ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

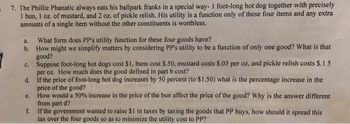

Transcribed Image Text:7. The Phillie Phanatic always eats his ballpark franks in a special way- I foot-long hot dog together with precisely

I bun, 1 oz. of mustard, and 2 oz. of pickle relish. His utility is a function only of these four items and any extra

amounts of a single item without the other constituents is worthless.

a.

What form does PP's utility function for these four goods have?

b. How might we simplify matters by considering PP's utility to be a function of only one good? What is that

good?

Suppose foot-long hot dogs cost $1, buns cost $.50, mustard costs $.05 per oz, and pickle relish costs $.1 5

per oz. How much does the good defined in part b cost?

d. If the price of foot-long hot dog increases by 50 percent (to $1.50) what is the percentage increase in the

price of the good?

How would a 50% increase in the price of the bun affect the price of the good? Why is the answer different

from part d?

f. If the government wanted to raise $1 in taxes by taxing the goods that PP buys, how should it spread this

tax over the four goods so as to minimize the utility cost to PP?

C.

e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please see below. I need help with this.arrow_forward1. Sam is going to Baltimore for the day to watch his favorite baseball team (Orioles). Sam loves his Orioles, but he is addicted to drinking beer (B) and eating hotdogs (D) while watching his team. His utility function is: U = (B*D)1/2 a. Suppose Sam has $50 to spend on beer and hotdogs. Beer costs $5 a mug and a hotdog costs $4. Draw Sam's budget constraint. b. Suppose Sam spends all of his income on beer. How many mugs of beer can he buy? What is his utility? c. Will Sam's income allow him to reach a U = 5? d. If Sam buys 4 hotdogs, how many mugs of bear can he buy? What is his utility? e. What is the combination of beer and hotdogs that yield the highest utility? 2. Firm A's Price $20 $15 $20 $40 profit $35 profit Firm B's Price $37 profit $39 profit $15 $49 profit $38 profit $30 profit $35 profit a. Firms A and B are member of an oligopoly. Which solution will Firm A and B select? b. Is there a Nash equilibrium? If so, what is it? c. Which solution will Firm A and B select if Firm…arrow_forwardConsider a 2-good, 2-agent pure exchange economy where the initial endowment is eд = (5, 5), eß = (5, 5) and preferences are represented by UA, UB: R → R where UA (XA) UB (XB) = X₁X2 and Which 2 of the following 8 options are false: For all B [0, 1], the initial endowment is a Walrasian Equilibrium allocation. If B<1 then at prices p = (1,1) there will be excess demand of good 2 and excess supply of good 1. O For all B € [0, 1], every Pareto efficient allocation can be supported as a Walrasian Equilibrium for some reallocation of resources. O For any prices p = (1, 1), the budget sets of both players leave the Edgeworth box. For all B € [0, 1], the bottom left and top right corners of the Edgeworth box (0A and Og) are both Pareto efficient. For all B [0, 1], the Walrasian Equilibrium will be Pareto efficient. For all 8 [0, 1], Bob's preferences are strictly convex. For ß = 1/2, the Pareto Set is the straight line joining OA and Og.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardonly question 1arrow_forward7. The Phillie Phanatic always eats his ballpark franks in a special way- I foot-long hot dog together with precisely I bun, 1 oz. of mustard, and 2 oz. of pickle relish. His utility is a function only of these four items and any extra amounts of a single item without the other constituents is worthless. a. What form does PP's utility function for these four goods have? b. How might we simplify matters by considering PP's utility to be a function of only one good? What is that good? Suppose foot-long hot dogs cost $1, buns cost $.50, mustard costs $.05 per oz, and pickle relish costs $.1 5 per oz. How much does the good defined in part b cost? d. If the price of foot-long hot dog increases by 50 percent (to $1.50) what is the percentage increase in the price of the good? How would a 50% increase in the price of the bun affect the price of the good? Why is the answer different from part d? f. If the government wanted to raise $1 in taxes by taxing the goods that PP buys, how should it…arrow_forward

- 12 Manuel is a consuming his optimal bundle, and is currently willing to give up 5 apples to obtain 1 orange. Jorge is in the same economy and consuming his optimal bundle, but his marginal utility of oranges is twice that of Manuel. How many apples is Jorge willing to give up to obtain 1 orange? Explain Brieflyarrow_forwardSuppose you had a budget of $20.00 and the prices of a burger and a slice of pizza are $5.00 and $2.00respectively. What would be your optimal consumption bundlearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education