FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

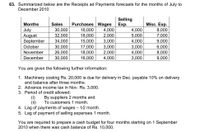

Transcribed Image Text:63. Summarized below are the Receipts ad Payments forecasts for the months of July to

December 2010

Purchases Wages

4,000

Selling

Exp.

Months

Sales

Misc. Exp.

30,000

32,000

4,000

5,000

8,000

July

August

September

16,000

18,000

15,000

2,000

7,000

34,000

30,000

26,000

30,000

3,000

17,000

18,000

16,000

3,000

2,000

4,000

4,000

3,000

4,000

3,000

9,000

6,000

8,000

9,000

October

November

December

You are given the following further information:

1. Machinery costing Rs. 20,000 is due for delivery in Dec. payable 10% on delivery

and balance after three months.

2. Advance income tax in Nov. Rs. 3,000.

3. Period of credit allowed:

(i)

By suppliers 2 months and

(ii)

To customers 1 month.

4. Lag of payments of wages – 12 month.

5. Lag of payment of selling expenses 1 month.

You are required to prepare a cash budget for four months starting on 1 September

2010 when there was cash balance of Rs. 10,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- nkt.2arrow_forwardNumber 5arrow_forwardA company is preparing its cash buget for the month of May. Below is A/R information: Actual credit sale for March $130,000 Actual credit sale for April $160,000 Estimated credit sales for May $210,000 Estimated collections in the month of sale 25% Estimated collections in the first month after the month of sale 60% Estimated collections in the second month after the month of sale 10% Estimated provision of bad debts (made in month of sale) 5% ** Firm writes off all UNCOLLECTIBLE account receievables at the end of second month after the month of sale. Required: For the month of May, calculate the following: 1. Estimated cash receipts from account recievable collections. 2. The gross amount of A/R at the end of the month (after appropriate write off of uncollectiable amounts). 3. The net amount of A/R at the end of the month 4. Recalculate the requirement 1 & 2 under the assumption that estimated collections in the month of sale equal 60% and in the first…arrow_forward

- You collect 75% of a month's sales in the month of the sale and 25% of sales in the following month. May sales June sales July sales O $105 O $35 $120 Compute cash inflows for June. $135 $140 $100 not enough information, because sales revenue differsarrow_forwardFernando Company developed the following data for the month of August:1. August 1 cash balance P123,000.2. Cash sales in August P800,000.3. Credit sales for August are P300,000; for July P400,000; and for June P400,000. 70% of credit sales are collected in the month of sale, 15% in thefollowing month, and 10% in the second month following the sale. 4. Purchases for July were P500,000 and for August are P400,000. One-fourth of purchases are paid in the month of purchase and the remaining three-quarters in the following month. 5. August salaries are P314,000, utilities are P32,200, and depreciation on the building and equipment is P100,000. Required:1. Anticipated cash receipts from accounts receivable in August.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education