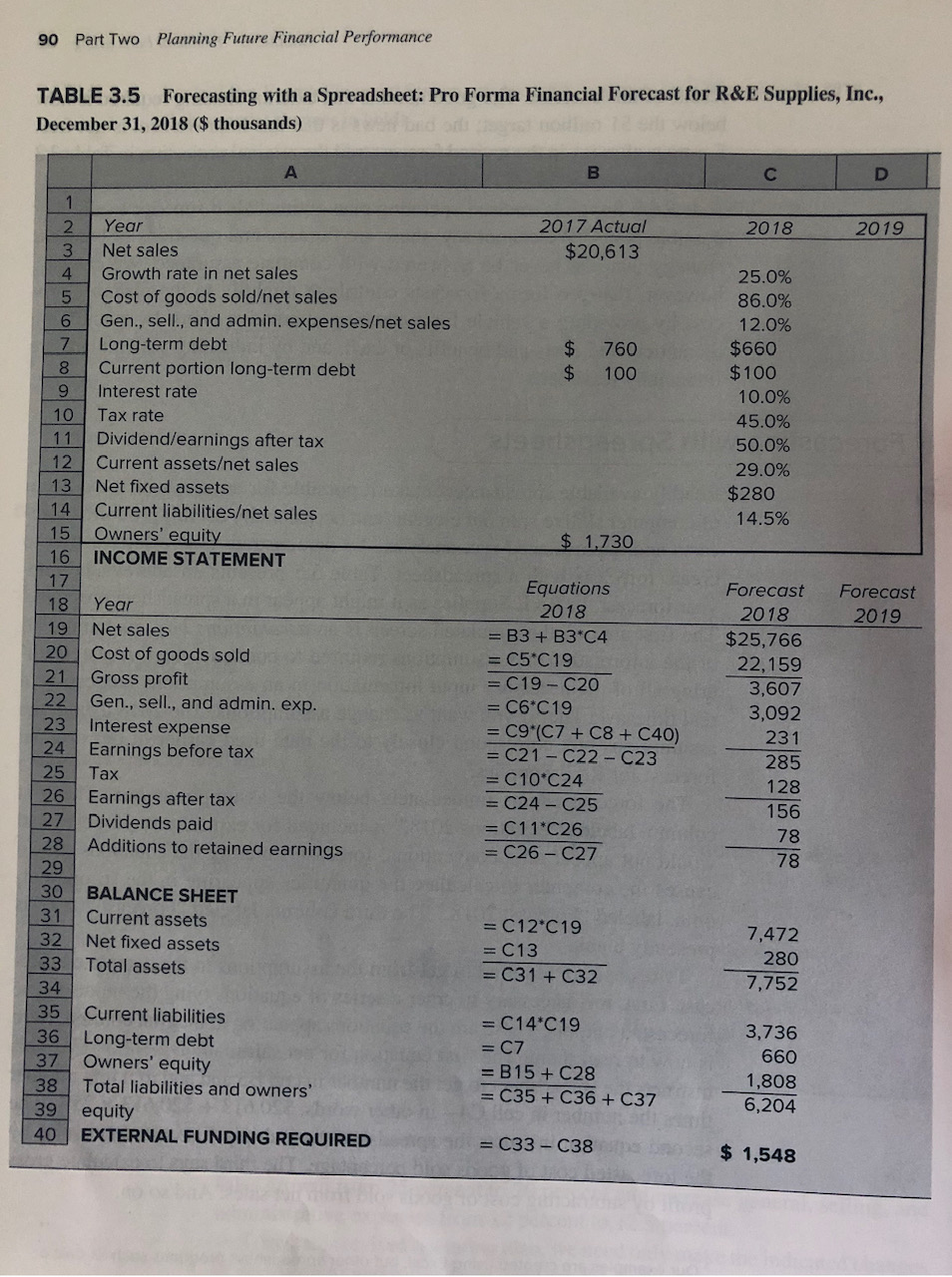

Table 3.5 presents a computer spreadsheet for estimating R&E Supplies’ external financing required for 2018. The text mentions that with modifications to the equations for equity and net sales, the

Transcribed Image Text:90

Part Two Planning Future Financial Performance

TABLE 3.5 Forecasting with a Spreadsheet: Pro Forma Financial Forecast for R&E Supplies, Inc.,

December 31, 2018 ($ thousands)

2017 Actual

$20,613

Year

2018

2019

Net sales

4.

Growth rate in net sales

25.0%

Cost of goods sold/net sales

Gen., sell., and admin. expenses/net sales

Long-term debt

Current portion long-term debt

9.

86.0%

6.

12.0%

2$

24

760

$660

100

$100

Interest rate

10.0%

10

11 Dividend/earnings after tax

Current assets/net sales

Tax rate

45.0%

50.0%

12

29.0%

13

14

Net fixed assets

$280

Current liabilities/net sales

14.5%

Owners' equity

16 INCOME STATEMENT

15

$1,730

17

Equations

2018

Forecast

Forecast

18

Year

2018

2019

19

Net sales

= B3 + B3*C4

$25,766

Cost of goods sold

Gross profit

20

= C5*C19

= C19 - C2O

22,159

21

3,607

22

Gen., sell., and admin. exp.

= C6*C19

= C9*(C7 + C8 + C40)

= C21 - C22- C23

= C10 C24

3,092

23

Interest expense

231

24 Earnings before tax

285

25

Tax

128

26 Earnings after tax

27 Dividends paid

= C24 - C25

156

= C11 C26

= C26 – C27

78

28

Additions to retained earnings

29

78

30

BALANCE SHEET

31 Current assets

= C12*C19

7,472

32

Net fixed assets

= C13

33

Total assets

280

= C31 + C32

34

7,752

Current liabilities

36 Long-term debt

Owners' equity

35

= C14*C19

= C7

= B15 + C28

= C35 + C36 + C37

3,736

37

660

38

39 equity

1,808

6,204

Total liabilities and owners'

40

EXTERNAL FUNDING REQUIRED

= C33 - C38

$ 1,548

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the findings, provide a brief summary about the financial status of each of the companies and provide a recommendation for the investment choice.arrow_forwardplease show excel formulasarrow_forwardCalculate the projected price/earnings ratio and market/book ratio. Explain whether these ratios indicate that investors will be expected to have a high or low opinion of the company. Computron's Balance Sheets (Millions of Dollars) 2019 2020 Assets Cash and equivalents $ 60 $ 50 Short-term investments 100 10 Accounts receivable 400 520 Inventories 620 820 Total current assets $ 1,180 $ 1,400 Gross fixed assets $ 3,900 $ 4,820 Less: Accumulated depreciation 1,000 1,320 Net fixed assets $ 2,900 $ 3,500 Total assets $ 4,080 $ 4,900 Liabilities and equity Accounts payable $ 300 $ 400 Notes payable 50 250 Accruals 200 240 Total current liabilities $ 550 $ 890 Long-term bonds 800 1,100 Total liabilities $ 1,350 $ 1,990 Common stock 1,000 1,000 Retained earnings 1,730 1,910 Total equity $ 2,730 $ 2,910 Total liabilities and equity $ 4,080 $ 4,900…arrow_forward

- Shamal Plastics Industries Sohar, is one of the leading plastic sheets manufacturing companies in Sultanate of Oman. While preparing the financial statement for the year 2020, some of the earnings reported in the year 2021 has been shifted to 2020. This denotes that Shamal Plastics Industries management might have followed O a. The political cost hypothesis Ob. The debt covenant hypothesis or political cost hypothesis. Oc The bonus plan hypothesis or political cost hypothesis. Od The bonus plan hypothesis or debt covenant hypothesis.arrow_forwardToby’s forecasted 2021 financial statements follow, along with some industry average ratios. Calculate Toby’s 2021 forecasted ratios and fill in the above table. Calculate the EPS and DPS. The company has a 40% payout ratio. Please provide the solutions for the EPS, DPS, Days Sales Outstanding, Fixed Asset Turnover, Total Asset Turnover, Return on Assets, Return on Equity, Total Debt Ratio, Profit Margin on Sales, P/E Ratio.arrow_forwardGiven the following information, calculate for 2016 the number of days of working capital financing the firm will need to obtain from other sources? (i.e., show the calculations of the Days Outstanding (including embedded Turnover ratios) for each of Accounts Receivable, Inventory, and Accounts Payable, as well as the intermediate calculation of Purchases used to calculate Days Outstanding for Payables, and finally, the number of days of external working capital financing required.arrow_forward

- Rachel the chief financial officer of sunrise fruit snakcs, needed to determine the compnays projected cost of capital for next year, to do so , wshe needed to know the following infomraiont expect a) the proejcted equity level for next year b) the projected intereset rate on next years debt The projected debt level for next year D0 the projected cash balance for next yeararrow_forwardHCA Healthcare, Inc. (HCA) is a publicly traded, for-profit, large healthcare system. Using the data found in the link below: a) calculate the operating margin for 2021, 2020, 2019, and 2018; b) provide a short description of any trends you might see with the operating margin regarding the financial health of this company. https://finance.yahoo.com/quote/HCA/financials?p=HCA >arrow_forwardThe website is www.moneychimp.com. THE ANSWER MUST BE CORRECT.arrow_forward

- https://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf (Use the link the answer the question below) Working Capital Management : Use Republic Bank Limited Annual Report 2022 to answer the Questions. Assess the company’s working capital position by analyzing its current assets and liabilities using common methods and measures. Evaluate the efficiency of the company’s working capital management strategies, including inventory management, accounts receivable, and accounts payable. Based on your assessment and evaluation above, provide brief recommendations in point form for improving the company’s working capital management practices.arrow_forwardWilliams Company is a manufacturer of auto parts having the following financial statements for 2021-2022.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education