FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Given the following information of the mortgage pool that backs a MPT, what is the regular scheduled payment in month 1 of the security? Use WAC as the mortgage rate and WAM as the number of periods for your calculations. Round your final answer to two decimals.

• 30 year FRM, fully amortizing, monthly payments

• Loans seasoned for 3 months before entering pool

• WAM: 357

• WAC: 4%

• Servicer/Guaran

• Prepayment assumption: 75% PSA

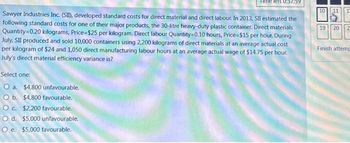

Transcribed Image Text:Sawyer Industries Inc. (SII), developed standard costs for direct material and direct labour. In 2013, SII estimated the

following standard costs for one of their major products, the 30-litre heavy-duty plastic container. Direct materials

Quantity 0.20 kilograms, Price=$25 per kilogram. Direct labour Quantity=0.10 hours, Price=$15 per hour. During

July, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost

per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

July's direct material efficiency variance is?

Select one:

O a. $4,800 unfavourable.

O b. $4,800 favourable.

O c. $2,200 favourable.

O d. $5,000 unfavourable.

O e. $5,000 favourable.

10

19 20

1

2

Finish attemp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Find the indicated amounts for the fixed-rate mortgages. Monthly payment Mortgage per $1,000 Purchase Total Down Mortgage Interest Interest price of home payment amount paid for mortgage Years rate payment paid $85,000 $8,000 | Click the icon to view the table of the monthly payment of principal and interest per $1,000 of the amount financed. 6.00% 25 The mortgage amount is $ (Round to the nearest dollar as needed.)arrow_forwardUse Excel to create an annual summary (5-years) amortization schedule for a fully-amortizing, fixed rate mortgage for $4,000,000 at 5.5% for 30 years, monthly payments, 1 discount point. Use the power of Excel. Show me the excel table. (Picture/Screenshot/Table)arrow_forwardWhat is the total interest paid on a for $200,000 loan with 30 year mortgage at 7% annual. Assume that the mortgage is kept for the full .30 years $28,300,000 O $28,300 O $283,000 O $2830 Oarrow_forward

- Please make sure the answers are clear n easy to read. Please do it on white paper. Again make sure the answer is clear. do it on white paperarrow_forwardNeed help pleasearrow_forwardDetermine the periodic payments on the given mortgage. HINT [See Example 5 Round your answer to the nearest cent.) a $ 1,000,000, 35-year, 5.1% mortgage with monthly paymentsarrow_forward

- Correct pls thNksarrow_forward❌❌❌❌❌❌✅✅✅arrow_forwardFind the indicated amounts for the fixed-rate mortgages. Purchase price of home Down Mortgage Interest payment amount Monthly payment Mortgage payment Total paid for mortgage Interest Years rate paid per $1,000 S130,000 | Click the icon to view the table of the monthly payment of principal and interest per $1,000 of the amount financed. 5.00% 30 The mortgage amount is $ (Round to the nearest dollar as needed.)arrow_forward

- Determine the outstanding principal of the given mortgage. HINT [See Example 7.] (Assume monthly interest payments and compounding periods. Round your answer to the nearest cent.) a $ 100,000, 30-year, 4.3% mortgage after 10 yearsarrow_forwardNeed Detailed answer with steps please 30. Considering the following information, what is the NPV if the borrower refinances the loan? Expected holding period: 3 years, Current loan balance: $100,000; Current loan interest: 7%; Current loan mortgage payment: $898.33; Remaining term on current mortgage: 15 years; New loan interest: 5.5%; New loan mortgage payment: $817.08; New loan term: 15 years; Cost of refinancing: $5,000. Assume that the opportunity cost is the interest rate on the new loan (5.5%). A. -$5,000.00 B. -$1,155.27 C. $3,844.73 D. $8,844.73arrow_forwardPrime cost equals product cost less direct labor True or False True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education