FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please provide answer in text (Without image)

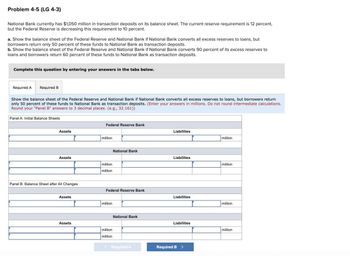

Transcribed Image Text:Problem 4-5 (LG 4-3)

National Bank currently has $1,050 million in transaction deposits on its balance sheet. The current reserve requirement is 12 percent,

but the Federal Reserve is decreasing this requirement to 10 percent.

a. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts all excess reserves to loans, but

borrowers return only 50 percent of these funds to National Bank as transaction deposits.

b. Show the balance sheet of the Federal Reserve and National Bank if National Bank converts 90 percent of its excess reserves to

loans and borrowers return 60 percent of these funds to National Bank as transaction deposits.

Complete this question by entering your answers in the tabs below.

Required A Required B

Show the balance sheet of the Federal Reserve and National Bank if National Bank converts all excess reserves to loans, but borrowers return

only 50 percent of these funds to National Bank as transaction deposits. (Enter your answers in millions. Do not round intermediate calculations.

Round your "Panel B" answers to 3 decimal places. (e.g., 32.161))

Panel A: Initial Balance Sheets

Assets

Assets

Panel B: Balance Sheet after All Changes

Assets

Assets

Federal Reserve Bank

million

million

million

Federal Reserve Bank

million

National Bank

million

million

National Bank

< Required A

Liabilities

Liabilities

Liabilities

Liabilities

Required B >

million

million

million

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education