A market with many buyers and sellers in the market is said to be a perfectly competitive market. A market is considered perfectly competitive as the buyers and the sellers have the perfect knowledge of the product and its prices and sellers are offering homogenous goods.

In such a market, there is no legal restriction on the entry or exit of the firm. Any time any firm can enter the market or any time can leave the market.

Examples are the Stock Market, Grain Market, and Raw Gold Market.

- A LARGE NUMBER OF BUYERS AND SELLERS: The “Large Number” indicates the ineffectiveness of a single seller or buyer in influencing the prevailing market price of its own, as each seller or buyer has an insignificant share in market supply or market demand.

Implications: The output sold by each firm is very small compared to the total output of all the firms combined. Thus, by increasing or decreasing the quantity supplied, a seller cannot affect market supply as he sells only a small proportion of the market supply. In this way, the firm does not have the bargaining power and hence is a “price taker”

The price of the commodity is determined by the market forces of demand and supply and each buyer and seller has to accept the same price. Hence uniform price prevails.

2. HOMOGENOUS GOODS: Those goods which are identical with respect to quality, size, design, and color are called homogenous goods. Such products are the perfect substitutes or the perfect standardized products that the buyers do distinguish the product of one firm from that of another. This makes their elasticity of demand infinite.

Implications: A seller cannot afford to charge a high price for the homogenous goods as the buyer had the option to purchase the same product from another seller.

Uniform price prevails for the products of all the firm in the industry, and those who charge higher prices lose their customers.

3. FREE ENTRY AND EXIT: There are no legal restrictions or barriers to the entry and exit of firms. Firms are free to start producing the commodity or to stop production. A firm seeking profit can enter the market, and any firm suffering loss can leave the market.

Implications: The freedom of entry and exit of firms has an important implication. This ensures that no firm can earn above the normal profit in the long run.

- PERFECT KNOWLEDGE: Buyers and sellers are fully aware of the price and other market conditions.

Implications: The firms have all the knowledge about the product market and the input markets, and thus each firm has equal access to the technology and the inputs used in the technology. No firm has the cost advantage. Thus, all the firms earn uniform profits.

- PERFECT MOBILITY OF THE FACTORS: The resources used in the production process like energy, labor, and raw material can move easily in and out of an industry. There are no artificial barriers (like trade unions, license requirements, patent rights, etc.) and the factors can move to an industry that pays the highest remunerations and no natural barrier which may take the form of huge capital expenditure required to start a new firm.

- NO TRANSPORTATION COST: It is assumed that different firms work close to each other in such a way that there is no transportation cost and if any, is part of the cost of production. This is also a necessary price for the price to be uniform.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

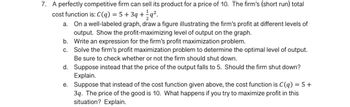

- 10. Figure 5 shows the graph of the short-run cost curves for Tim-T-Shirts, a firm operating in a perfectly competitive market. P* denotes the current price for Tim T-Shirts. Based on the information in the graph, which of the following should we expect in the long run? a) New firms will enter the market. b) The number of firms in the market will remain unchanged. c) Gray Sweaters will increase the current price of sweaters. d) There is not enough information to answer the question. Figure 5 Price and Costs P* MC ATC AVC Quantityarrow_forwardyou've been learning about what makes a market perfectly competitive, how a firm in a perfectly competitive market makes profit-maximizing decisions, and how a perfectly competitive market moves towards equilibirium. But how applicable is this to real life? For this discussion, try to think of a market (for a product or service) that is perfectly competitive or very close to it. What characteristics of the market make it like perfect competition? Are there factors that keep it from being perfectly competitive? If so, what are they? How close do you think the firms in this market are to perfectly competitive firms in choosing equilibrium price and quantity?arrow_forwardlooking to see if my answer is correct for this homework problem and if not why. the AVC is throwing me offarrow_forward

- Profit maximization using total cost and total revenue curves Suppose Caroline runs a small business that manufactures shirts. Assume that the market for shirts is a competitive market, and the market price is $20 per shirt. The following graph shows Caroline's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for shirts quantities zero through seven (inclusive) that Caroline produces. Caroline's profit is maximized when she produces______ shirts. When she does this, the marginal cost of the last shirt she produces is ______, which is (GREATER OR LESS) than the price Caroline receives for each shirt she sells. The marginal cost of producing an additional shirt (that is, one more shirt than would maximize her profit) is _____, which is (GREATER OR LESS) than the price Caroline receives for each shirt she sells. Therefore, Caroline's profit-maximizing quantity corresponds to the…arrow_forwardSuppose Amari operates a handicraft pop-up retail shop that sells phone cases. Assume a perfectly competitive market structure for phone cases with a market price equal to $20 per phone case. The following graph shows Amari's total cost curve. Use the blue points (circle symbol) to plot total revenue and the green points (triangle symbol) to plot profit for phone cases for quantities zero through seven (including zero and seven) that Amari produces. TOTAL COST AND REVENUE (Dollars) 200 150 125 100 75 50 25 0 0 O Search Total Cost 20 Total Revenue Profit C Ccc Uarrow_forwardA firm is selling apples is profit-maximizing, but they're in a constant cost industry. The industry is perfectly competitive and currently in long-run equilibrium. Assume apples are a normal good and consumer income falls, and the firm continues to produce. 1. Illustrate the decrease in income in the short run with a cost curves graph. Make sure to highlight the area of loss.arrow_forward

- Consider the perfectly competitive market for sports jackets. The following graph shows the marginal cost ( MCMC ), average total cost ( ATCATC ), and average variable cost ( AVCAVC ) curves for a typical firm in the industry.arrow_forwardUse a graph to demonstrate the scenario where a competitive firm would be earning positive profit in the short run. Can this scenario be maintained in the long run? Why? What are the ‘shutdown point’ and ‘break even point’ of a competitive firm . Explain with diagram. A competitive market starts in a situation of long run equilibrium. Then there is an increase in demand. Explain what happens in the short run and long run, using necessary diagrams.arrow_forwardExplain how the profit-maximizing rule of setting P = MC leads a perfectly competitive market to be allocatively efficient.arrow_forward

- The following graph shows the demand curve, as well as the AVC, ATC and MC curves of a company selling rolled oats in a perfectly competitive market. Use the graph to answer the questions. The goal of the company is to maximize its profit. How many boxes of rolled oats should it sell to attain this goal? What price will it charge? How much profit does this firm make per month? Will this company produce or shut down in the short run? Why? Will this firm exit the market for rolled oats in the long run or not? Why?arrow_forwardSuppose the cost of renting a snowy bus were to fall from $30 per hour to $20 per hour. What do you expect would happen in the short-run (stage 1 equilibrium) to (a) the number of cones produced by each snowy bus; (b) total production of cones in the market, and (c) economic profits of snowy bus businesses? Briefly explain (you don't need to do any calculations, just explain inwords).arrow_forwardConsider the perfectly competitive market for steak (a normal good). Starting from long-run equilibrium, show graphically what happens in the short and long run to q. Q. P, and r in the market for steak (in comparison to the starting point) if income increases. Briefly explain.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education