Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

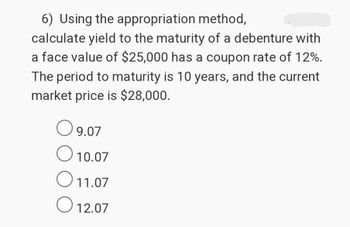

Transcribed Image Text:6) Using the appropriation method,

calculate yield to the maturity of a debenture with

a face value of $25,000 has a coupon rate of 12%.

The period to maturity is 10 years, and the current

market price is $28,000.

○ 9.07

О

10.07

11.07

О

12.07

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 10. Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security of $4,000 will be worth $5,324.00 three years in the future, assuming that no additional deposits or withdrawals are made, what is the implied interest rate the investor will earn on the security? ○ 6.00% ○ 7.50% ○ 10.00% ○ 12.00% If an investment of $35,000 is earning an interest rate of 11.00% compounded annually, it will take value of $58,977.04-assuming that no additional deposits or withdrawals are made during this time. for this investment to grow to a Which of the following statements is true, assuming that no additional deposits or withdrawals are made? If you invest $1 today at 15% annual compound interest for 82.3753 years, you'll end up with approximately $100,000. ○ If you invest $5 today at 15% annual compound interest for 82.3753 years,…arrow_forward5. Suppose you have a 2.5-year remaining on an interest rate swap with a notional principal of $10,000, 000 between Company A and Company B. Company A pays fixed rate and Company B pays the float rate. Fixed and float payments are exchanged every year and the last payment was exchanged 6 months ago. The fixed rate is 3.5% per annum, and the floating rate is tied to the annual LIBOR. The previous 1-year LIBOR rate, set 6 months ago, is 2.75%, 6 month LIBOR is 3.25%. the 1.5-year LIBOR is 3.25%, and the 2.5-year LIBOR is 3.50%. Calculate the present value of the fixed and floating legs of the swap, and determine the swap's net present value from Company A's perspective. Assume annual compounding for discounting.arrow_forward(mark-to-market) You enter a long position in a € future contract with the size of €125,000 today. The futures expire in 90 days. The interest rates are iS = 3.9% and i€ = 3.9%. The current spot rate is $1.38/€. Assume 360 days a year. If the spot rate is $1.43/€ the next day and interest rates remain the same, your profit or loss for this day is S _. (Keep the sign and two decimal places.)arrow_forward

- (mark-to-market) You enter a long position in a € future contract with the size of €125,000 today. The futures expire in 90 days. The interest rates are i$=2.6% and iç-5.5%. The current spot rate is $1.38/€. Assume 360 days a year. If the spot rate is $1.36/€ the next day and interest rates remain the same, your profit or loss for this day is $_ ____.(Keep the sign and two decimal places.)arrow_forwardSuppose that oil forward prices for 1 year, 2 years, and 3 years are $62, $74, and $80 per barrel. The 1-year effective annual interest rate is 3.4%, the 2-year interest rate is 3.0%, and the 3-year interest rate is 2.6%. What is the fixed per-barrel price in a 3-year swap that calls for delivery of 4 barrels of oil at the end of the first year, 2 barrels the second year, and 2 barrels the third year?arrow_forwardYou have just purchased a six-month, $550,000 negotiable CD, which will pay a 8.5 percent annual interest rate. a. If the market rate on the CD rises to 9 percent, what is its current market value?b. If the market rate on the CD falls to 8.25 percent, what is its current market value?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education