FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

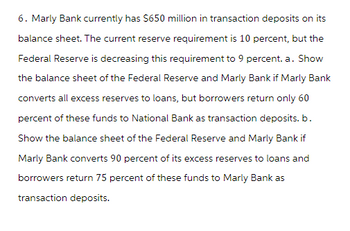

Transcribed Image Text:6. Marly Bank currently has $650 million in transaction deposits on its

balance sheet. The current reserve requirement is 10 percent, but the

Federal Reserve is decreasing this requirement to 9 percent. a. Show

the balance sheet of the Federal Reserve and Marly Bank if Marly Bank

converts all excess reserves to loans, but borrowers return only 60

percent of these funds to National Bank as transaction deposits. b.

Show the balance sheet of the Federal Reserve and Marly Bank if

Marly Bank converts 90 percent of its excess reserves to loans and

borrowers return 75 percent of these funds to Marly Bank as

transaction deposits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- what is the maximum amount of loans that the Second National Bank can make if it holds only the required reserves?arrow_forward17. Assume that a bank obtains most of its funds from long-term borrowed funds such as Federal Home Loan Bank borrowings. The bank's assets are in the form of loans with rates that adjust affected if interest rates every three months. In the next three months, the bank would be increase. A. negatively. B. favorably. C. unaffected.arrow_forwardSuppose banks desire to hold no excess reserves and that the Fed has set a reserve requirement of 20 percent. If you deposit $18,000 into First Jayhawk Bank, a. First Jayhawk's required reserves increase by $1,800. b. First Jayhawk will be able to lend out $16,200. c. First Jayhawk's assets and liabilities both will increase by $18,000. d. All of the above are correct.arrow_forward

- Pixar Bank has the following balance sheet: Assets Cash 21,000 Liabilities and Equity Demand Deposits 550,000 Short-term Securities 369,000 Interbank Borrowed 151,000 Loans Total 400,000 Equity 790,000 Total 89,000 790,000 Pixar Bank's largest customer decides to exercise a $10,000 loan commitment. If the bank chooses to meet this loan commitment using purchased liquidity management techniques, which of the following correctly describes the balance in each account after the transaction? Select one: O a. Loans $410,000 and Funds Borrowed = $161,000 O b. Loans = $400,000 and Funds Borrowed = $161,000 О с. Loans $410,000 and Equity = $99,000 O d. None of the above e. Cash $11,000 and Loans = $410,000arrow_forwardOn April 2, 2020, shortly after the $7.5 million deposit outflow, Key Bank had borrowed the needed fund in the fed funds market to cover the shortfall in reserves for the remainder of the month (29 days, from 4/2 to 4/30). The required yield on a discount basis was 1.5%. On April 30, 2020, Key Bank finally received the first required payments from its mortgages, loan, and T-bills, and it also paid off its fed funds loan. Key Bank was required to establish a loan loss reserve at 0.5% of the commercial loan value and the bank was in the 35% tax bracket. The bank had not engaged in any off-balance-sheet activities. Question: According to the balance sheet as of April 30, 2021, was Key Bank complying with the risk weighted capital requirement set by Basel 1? Group of answer choices The bank's tier 1 capital, but not total capital, meets the minimum requirement. The bank's total capital, but not tier 1 capital, meets the minimum requirement. Neither tier 1 capital nor total capital of the…arrow_forwardGiven below is the balance sheet for the Bank of New Providence: Assets ($1,000,000s) Liabilities ($1,000,000s) Cash 52 Deposits 650 T-bills and Bonds 257 Long-term debt 326 Loans to Other Banks 95 Equity 88 Commercial Loans 364 Mortgages 296 Total 1,064 Total 1,064 The net profit for the bank was $10.3 million. A required reserve is specified at 5% of deposits. What is the Bank's EM?arrow_forward

- The table shows the balance sheet of a banking system (aggregated over all banks) The desired reserve ratio on all deposits is 5 percent. There is no currency drain Assets Liabilities (millions of dollars) What is the quantity of loans and the quantity of total deposits when the banks have no excess reserves? Reserves at the Fed Cash in vault 25 Checkable deposits Savings deposits 100 20 100 >>> Answer to 2 decimal places Securities 65 Loans 90 The total quantity of loans after the banks have lent all their excess reserves is SOmilion. The total quantity of deposits after the banks have lent all their excess reserves is Smillionarrow_forwardPlease provide answer in text (Without image)arrow_forwardc.) Bank A has three types of assets: Debenture ($90,000), Mortgage ($75,000), and Loan to the Government ($2000). The bank has Tier 1 capital of $15,000 and Tier 2 capital of $20,000. Calculate Capital adequacy ratio. If the capital adequacy requirement ratio is 8%, does the bank meet the requirement?arrow_forward

- 45. Consider the following situation in the Canadian banking system: • The Bank of Canada purchases $5 million worth of government securities from an investment dealer with a cheque drawn on the Bank of Canada. • The dealer deposits this cheque at Bank XYZ, a commercial bank. • The target reserve ratio for all commercial banks is 20%. • All commercial banks operate with no excess reserves. • There is no cash drain. Suppose the public decides to hold 30% of their deposits in cash — that is, there is now a cash drain of 30%. As a result of the new deposit, the money supply would eventually decrease by $12.50 million. increase by $10 million. decrease by $15 million. increase by $12.50 million. not change.arrow_forwardQuestion: Given below is the balance sheet for the Bank of New Providence: Assets ($1,000,000s) Liabilities ($1,000,000s) Cash 52 Deposits 650 T-bills and Bonds 257 Long-term debt 326 Loans to Other Banks 95 Equity 88 Commercial Loans 364 Mortgages 296 Total 1,064 Total 1,064 The net profit for the bank was $10.3 million. A required reserve is specified at 5% of deposits. What is the bank's ROA?arrow_forwardYou observe the following details about a bank (amounts in million) net interest income: $1,250 net noninterest income: $200 operating expenses: $900 loan loss provisions: $170 gains from trading: $75 Taxes: $150 Total assets: $17,000 Equity: $2,200 What is the bank's ROE? Write your answer expressed as a %, and round to two decimals. For instance, if you think the ROE is 0.0856237, then you write 8.56 belowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education