FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

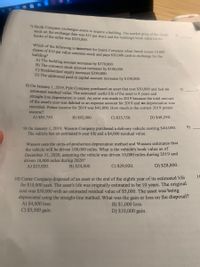

Transcribed Image Text:7) Smith Company exchanges assets to acquire a building. The market price of the Smith

stock on the exchange date was $35 per share and the building's book value on the

books of the seller was $250,000.

7)

Which of the following is incorrect for Smith Company when Smith issues 10,000

shares of $10 par value common stock and pays $20,000 cash in exchange for the

building?

A) The building account increases by $370,000.

B) The common stock account increases by $100,000.

C) Stockholders' equity increases $350,000.

D) The additional paid-in capital account increases by $100,000.

8) On January 1, 2019, Pyle Company purchased an asset that cost $50,000 and had no

estimated residual value. The estimated useful life of the asset is 8 years and

straight-line depreciation is used. An error was made in 2019 because the total amount

of the asset's cost was debited to an expense account for 2019 and no depreciation was

recorded. Pretax income for 2019 was $42,000. How much is the correct 2019 pretax

income?

8)

A) $85,750.

B) $92,000.

C) $35,750.

D) $48,250.

9)

9) On January 1, 2019, Wasson Company purchased a delivery vehicle costing $40,000.

The vehicle has an estimated 6-year life and a $4,000 residual value.

Wasson uses the units-of-production depreciation method and Wasson estimates that

the vehicle will be driven 100,000 miles. What is the vehicle's book value as of

December 31, 2020, assuming the vehicle was driven 10,000 miles during 2019 and

driven 18,000 miles during 2020?

A) $25,920.

B) $24,800.

C) $29,920.

D) $28,800.

10

10) Carter Company disposed of an asset at the end of the eighth year of its estimated life

for $10,000 cash. The asset's life was originally estimated to be 10 years. The original

cost was $50,000 with an estimated residual value of $5,000. The asset was being

depreciated using the straight-line method. What was the gain or loss on the disposal?

A) $4,000 loss.

C) $5,500 gain.

B) $1,000 loss.

D) $10,000 gain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ryan Ltd. sold equipment with a book value of $80.000 for a $10,000 loss, sold Ryan Ltd. common stock for $145,000, repaid a notes payable for $220,000 (this amount includes $20,000 of interest on the notes payable), paid dividends of $35.000, resold treasury stock for $25,000 (the treasury stock was originally purchased for $15.000), and received dividends in the amount of $30,000. The net cash outflow from financing activities was:arrow_forwardJohn Kim agrees to contribute equipment with a fair market value of $5,000 in exchange for 100 shares of Rio Inc.'s common stock with a par value of $1 per share. Rio will record this transaction as a credit to which of the following accounts? (Check all that apply.) Cash Common Stock Equipment Paid-in Capital in Excess of Land Paid-in Capital in Excess of Par Valuearrow_forwardRussell Corp.'s transactions for the year ended December 31, 20X1 included the following:· Acquired 50% of Maxwell Corp.'s common stock for $200,000 cash which was borrowed from a bank.· Issued 5,000 shares of its preferred stock for land having a fair value of $320,000.· Issued 500 of its 11% debenture bonds, due 20X6, for $392,000 cash.· Purchased a patent for $220,000 cash.· Paid $120,000 toward a bank loan.· Sold available-for-sale securities for $796,000. Russell’s net cash provided by financing activities for 20X1 was Question 12 options: $472,000. $560,000. $592,000. $680,000.arrow_forward

- Indigo Corporation purchased 370 shares of Sherman Inc. common stock for $13,100 (Indigo does not have significant influence). During the year, Sherman paid a cash dividend of $3.00 per share. At year-end, Sherman stock was selling for $37.50 per share. Assume the stock is nonmarketable. Prepare Indigo's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)arrow_forwardSmith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $38 per share and the bullding's book value on the books of the seller was $215,000. Which of the following is correct for Smith Company when Smith issues 10,000 shares of $10 par value common stock and pays $21,500 cash in exchange for the butlding? Murtiple cholce Total assets Increase $380,000. Stockholders equity increases $215.000. Total assets increase $350.500. stocknoiders' equity increases $358.500.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Brooks Company purchases debt investments as trading securities at a cost of $71,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $90,000. Brooks sells a portion of its trading securities (costing $35,500) for $40,250 cash. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction.arrow_forwardPresented below is information related to Cullumber Company.1. On July 6, Cullumber Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $200,000 Buildings 600,000 Equipment 400,000 Total $1,200,000 Cullumber Company gave 12,000 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property.2. Cullumber Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $168,000 Construction of bases for equipment to be installed later 216,000 Driveways and parking lots 195,200 Remodeling of office space in building, including new partitions and walls 257,600 Special assessment by city on land 28,800 3. On December 20, the company paid cash…arrow_forwardSudoku Company issues 21,000 shares of $9 par value common stock in exchange for land and a building. The land is valued at $231,000 and the building at $377,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building.arrow_forward

- Belize Biltmore Plaza acquires a patent from Camino Real in exchange for 3,000 shares of Belize Biltmore Plaza’s $6 par value common stock and $85,000 cash. When the patent was initially issued to Camino Real, Belize Biltmore Plaza’s stock was selling at $8.25 per share. When Belize Biltmore Plaza acquired the patent, its stock was selling for $9.50 per share. Belize Biltmore should record the patent at what amount?arrow_forward22,000 shares reacquired by Sunland Corporation for $50 per share were exchanged for undeveloped land that has an appraise value of $1,630,000. At the time of the exchange, the common stock was trading at $57 per share on an organized exchange. (a) Prepare the journal entry to record the acquisition of land assuming that the purchase of the stock was originally recorded using the cost method. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forward29,000 shares reacquired by Bridgeport Corporation for $55 per share were exchanged for undeveloped land that has an appraised value of $1,808,000. At the time of the exchange, the common stock was trading at $66 per share on an organized exchange. (a) Prepare the journal entry to record the acquisition of land assuming that the purchase of the stock was originally recorded using the cost method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education