Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

Transcribed Image Text:5

Book

Hint

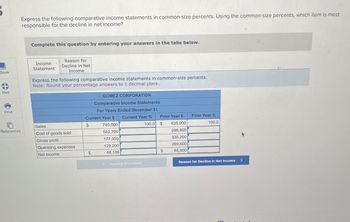

Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most

responsible for the decline in net income?

Complete this question by entering your answers in the tabs below.

Income

Statement

Reason for

Decline in Net

Income

Express the following comparative income statements in common-size percents.

Note: Round your percentage answers to 1 decimal place.

GOMEZ CORPORATION

Comparative Income Statements

Print

For Years Ended December 31

Current Year $ Current Year %

Prior Year $

Prior Year %

包

Sales

$

740,000

100.0

$

635,000

100.0

References

Cost of goods sold

562,700

299,800

Gross profit

177,300

335,200

Operating expenses

129,200

269,600

Net income

$

48,100

$

65,600

Income Statement

Reason for Decline in Net Income

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Comparative Income Statement Use the following comparative income statement form to enter amounts you identify from the computations on the Liquidity and Solvency Measures part and on the Profitability Measures part. Compute any missing amounts and complete the horizontal analysis columns. Enter percentages as decimal amounts, rounded to one decimal place. When rounding, look only at the figure to the right of one decimal place. If 5, round up. For example, for 32.048% enter 32.0%. For 32.058% enter 32.1%. Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Operating income Other expense (interest) Income before income tax expense Income tax expense Net income Comparative Income Statement For the Years Ended December 31, 20Y6 and 20Y5 $ 20Y6 8,250,000 X (1,242,000) 20Y5 $7,287,000 (3,444,000) $3,843,000 $(1,457,600) (1,106,000) $(2,563,600) $1,279,400 (120,600) $1,158,800 (181,980) $976,820 $ $ $ Increase/(Decrease) Amount 823,000 X…arrow_forwardExpress the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Reason for Income Decline in Net Statement Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales $ 760,000 100.0 $ 670,000 Cost of goods sold 565,400 291,000 Gross profit 194,600 379,000 Operating expenses 130,400 227,600 Net income $ 64,200 $ 151,400arrow_forwardExpress the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Reason for Income Decline in Net Statement Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales 2$ 750,000 $ 690,000 Cost of goods sold 560,000 288,800 Gross profit 190,000 401,200 Operating expenses 129,200 219,200 Net income $ 60,800 $ 182,000 Income Statement Reason for Decline in Net Income >arrow_forward

- Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. Note: Round your percentage answers to 1 decimal place. GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales $ 725,000 100.0 $ 665,000 Cost of goods sold 562,700 1.0 291,000 Gross profit 162,300 0.4 374,000 Operating expenses 129,200 268,400 Net income 33,100 $ 105,600 Income Statement Reason for Decline in Net Income >arrow_forwardExpress the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Reason for Decline in Net Income Statement Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales $ 795,000 $ 665,000 Cost of goods sold 568,100 288,800 Gross profit 226,900 376,200 Operating expenses 129,200 234,800 Net income $ 97,700 $ 141,400 < Income Statement Reason for Decline in Net Incomearrow_forwardFork Saved Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. Note: Round your percentage answers to 1 decimal place. GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales $ 775,000 $ 635,000 Cost of goods sold 570,800 284,400 Gross profit 204,200 350,600 Operating expenses 129,200 248,000 Net income $ 75,000 $ 102,600arrow_forward

- Express the following comparative income statements in common-size percents. Using the common-size percents, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income tes Express the following comparative Income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income tatements For Years Ended December 31 Current Year $ Current Year % Prior Year $ Prior Year % Sales 735,000 645,000 570,800 282,200 362,800 269,600 Cost of goods sold Gross profit 164,200 Operating expenses 128,000 Net income 36,200 93,200arrow_forwardVery important please be correct thank youarrow_forwardSubject: acountingarrow_forward

- Express the following comparative income statements in common-size percents. Using the commonsize percentages, which item is most responsible for the decline in net income?arrow_forwardRequirements 1. Prepare a comparative common-size income statement for Mariner Designs, Inc. using the 2024 and 2023 data. Round percentages to one-tenth percent. 2. To an investor, how does 2024 compare with 2023 ? Explain your reasoningarrow_forwardExpress the following comparative income statements in common-size percents.Using the common-size percentages, which item is most responsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. (Round your percentage answers to 1 decimal place.) GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year Prior Year $ % $ % Sales $740,000 100.0 $625,000 100.0 Cost of goods sold 560,300 290,800 Gross profit 179,700 334,200 Operating expenses 128,200 218,500 Net income $51,500 $115,700 Using the common-size percentages, which item is most responsible for the decline in net income? Using the common-size percentages, which item is most…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage