FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

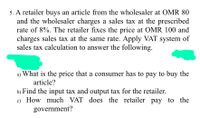

Transcribed Image Text:5. A retailer buys an article from the wholesaler at OMR 80

and the wholesaler charges a sales tax at the prescribed

rate of 8%. The retailer fixes the price at OMR 100 and

charges sales tax at the same rate. Apply VAT system of

sales tax calculation to answer the following.

a) What is the price that a consumer has to pay to buy the

article?

b) Find the input tax and output tax for the retailer.

c) How much VAT does the retailer pay to the

government?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. Mahmood buys a commodity from the wholesaler at OMR 1,200 and was charged by VAT at the rate prescribed of 10%. He fixes the price of this commodity at OMR 1,500 for the customer and in turn he charges VAT at the same rate. Calculate the amount of Value Added tax (VAT) paid by Mahmood to the government. A. OMR 120 B. OMR 270 C. OMR 150 D. OMR 30arrow_forwardA store had receipts of $6045.50. If the sales tax rate is 7%, how much merchandise did the store sell? The value of the merchandise sold (not including sales tax) is $ (blank)arrow_forwardFirms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Tasty Tuna Corporation buys on terms of 1/20, net 60 from its chief supplier. If Tasty Tuna receives an invoice for $1,254.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) $1,553.04 $1,242.43 $1,056.07 O $931.82 The nominal annual cost of the trade credit extended by the supplier is calculations to four decimal places, and your final answer to two decimal places.) , assuming a 365-day year. (Note: Round all intermediate Suppose Tasty Tuna does not take advantage of the discount and then chooses to pay its supplier late-so that on average, Tasty Tuna will pay its supplier on the 65th day after the sale. As a result, Tasty Tuna can decrease its nominal cost of trade…arrow_forward

- Calculate the following: Retail selling price Sales tax (6%) Excise tax (10%) Total price including taxes $1,200arrow_forwardA wholesale firm made sales with the following list prices and trade discounts. Calculate the amount the firm will use to record each sale in the sales journal. A. List price of $1,700 and trade discount of 55 percent. B. List price of $1,300 and trade discount of 45 percent. C. List Price of $2,200 and trade discounts of 30 and 20 percent. (Round your answer to 2 decimal places.) A. Amount B. Amount C. Amountarrow_forwardDextra Computing sells merchandise for $16,000 cash on September 30 (cost of merchandise is $11,200). Dextra collects 7% sales tax. Record the entry for the $16,000 sale and its sales tax. Also record the entry that shows Dextra sending the sales tax on this sale to the government on October 15. View transaction list Journal entry worksheet 1 2 3 Record the cash sales and 7% sales tax. Date September 30 Note: Enter debits before credits. General Journal Debit Credit >arrow_forward

- Raney Co is a retail store operating in a state with a 6% retail sales tax. The retailer may keep 2% of the sales tax collected. Raney Co records the sales tax collected in the Sales account. The amount recorded in the Sales account during May was $148,400. What was the amount of sales tax (to the nearest dollar) for May? O $8.726 O $8,400 O $8.904 O $9.438arrow_forwardIn application for VAT refunds due from input tax on zero-rated sale, the BIR is expected to make refund within _____ days: 30 90 120 60arrow_forwardprescribed rate of VAT on the goods is 10% and the retailer sells it to the consumer at the printed price.Save A A manufacturer printed the price of his goods as BD120 per article. He allowed a discount ot 30% to the wholesaler who in his turn allowed a discount of 20% on the printed price to the retailer. It the Require Find the value added tax paid by the wholesaler and the retailer.arrow_forward

- Sales Tax Transactions Journalize the entries to record the following selected transactions. a. Sold $486,000 of merchandise on account, subject to a sales tax of 5%. The cost of the goods sold was $286,740. If an amount box does not require an entry, leave it blank. b. Paid $42,780 to the state sales tax department for taxes collected. If an amount box does not require an entry, leave it blank. Check My Work ▾ Previous Nextarrow_forwardwhat is the total price of the first invoice that activates the chain discount?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education