FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Question 9 of 9

Current Attempt in Progress

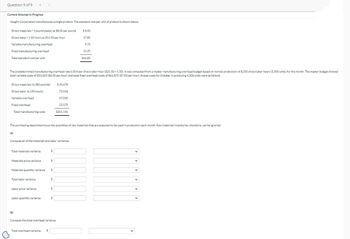

Vaughn Corporation manufactures a single product. The standard cost per unit of product is shown below.

Direct materials-1 pound plastic at $8.00 per pound

Direct labor-1.50 hours at $11.90 per hour

Variable manufacturing overhead

Fixed manufacturing overhead

Total standard cost per unit

Direct materials (4,380 pounds)

Direct labor (6,190 hours)

Variable overhead

Fixed overhead

The predetermined manufacturing overhead rate is $14 per direct labor hour ($21.00 +1.50). It was computed from a master manufacturing overhead budget based on normal production of 8,250 direct labor hours (5,500 units) for the month. The master budget showed

total variable costs of $53,625 ($6.50 per hour) and total fixed overhead costs of $61,875 ($7.50 per hour). Actual costs for October in producing 4,200 units were as follows.

(a)

Total manufacturing costs

Total materials variance

Compute all of the materials and labor variances.

Materials price variance

Materials quantity variance

The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored.

Total labor variance

Labor price variance

Labor quantity variance

(b)

Total overhead variance

$

S

$

S

$

$

$35,478

75,518

67,030

23,170

$201.196

$

Compute the total overhead variance.

$8.00

17.85

9.75

11.25

$46.85

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please only answer the total amount of fixed manufacturing overhead.arrow_forwardBramble's standard quantities for 1 unit of product include 3 pounds of materials and 1.0 labor hours. The standard rates are $3 per pound and $5 per hour. The standard overhead rate is $10 per direct labor hour. The total standard cost per unit of Bramble's product is O $24.00. O $18.00. O $15.00. O $14.00.arrow_forwardAssume the following information appears in the standard cost card for a company that makes only one product: Standar Quantity or Hours Standar Price or Rate Standard Cost Direct materials 5 pounds $ 11.00 per pound $ 55.00 Direct labor 2 hours $ 16.90 per hour $ 33.80 Variable manufacturing overhead 2 hours $ 3.00 per hour $ 6.00 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound. All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. What is the direct labor rate variance?arrow_forward

- see imagearrow_forwardAssume the following information appears in the standard cost card for a company that makes only one product: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 5 pounds $ 11.00 per pound $ 55.00 Direct labor 2 hours $ 17.00 per hour $ 34.00 Variable manufacturing overhead 2 hours $ 3.80 per hour $ 7.60 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound. All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. The actual variable overhead cost incurred during the period was $25,000. Assuming the company uses direct labor-hours to compute its predetermined overhead rate, what is the variable overhead efficiency variance?arrow_forwardOriole's standard quantities for 1 unit of product include 3 pounds of materials and 2.5 labor hours. The standard rates are $4 per pound and $5 per hour. The standard overhead rate is $8 per direct labor hour. The total standard cost per unit of Oriole's product isarrow_forward

- WCS Inc. owns some common stock of Palmer Inc. and it just received $1,800 of dividend. If WCS Inc. is subject to a tax rate of 21%, what is the tax on this investment income? A. $148 OB. $164 OC. $189 OD. $226 OE. $282 OF. $324 G. $378 H. None of the abovearrow_forwardDogarrow_forwardBramble Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-2 pound plastic at $6 per pound Direct labor-1.0 hours at $12.00 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit Direct materials (10,330 pounds) Direct labor (5,000 hours) Variable overhead Fixed overhead Total manufacturing costs Show Transcribed Text $64,046 61.000 52.122 21,578 The predetermined manufacturing overhead rate is $14 per direct labor hour ($14.00+ 1.0). It was computed from a master manufacturing overhead budget based on normal production of 5,200 direct labor hours (5.200 units) for the month. The master budget showed total variable overhead costs of $36,400 ($7.00 per hour) and total fixed overhead costs of $36,400 ($7.00 per hour) Actual costs for October in producing 5.100 units were as follows. $198.746 Overhead volume variance Overhead controllable variance $ $12.00 12.00 $ 7.00 7.00 The…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education