FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

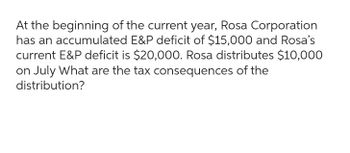

Transcribed Image Text:At the beginning of the current year, Rosa Corporation

has an accumulated E&P deficit of $15,000 and Rosa's

current E&P deficit is $20,000. Rosa distributes $10,000

on July What are the tax consequences of the

distribution?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Four Square Services Corporation estimates that its 2021 taxable income will be $1,000,000. Thus, it incurs a $210,000 liability. For the following independent cases, compute Four Square's minimum quarterly estimated tax payments that will avoid an underpayment penalty. a. For 2020, taxable income was $800,000, and tax liability was $168,000. b. For 2019, taxable income was $2 million, and tax liability was $680,000. For 2020, taxable income was $100,000, and tax liability was $21,000.arrow_forwardIn early 2012, Cho-Sun's gross pay increased from $71,000 per year to $83,000 per year. Answer parts (a) and (b). Taxable Income (Income tax brackets) Tax Rates $44,701 or less 15% of taxable income less than or equal to $44,701; plus Over $44,701 up to $89,401 22% of taxable income greater than $44,701 and less than or equal to $89,401; plus Over $89,401 up to $138,586 26% of taxable income greater than $89,401 and less than or equal to $138,586; plus Over $138,586 29% of taxable income greater than $138,586 (a) What was the annual percent increase in Cho-Sun's pay before federal income taxes? nothing% (Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.) (b) What was the annual percent increase in Cho-Sun's pay after federal income taxes were deducted? nothing% (Round the final answer to two decimal places as needed.…arrow_forwardFor its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 280,000 Permanent difference (15,600 ) 264,400 Temporary difference-depreciation (20,900 ) Taxable income $ 243,500 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?arrow_forward

- Range Rover Inc. had taxable income of $152,000 for the year. The GAAP basis of accounts receivable (net) $9,600 less than the tax basis of accounts receivable. Assuming a tax rate of 25%, record the income tax journal entry on December 31. Assume zero beginning balances in deferred tax accounts Note: faline in a journal entry ant required for the transaction select N/A as the account names and leave the Dr. and Cr. answers blank (zero) Dr. Account Name Date Dec 31 income Tax Expose Income Tax Payate Deferred Tax Asset Tocesant incomearrow_forwardFor its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 300,000 Permanent difference (15,000 ) 285,000 Temporary difference-depreciation (20,000 ) Taxable income $ 265,000 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as its deferred income tax liability as of the end of its first year of operations?arrow_forwardRomie Ltd is preparing accounts for the year ended 31 December 20X5. The company has an estimated tax charge of $35,000 for the year ended December 20X5. The trial balance includes an entry of $2,000 relating to an over provision of tax in the previous financial year. What is the charge for tax in the statement of profit or loss for the year ended December 20X5?arrow_forward

- At the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.arrow_forwardthe rate 0.6% was used for the net FUTAIn April of the current year, Steelman Press Company transferred Ken Sherm from its factory in Louisiana to its plant in Florida. The company's SUTA tax rates based on its experience ratings are 3.2% in Louisiana and 3.8% in Florida. The taxable wage limits are $7,700 in Louisiana and $7,000 in Florida. This year, Steelman Press Company paid Ken Sherm wages of $14,190; $4,950 were paid in Louisiana and the remainder in Florida. Compute the following; round your answers to the nearest cent. tax rate for employers. a)Amount of SUTA tax the company must pay to Florida on Sherm's wages? b) Amount of SUTA tax the company must pay to Louisiana on Sherm's wages? c). Amount of the net FUTA tax on Sherm's wages?arrow_forwardNiemann Company has a SUTA tax rate of 7.1%. The taxable payroll forthe year for FUTA and SUTA is $92,600.(a) The amount of FUTA tax for the year is(b) The amount of SUTA tax for the year isarrow_forward

- The XYZ, Inc. reported $50 million of taxable income. Its federal tax rate was 21% (ignore any possible state corporation taxes). What is the company’s federal income tax bill for the year? Question 1 options: a) $11,500,000 b) $10,500,000 c) $12,100,000 d) $11,100,000arrow_forwardA summary of the transactions of Ramstage Co, which is registered for sales tax at 15% showed the following for the month of August 20X9. Outputs $60000(exclusive of sales tax) Inputs $46000(inclusive of sales tax) At the beginning of the period Ramstage Co owed $3400 to the government tax authority,and during the period $2600 was paid to the tax authority. What was the amount owed to the government tax authorities at the end of the accounting period?arrow_forwardFor the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Second Third Installment What are LNS's minimum first-, second-, third-, and fourth-quarter estimated tax payments, using the annualized income method? Note: Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount. First quarter Second quarter Third quarter Fourth Cumulative quarter Taxable Income $ 1,700,000 2,636,000 3,681,000 Taxable Income $ 1,700,000 $ 1,700,000 $ 2,636,000 $ 3,681,000 Annualization Factor 4 $ 4 $ 2 S $ 1.3333333 Annual Estimated Taxable Income 6,800,000 6,800,000 5,272,000 4,908,000 Answer is not complete. Tax on estimated taxable income $ 6,800,000 $ 6,800,000 $5,272,000 $ 4,895,730 Percentage of Tax Required To Be Paid 25 50 75 100 %0 %…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education