ECON MACRO

5th Edition

ISBN: 9781337000529

Author: William A. McEachern

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

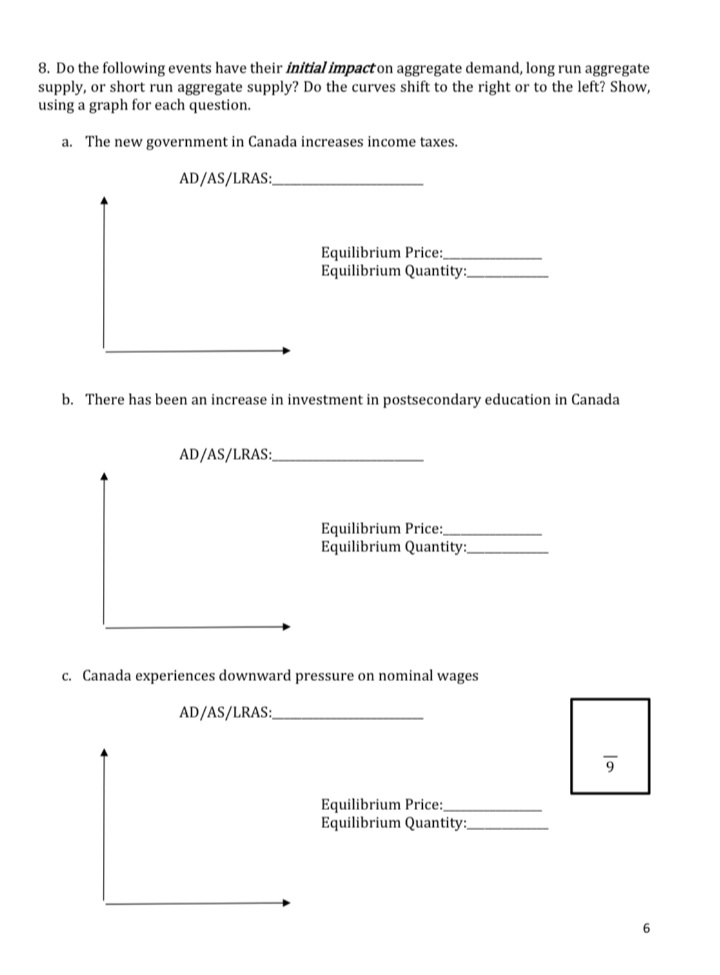

Transcribed Image Text:8. Do the following events have their initial impact on aggregate demand, long run aggregate

supply, or short run aggregate supply? Do the curves shift to the right or to the left? Show,

using a graph for each question.

a. The new government in Canada increases income taxes.

AD/AS/LRAS:

Equilibrium Price:

Equilibrium Quantity:

b. There has been an increase in investment in postsecondary education in Canada

AD/AS/LRAS:

Equilibrium Price:

Equilibrium Quantity:

c. Canada experiences downward pressure on nominal wages.

AD/AS/LRAS:

Equilibrium Price:,

Equilibrium Quantity:

9

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Carefully evaluate: “The supply and demand for agricultural products are such that small changes in agricultural supply result in drastic changes in prices. However, large changes in agricultural prices have modest effects on agricultural output.” (Hint: A brief review of the distinction between supply and quantity supplied may be helpful.) Do exports increase or reduce the instability of demand for farm products? Explain.arrow_forwardHelp with Supply and Demand graph questionarrow_forwardi have listed the choices :) thank youuuuuarrow_forward

- A product's price and the quantity consumed both increased from one year to the next. Which of the following could have happened? A Demand decreased and supply remained constant. В Demand increased and supply remained constant. C Supply increased and demand remained constant. Supply decreased and demand remained constant. Morearrow_forwardUse Table 26.3 to answer the following questions. Sketch an aggregate supply and aggregate demand diagram. What is the equilibrium output and price level? If aggregate demand shifts right, what is equilibrium output? If aggregate demand shifts left, what is equilibrium output? In this scenario, would you suggest using aggregate demand to alter the level of output or to control any inflationary increases in the price level?arrow_forwardPredict how each of the following economic changes will affect the equilibrium price and quantity in the financial market for home loans. Sketch a demand and supply diagram to support your answers. The number of people at the most common ages for home-buying increases. People gain confidence that the economy is growing and that their jobs are secure. Banks that have made home loans find that a larger number of people than they expected are not repaying these loans. Because of a threat of a war, people become uncertain about their economic future. The overall level of saving, in the economy diminishes. The federal government changes its bank regulations in a way that makes it cheaper and easier for banks to make home loans.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax