Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I am not understanding how to use excel to get the answer to this.

Please show excel work. Answer should be: $2,058,046

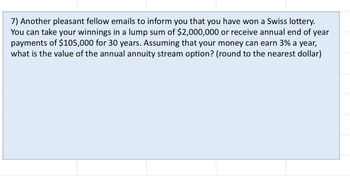

Transcribed Image Text:7) Another pleasant fellow emails to inform you that you have won a Swiss lottery.

You can take your winnings in a lump sum of $2,000,000 or receive annual end of year

payments of $105,000 for 30 years. Assuming that your money can earn 3% a year,

what is the value of the annual annuity stream option? (round to the nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute a final numerical answer for each of the following problems. Youshould work out your solutions on loose leaf paper in an organized manner so that when I post the solutionkey, you can determine why answers that you missed were incorrect. This will allow you to LEARN fromany mistakes so you to not repeat these on the Final Exam (which is worth 35% of your grade in this class).Unless instructed otherwise on a question, round all dollar answers to 2 decimal places, record IRR valuesas a percent rounded to 2 decimal places, round payback period or profitability index values to 1 decimalplace, and record WACC values as a percent rounded to 2 decimal places.USE THE TABLE BELOW TO ANSWER THE FOLLOWING THREE (3) QUESTIONSYear Project A Cash Flows ($s) Project B Cash Flows ($s) Project C Cash Flows ($s)0 -100,000 -700,000 -2,350,0001 25,000 180,000 2,500,0002 20,000 150,000 2,500,0003 30,000 190,000 2,500,0004 25,000 140,0005 25,000 140,0006 20,000The payback period for Project A is…arrow_forwardplease help me solve this question, it is saying this is the wrong answer. thanks! please answer with steps computation explanation do that I can understand the whole process no copy pastearrow_forward6. I need help with formulasarrow_forward

- ok sk int rences C raw 124,010 :8: F1 Exercise 6-8A (Static) Which of the following is true about the cost of employees within a business context? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) @ 2 W ?Hiring employees involves a significant overhead cost. ? Costs associated with employees include only salary and limited hiring expenses. ?Employees constitute a high cost of conducting business. ?The cost of providing employee benefits is minimal and of little importance. F2 # 3 E S D AL 15 80 F3 $ с 4 R Q F4 % 5 * 8 F G H J DII F8 I XCVBNM ( 9 K A DD F9 0 < ) 0 F10 L P 4 F11 M + [ F12 = ? 11 I Warrow_forwardNeed help with this problem (number 14). Need help with the blank data. Thanks!arrow_forwardChapter 1: Applying Excel: Excel Worksheet (Part 1 of 2) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell C18 enter the formula "= B6". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts in both the traditional and contribution format income statements match the numbers in Exhibit 1-7. Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4,700. If you do not get these answers, find the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by clicking “Browse.” Next, click…arrow_forward

- Please solve with steps. Thank you??arrow_forwardHello, I need help solving this accounting problem.arrow_forwardSolve a Related Rates Problem. A technical support contracting firm hires people to work from home using their proprietary support scripting system. The more employess they have, the more contracts they can support and therefore the more revenue they can generate. Suppose that the company's revenue and number of employees is related by R² = 297x³, where is R is the revenue in thousands of USD anda is the number of employees in hundreds. If there is no shortage of work to be done, the company currently has 3300 employees, and the company wants to increase their revenue from $3,267,000.00 this year to $5,643,000.00 next year, how many new employees should be hired in order to make that possible? The company should hire new employees before next year. Preview My Answers Submit Answers harrow_forward

- Godoarrow_forwardPlease don't give image formatarrow_forwardI will provide the question and answer but I need an explanation on how to get the answers. There are 4 answers (below) and the chart should be attached. Solve the problem. Round dollar amounts to the nearest dollar. Westminster Office Machines allocates its overhead of $1,487,304 by the sales of each product. Find the overhead for each department. List your answers if the order of the table. ($423,696, $458,304, $222,684, $382,620)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education