FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

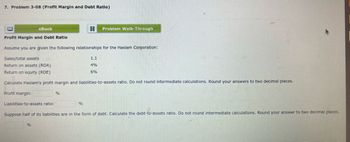

Transcribed Image Text:7. Problem 3-08 (Profit Margin and Debt Ratio)

Profit Margin and Debt Ratio

eBook

Profit margin:

Assume you are given the following relationships for the Haslam Corporation:

Sales/total assets

Return on assets (ROA)

Return on equity (ROE)

Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places.

Liabilities-to-assets ratio:

%

%

3 Problem Walk-Through

%

1.1

4%

6%

Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ff2arrow_forwardPlease help with the following question, thank you!arrow_forwardQuestion 6 (this question has 2 parts) Gordon Industries Ltd has provided you with the following information: 2019 2020 2021 Debt to Equity 10.5% 23.4% 36.2% Gross Profit margin 30.2% 36.5% 35.3% Net profit margin 19.5% 17.6% 13% Return on Equity 15.1% 17.5% 16.2% Asset Turnover (times) 0.71 0.82 1.41 Return on Assets 13.8% 14.4% 18.3% Interest coverage ratio 4 times 3 times 2.5 times a) Advise Gordon Industries of the relationship between Return on Assets, Asset Turnover and Net Profit Margin. Comment on the profitability position of Gordon and any advice you consider relevant. b) Advise the shareholders of Gordon Industries on the financial structure of the company.arrow_forward

- EAST COAST YACHTS 2020 Income Statement Sales Cost of goods sold Selling, general, and administrative Depreciation EBIT Interest expense EBT Taxes (25%) Net income Dividends Retained earnings $550,424,000 397,185,000 65,778,000 17,963,000 $ 69,498,000 9,900,000 $ 59,598,000 14,899,500 $ 44,698,500 $ 19,374,500 25,324,000 Current assets Cash and equivalents Accounts receivable Inventory Other Total current assets Fixed assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Intangible assets and others Total fixed assets Total assets EAST COAST YACHTS 2020 Balance Sheet $ 10,107,000 16,813,300 18,135,700 1,054,900 $ 46,110,900 $412,032,000 (102,452,000) $309,580,000 6,772,000 $316,352,000 $362,462,900 Current liabilities Accounts payable Accrued expenses Total current liabilities Long-term debt Total long-term liabilities Stockholders' equity Preferred stock Common stock Capital surplus Accumulated retained earnings Less treasury stock…arrow_forwardperience p....pptm ^ Type here to search w X # 3 E Coronado Company's condensed financial statements provide the following information. C Cash Accounts receivable (net) Short-term investments Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Current liabilities ACC341-2022-Ho....xlsx $ 4 Bonds payable R F % 5 O CORONADO COMPANY BALANCE SHEET T At O+ 6 V B ▶ music 2.jpeg n H & 7 Dec. 31, 2020 $52,100 197,700 80,800 442,700 3,000 $776,300 849,900 $1,626,200 237,700 401,800 U 20 8 J Dec. 31, 2019 $60,200 O 80,800 39,600 N M 360,200 $547,700 849,900 $1,397,600 6,900 155,700 ( 401,800 9 W K F11 ) O 0 888 P Home End C Rair Insearrow_forwardipment Counts payable mer investments rrell, Withdrawals ervices revenue ent revenue alaries expense dvertising expense tilities expense $ 23,500 12,500 27,500 10,500 64,500 14,500 42,500 8,500 6,500 Saved Prepare its year-end income statement. Prepare its year-end statement of owner's equity, using net income calculated in par Complete this question by entering your answers in the tabs below. Required A Required B Prepare its year-end statement of owner's equity, using net income calculated in part a. Hint: was $0. TERRELL COMPANY Statement of Owner's Equity For Year Ended December 31 Terrell, Capital, January 1 $ 0 Add: Investments by owner Add: Net income 27,500 8,500 36,000 11,547 MAY 21 tv MacBook Proarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education