Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:-

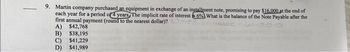

9. Martin company purchased an equipment in exchange of an installment note, promising to pay $16.000 at the end of

each year for a period of 4 years. The implicit rate of interest 6% What is the balance of the Note Payable after the

first annual payment (round to the nearest dollar)?

A) $42,768

B) $38,195

C) $41,229

$41,989

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The balance sheet for Shankland Corporation follows: 000'009 $ 000006 Current assets Long-term assets (net) Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings 000 0000 000 00 000 009' 000 006 Total liabilities and stockholders' equity 000'00s Required Compute the following. (Round "Ratios" to 1 decimal place.) Working capital Current ratio Debt-to-assets ratio Debt-to-equity ratioarrow_forwardWhich of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardTORR, Inc. issues a $500,000, 6%, six-year note on January 1, 20X1. If the monthly payment is $8,286, what is the note's carrying value after the first month's payment is made on January 31, 20X1?arrow_forward

- A5 A 12-year loan is repaid with annual payments at the end of each year. For the first four years, each payment is X; for the next four years, each payment is 3X; for the final four years each payment is 2X. The amount of interest due in the fifth payment is twice as much as the interest due in the 9th payment. Find i, the (non-zero) annual effective interest rate, rounded to two decimal places after converting to a percentage. Please solve using steps and definitions, not Excel spread sheet.arrow_forwardA businessman obtains a loan of $100,000 for a 5-year term with an interest rate of 7% per year, compounded quarterly, which must be paid in quarterly installments by the French amortization system. If the interest rate is reset to 6% annually compounded quarterly after payment 16; determines the value of the new quarterly installment. 1) $2356.87 2) $5932.82 3) $6947.23 d) $5,532.76 e) $4,578.92arrow_forwardHalep Inc. borrowed $30,000 from Davis Bank and signed a 4-year note payable stating the interest rate was 4% compounded annually. Halep Inc. will make payments of $8,264.70 at the end of each year. Annual Period Interest Expense Annual Payment Principal Payment Ending Balance 1 $1,200.00 $8,264.70 $7,064.70 $22,935.30 2 $917.41 $8,264.70 $7,347.29 $15,588.01 3 $623.52 $8,264.70 $7,641.18 $7,946.83 4 $317.87 $8,264.70 $7,946.83 $0 Principal Payment Cash Interest Income LT Notes Payable Annual Payment Interest Expense provide the journal entry for the first year payment: DR DR/CR? CRarrow_forward

- Suppose you inherit $100,000 at age 25 and immediately invested in a growth fund who’s annual rate of return average is 13%. Five years later, you transfer all proceeds from the scrubs fun into a long-term IRA that pays an average annual rate of 8%. Immediately you start making additional contributions of $7000 per year to the same IRA. Assuming continuous interest, steady interest rates, and a perfect record of making annualcontributions, how much is this IRA worth when you reach the age of 65? The formula that will need to be used is A = P e^r*t + D/r (e^r*t - 1). Hint: use the continuous interest formula to find the accumulated amount for the first five years, which is then the annual investment, P, into the IRA. arrow_forward5arrow_forward25 A company purchases a piece of machinery by issuing a $300,000 five-year note payable. The stated and effective annual interest rates are both 6%, and monthly installment payments are $5,800. What is the balance in the Notes Payable account after two payments have been made? $288,400 O $291,379 $295,700 $300,000 NEXT > BOOKMARKarrow_forward

- TORR, Inc. issues a $600,000, 9%, five-year note payable on January 1, 20X1. If the monthly payment is $12,455, what is the note's carrying value after the first month's payment is made on January 31, 20X1? Select one: a. $600,000 b. $592,045 c. $593,540 d. $595,500 e. $587,545arrow_forwardTORR, Inc. issues a $300,000, 6%, five-year note payable on January 1, 20X1. If the monthly payment is $5,800, what is the note's carrying value after the first month's payment is made on January 31, 20X1? Select one: a. $294,200 b. $300,000 c. $298,500 d. $295,700 e. $298,214arrow_forwardThe proceeds of a $9000, 8 year promissory note earning 5% compounded semi-annually were 10,475. How many years before maturity date was note sold if the discounted rate was 7.2% compounded annually?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education