Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

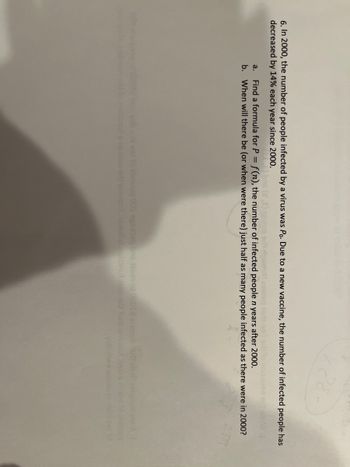

Transcribed Image Text:6. In 2000, the number of people infected by a virus was Po. Due to a new vaccine, the number of infected people has

decreased by 14% each year since 2000.

bns (21) 2nog srbi riguard) asazen je snil srl to no

a. Find a formula for P = f(n), the number of infected people n years after 2000.

b. When will there be (or when were there) just half as many people infected as there were in 2000?

abruoq 005 ogsbbsq ons 12501 01 02012

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Before After 5 Treated A B Untreated C D Imagine that we have a difference-in-differences regression: Y BO+B1xTreated + B2xAfter + B3x(TreatedxAfter) What is the value of B2? OD OD-C OB OB-Darrow_forwardConsider a random walk with 2 states, where • the probability of staying in location 1 is 0.17, and • once the walker reaches location 2 he will never go back to location 1. Find the transition matrix P. P = Find Pn for arbitrary positive integer n. pn =arrow_forwardWhat is the test statistics and critical values. I got 4.20 for the test statistic, but it says its incorrect.arrow_forward

- What is the mean of a binomial distribution in which the number of trials n = 100 and the probability of success p = 0.5? 550.0 500.0 0.500 50.00 100.0arrow_forwardUse the data shown in the following table: K a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). b. Compute the variance and standard deviation for each of the assets from 1929 to 1940. c. Which asset was the riskiest during the Great Depression? How does that fit with your intuition? Note: For all your answers type decimal equivalents. Data table Year 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 S&P 500 -0.08906 -0.25256 - 0.43861 -0.08854 0.52880 -0.02341 0.47221 0.32796 -0.35258 0.33204 -0.00914 - 0.10078 Small Stocks - 0.43081 -0.44698 -0.54676 -0.00471 2.16138 0.57195 0.69112 0.70023 - 0.56131 0.08928 0.04327 -0.28063 Corp. Bonds 0.04320 0.06343 -0.02380 0.12199 0.05255 0.09728 0.06860 0.06219 0.02546 0.04357 0.04247 0.04512 World Portfolio -0.07692 -0.22574 -0.39305 0.03030 0.66449 0.02552 0.22782 0.19283 -0.16950 0.05614 -0.01441 0.03528 Treasury Bills 0.04471 0.02266 0.01153 0.00882 0.00516 0.00265 0.00171 0.00173…arrow_forwardConsider the following information: Rate of Return Probability of State State of if State Economy Recession of Economy .25 Occurs -.09 Normal .45 11 Вoom .30 .30 Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forward

- Calculate the expected value of the given random variable X. X is the number of tails that come up when a coin is tossed five times. E(X) =arrow_forward3. * The force of interest (t) at time t (measured in years) is a + bt² where a and b are constants. An amount of £200 at time t = 0 accumulates to £210 at t = 5 and £230 at t = 10. 1 (a) Show that a = log (1.05) - 30 log(1.15) = 0.008352, and b = 250 log(1.15) - 125 log(1.05) = 0.0001687. (b) Compute A(0, 7) and hence compute the discounted value at t = 0 of a payment of £750 due at t = 7. (c) Compute A(6, 7). What is the equivalent constant annual interest rate for the year from t = 6 to t = 7? (d) Calculate the constant force of interest that would give rise to the same accumulation from t = 0 to t = 10.arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education