ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Don't use ai to answer I will report your answer Solve it Asap with explanation and calculation with all parts

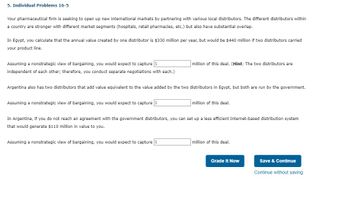

Transcribed Image Text:5. Individual Problems 16-5

Your pharmaceutical firm is seeking to open up new international markets by partnering with various local distributors. The different distributors within

a country are stronger with different market segments (hospitals, retail pharmacies, etc.) but also have substantial overlap.

In Egypt, you calculate that the annual value created by one distributor is $330 million per year, but would be $440 million if two distributors carried

your product line.

Assuming a nonstrategic view of bargaining, you would expect to capture $

million of this deal. (Hint: The two distributors are

independent of each other; therefore, you conduct separate negotiations with each.)

Argentina also has two distributors that add value equivalent to the value added by the two distributors in Egypt, but both are run by the government.

Assuming a nonstrategic view of bargaining, you would expect to capture $

million of this deal.

In Argentina, if you do not reach an agreement with the government distributors, you can set up a less efficient Internet-based distribution system

that would generate $110 million in value to you.

Assuming a nonstrategic view of bargaining, you would expect to capture $

million of this deal.

Grade It Now

Save & Continue

Continue without saving

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please no written by hand solutions Consider a game between two friends, Amy and Brenda. Amy wants Brenda to give her a ride to the mall. Brenda has no interest in going to the mall unless her favorite shoes are on sale at the large department store there. Amy likes these shoes as well, but she wants to go to the mall even if the shoes are not on sale. Only Amy subscribes to the newspaper, which carries a daily advertisement of the department store. The advertisement lists all items that are on sale, so Amy learns whether or not the shoes are on sale by showing the newspaper to Brenda. But this is costly for Amy, because she will have to take the newspaper away from her sister, who will yell at her later for doing so. In this game, nature first decides whether or not the shoes are on sale, and this information is made known to Amy (Amy observes whether nature chose S or N). Nature chooses S with probability p and N with probability 1-p. Then Amy decides whether or not to take the…arrow_forwardPlease answer the question Minimum 150 words How is it possible to measure the risk and consider the tradeoff risk return? (Time value of money)arrow_forwardA wheel of fortune in a gambling casino has 54 different slots in which the wheel pointer can stop. Four of the 54 slots contain the number 9. For a 1 dollar bet on hitting a 9, if he or she succeeds, the gambler wins 10 dollars plus the return of the 1 dollar bet. What is the expected value of this gambling game? What is the meaning of the expected value result?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardAnswer this questionarrow_forwardT/F Opportunity cost is the cost of nest best foregone.arrow_forward

- Game Theory I am trying to assign numbers (theoretical)to a game im making. Its about Tipping. Its based on 3 different efforts a server has showed Can you assign numbers to each of these. This is all made up so you can use whatever values they just need to be in regard to the other values. Thanks. I was thinking to start on high effort Tip could be +10 and no tip could be -10 Best and worst scenario. You do high effort service and get tipped and high effort with no tip. Thanksarrow_forwardEconomics If a person is playing chess with a Al(computer). Is this a sequential game or simultaneously game ?arrow_forwardLast answer was incorrect.arrow_forward

- My dear hero expert bro and pro Hand written solution is not allowed. Solve all three parts as they are parts not different questions.arrow_forwardA local insurance company offers both home and auto insurance to four types of customers with the reservation prices listed in the figure below. Assume for simplicity that there is only one consumer of each type. Home Auto Bundle Customer A $90 $67 $157 Customer B Customer C Customer D $117 $87 $204 $103 $77 $180 $83 $52 $135 If the firm were to sell home and auto insurance separately, it would charge $83 for home insurance, $52 for auto insurance, and earn a combined revenue of $540. Determine the revenue the firm would receive if it used a pure bundle. Comparing the revenue of the pure bundle to the revenue of selling home and auto insurance separately, we can conclude that the reservation prices of the consumers must: O A. have no correlation B. be positively correlated C. be negatively correlated D. be serially correlatedarrow_forwardQUESTION 3 If P(A)=0, then it means that event A will never happen will possibly happen sometime will happen for surearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education