Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

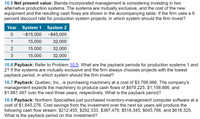

Transcribed Image Text:**10.5 Net Present Value:**

Blanda Incorporated management is considering investing in two alternative production systems. The systems are mutually exclusive, and the cost of the new equipment and the resulting cash flows are shown in the accompanying table. If the firm uses a 9 percent discount rate for production system projects, in which system should the firm invest?

| Year | System 1 | System 2 |

|------|----------|----------|

| 0 | −$15,000 | −$45,000 |

| 1 | $15,000 | $32,000 |

| 2 | $15,000 | $32,000 |

| 3 | $15,000 | $32,000 |

**10.6 Payback:**

Refer to Problem 10.5. What are the payback periods for production systems 1 and 2? If the systems are mutually exclusive and the firm always chooses projects with the lowest payback period, in which system should the firm invest?

**10.7 Payback:**

Quebec, Inc., is purchasing machinery at a cost of $3,768,966. The company's management expects the machinery to produce cash flows of $979,225, $1,158,886, and $1,881,497 over the next three years, respectively. What is the payback period?

**10.8 Payback:**

Northern Specialties just purchased inventory-management computer software at a cost of $1,645,276. Cost savings from the investment over the next six years will produce the following cash flow stream: $212,455, $292,333, $387,479, $516,345, $645,766, and $618,325. What is the payback period on this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 8 images

Knowledge Booster

Similar questions

- Project X Initial investment (CF) $500,000 Year (1) 1 2 3 4 5 Project Y $330,000 Cash inflows (CFt) $130,000 $120,000 $130,000 $200,000 $240,000 $150,000 $130,000 $75,000 $80,000 $60,000arrow_forwardCan you help me work out question 1(a) please without having to use excel? Thank you in advarrow_forward21arrow_forward

- 5.1.3 Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). INFORMATION Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only available to invest in one of them. You are given the following projected data: Initial cost Scrap value Depreciation per year Net profit Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flows Year 1 Year 2 Year 3 Year 4 Year 5 Project A R300 000 R40 000 R52 000 R20 000 R30 000 R50 000 R60 000 R10 000 Project B R300 000 0 R60 000 R90 000 R90 000 R90 000 R90 000 R90 000arrow_forwardNonearrow_forwardPart Barrow_forward

- NPV ProfileThe figure below shows the NPV profile for two investment projects.Refer to NPV Profile. Suppose the two projects require about the same initial investment. Which project generates more cash flows in the early years? Group of answer choices There is no difference between the two projects Project 2 Project 1 Cannot tell from the given informationarrow_forwardPls complete step and explain formula tooarrow_forward12q-19arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education