ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

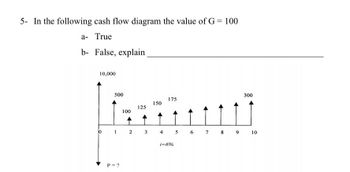

Transcribed Image Text:5- In the following cash flow diagram the value of G = 100

a- True

b- False, explain

10,000

500

100

P = ?

125

1 2 3

150

175

300

4 5 6 7 8 9 10

i=6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If a bank gives an interest rate of 5% annually. What is the sum of money after 2 years if the difference between the compound interest compounded annually and the simple interest is Dhs 100 Dhs 10000 a. b. Dhs 30000 c. Dhs 40000 d. Dhs 20000 e. Dhs 50000arrow_forwardB IUA Arial 11 + 4 1 Name: Classroom: Date: 1. Show your understanding of the time value of money by solving these problems. a. You deposit $200 in an account earning 2.6% a year and compounding annually. How much will be in the account after 20 years? b. You deposit the same amount in an account earning 2.6% annually that does not compound. How much is the account worth after 20 years? Support | Schoology Blog | PRIVACY POLICY | Terms of Use MacBook 000 000 DII DD F4 F5 F6 F9 F10 2$ & 4 5 7. 8. Y !!arrow_forwardPlease determine the equal cash flow A (from 1 to 5) for the cash flows provided below when considering at interest of 10% Net cash flow 500 500 500 ZorN3 4 5arrow_forward

- i will 10 upvotes urgent A borrower bought a house for$300,000; he can obtain an80%loan with a 20 -year fully amortizing.7%interest rate and monthly payment. Alternatively. he could get a 30 -year fully amortizing 90%loan at 9%. What is the incremental cost of borrowing the additional fund?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward9. A loan of $10000.00 taken out 6 months ago is to be repaid by 3 equal installments due now, 1 years from now, and 1.5 years from now respectively. What is the size of the equal installments if interest on the debt is 6% p.a. compounded monthly? Iarrow_forward

- Question 1 Due to health reasons, Dave is considering early retirement. He currently has $700,000 in a self- managed retirement fund. He thinks he will need S40,000 per year during retirement. He intends to invest his retirement in a low-risk mutual fund which return 1.5% per year. How many years can he live off this retirement fund without the need to look for a job?arrow_forward6.arrow_forwardHere is an unequal payment series. Calculate the present worth of this series. Positive is income, negative is a payment. Use on interest rate of 10.4 Year 1: -80000 Year 2: 10000 Year 3: 35000 Year 4: 50000 Year 5: 25000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education