FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

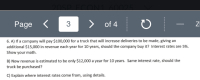

Transcribed Image Text:6. A) If a company will pay $100,000 for a truck that will increase deliveries to be made, giving an

additional $15,000 in revenue each year for 10 years, should the company buy it? Interest rates are 5%.

Show your math.

B) Now revenue is estimated to be only $12,000 a year for 10 years. Same interest rate, should the

truck be purchased?

C) Explain where interest rates come from, using details.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose you want to purchase a home for $525,000 with a 30-year mortgage at 4.84% interest. Suppose also that you can put down 30%. What are the monthly payments? (Round your answer to the nearest cent.) $ What is the total amount paid for principal and interest? (Round your answer to the nearest cent.) $ What is the amount saved if this home is financed for 15 years instead of for 30 years? (Round your answer to the nearest cent.)arrow_forwardPresent value with periodic rates. Cooley Landscaping needs to borrow $25,000 for a new front-end dirt loader. The bank is willing to loan the money at 8% interest for the next 6 years with annual, semiannual, quarterly, or monthly payments. What are the different payments that Cooley Landscaping could choose for these different payment plans? C What is Cooley's payment for the loan at 8% interest for the next 6 years with annual payments? $ (Round to the nearest cent.)arrow_forwardYour answer is incorrect. Sheridan Company is considering investing in an annuity contract that will return $33,500 annually at the end of each year for 15 years. Click here to view the factor table. What amount should Sheridan Company pay for this investment if it earns an 10% return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Sheridan Company should pay $ eTextbook and Media Save for Later SUPP Attempts: 2 of 3 used Submit Answerarrow_forward

- a. Renting a machine will need monthly payments of $6,000 for the next 5 years (i.e., at t = 1, 2, …, 60). However,if we choose to buy the machine today,which is (t = 0) will cost $320,000. Assume the machine's value is zero after 5 years. It is possible to borrow and lend at a semi-annually compounded interest rate of 6% (APR). Would it be better to buy or to lease? Explain. b.We are currently at year 0. It is worthy to note that there is a perpetuity that pays $250 at the end of each odd year and $150 at the end of each even year. The term structure is flat at 10% per year. Evaluate the present value of this perpetuity. c.Assume the CAPM is valid.The return on asset ABC is perfectly correlated with the return on market portfolio. Your friend makes the following statetment: a portfolio that had a dollar invested and at the same time,shorting one dollar of the market portfolio will have no systematic risk. Comment on this and whether it is feasible.arrow_forwardwhat would the formula be to solve for the table value? the table value is what i need to solve the problemarrow_forwardbetty's bakery is planning for future expansion. the company estimates that i will need 59,500 to purchase a new commercial oven 5 years from now. assuming a 2% annual interest rate compounded annually, use the pv function in excel or a financials calculator to determine how much betty's must invest today to have 59,500 5 years from now on. present value=??arrow_forward

- Compute the monthly payment and the total amount spent for a vehicle that costs $24,000 if you finance the entire purchase over 5 years at an annual rate of 8 25 percent. Calculate the payment if you finance the car for only four years. Finally, calculate the payment for three years. What do you notice about the payment under the different time assumptions? Note: Round intermediate computations to at least five (5) decimal places Click on the table icon to view the MILPF table The monthly payment, PMT, on the 5-year auto loan is $ (Round to the nearest cent.) The total amount spent if you financed $24,000 for 5 years at 8 25 percent per year is $ (Round to the nearest cent.) The monthly payment, PMT, on the 4-year auto loan is $ (Round to the nearest cent.) Finally, the monthly payment, PMT, on the 3-year auto loan is $ (Round to the nearest cent.) What do you notice about the payment under the different time assumptions? (Select the best choice below.) OA. As the number of payments…arrow_forwardPLEASE USE EXCEL, SHOW FORMULAS, AND INCLUDESPiderplot HiTek Manufacturing is purchasing a large tract of land for a new facility. Its loan is for $3 million, but this may vary by plus or minus 10%. The loan will be paid off in 15 years using annual payments, but this could be as low as 10 years or as high as 30 years. If the interest rate is 10% (between 8% and 12%), How much is each payment? Construct a spiderplot. Which change would be most significant?arrow_forwardYou want to buy a car, and the local bank will lend you $20,000. The loan will be fully amortized over 5 years (60 months) and the nominal interest rate will be 12%. The interest will be paid monthly. What will be the monthly loan payment? draw a time line and identify the known variables and unknown variables as if you were to input in EXCEL.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education