ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

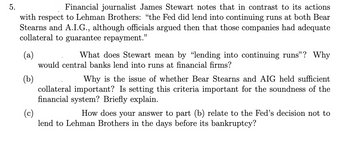

Transcribed Image Text:5.

Financial journalist James Stewart notes that in contrast to its actions

with respect to Lehman Brothers: "the Fed did lend into continuing runs at both Bear

Stearns and A.I.G., although officials argued then that those companies had adequate

collateral to guarantee repayment.”

(a)

(b)

What does Stewart mean by "lending into continuing runs"? Why

would central banks lend into runs at financial firms?

Why is the issue of whether Bear Stearns and AIG held sufficient

collateral important? Is setting this criteria important for the soundness of the

financial system? Briefly explain.

(c)

How does your answer to part (b) relate to the Fed's decision not to

lend to Lehman Brothers in the days before its bankruptcy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusionarrow_forward23) Which of the following legislation says the Federal Reserve should promote price stability and maximum employment, but does not specify how the Federal Reserve should weight these goals? the Clayton Antitrust Act of 1914 There is no such legislation affecting the Federal Reserve. the Federal Reserve Act of 1913 a 1977 amendment to the Federal Reserve Act.arrow_forwardPlease explain option a,b,carrow_forward

- 54.What are the implications of a liquidity trap for the Federal Reserve? 55.(Consider This) How did the consolidated balance sheet of the 12 Federal Reserve banks change during the severe recession of 2007–2009?arrow_forward1. If one still argues that the monetary policies conducted by the Federal Reserve is heavily influenced by the Congress and the White House, what could be the evidence we can find in the system which supports the argument? (briefly explain in a paragraph or so)arrow_forward4******************* 4)Why did the Financial Crisis and the Great Recession cause the FED to alter its monetary policy from using open market operations to target the federal funds rate to establishing a corridor between the IOER and the discount rate through which the federal funds rate would move over time?arrow_forward

- 5. The Federal Reserve's organization While all members of the Federal Reserve Board of Governors vote at Federal Open Market Committee (FOMC) meetings, only bank presidents are members of the FOMC. of the regional The Federal Reserve's role as a lender of last resort involves lending to which of the following financially troubled institutions? OUS banks that cannot borrow elsewhere OUS state governments when they run short on tax revenues Governments in developing countries during currency crises The Federal Reserve's primary tool for changing the money supply s In order to increase the number of dollars in the US economy (the money supply), the Federal Reserve will government bonds.arrow_forward3. Discuss the five stages in the evolution of the international monetary system (IMS) and the main characteristics of each stage. Requirements: your answer to this question should be no less than 300 wordsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education