SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Help

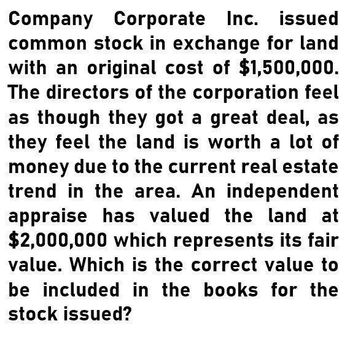

Transcribed Image Text:Company Corporate Inc. issued

common stock in exchange for land

with an original cost of $1,500,000.

The directors of the corporation feel

as though they got a great deal, as

they feel the land is worth a lot of

money due to the current real estate

trend in the area. An independent

appraise has valued the land at

$2,000,000 which represents its fair

value. Which is the correct value to

be included in the books for the

stock issued?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Don't USE AI to answer thisarrow_forward! Required information [The following information applies to the questions displayed below.] Russell Corporation sold a parcel of land valued at $400,000. Its basis in the land was $275,000. For the land, Russell received $50,000 in cash in year 0 and a note providing that Russell will receive $175,000 in year 1 and $175,000 in year 2 from the buyer. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Russell's realized gain on the transaction? Realized gainarrow_forward! Required information [The following information applies to the questions displayed below.] Russell Corporation sold a parcel of land valued at $400,000. Its basis in the land was $275,000. For the land, Russell received $50,000 in cash in year 0 and a note providing that Russell will receive $175,000 in year 1 and $175,000 in year 2 from the buyer. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) b. What is Russell's recognized gain in year O, year 1, and year 2? Year Recognized Gain 0 1 2arrow_forward

- Required information [The following information applies to the questions displayed below] Rolf exchanges an office building with FMV of $152,000 and stock with FMV of $28,400 for investment land with FMV of $180,400. Rolf's adjusted basis in the building and stock is $115,000 and $10,840, respectively. a. How much gain (or loss) will Rolf recognize on the exchange? (Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable.)arrow_forwardCorrect Answer with detailed explanationarrow_forwardWeatarrow_forward

- The deed we saw from 1910 (property near Belle Meade, Davidson Co., TN) lists the selling price for 303 acres of land at $12,000. In 2009, the property was appraised for $20,000,000. A non-profit group purchased it for $10,800.000. a. First, calculate the simple RO1 (%) based on the 1910 price and the 2009 price of $10,800,000. b. What other information would be useful in estimating the true profit made?arrow_forwardanswer must be in table format or i will give down votearrow_forwardHalyu Corp., a domestic corporation, sold a parcel of land with the following details: The land has a Transfer Certificate of Title No. 109201. It is an agricultural property situated in the municipality of Lopez, Quezon province, with an area of 2,500 square meters. The land was acquired in 2004 for a purchase price of P500,000. At the time of the sale, the land's fair market value stands at P7,500,000, which aligns with the prevailing market values set by the Sanggunian. The agreed consideration for the sale is P6,700,000. How much is the documentary stamp tax from the sale? P56,250 P50,250 P112,500 P100,500arrow_forward

- A company is considering purchasing a parcel of land that was originally acquired by the seller for $85,000. While the land is currently offered for sale at $150,000, it is considered by the purchaser as easily being worth $140,000, and is finally purchased for $137,000, the land should be recorded in the purchaser's books at:arrow_forward* please provide steps to the answer *arrow_forwardAyayai Automotive is looking to expand its operations and has approached Dynatech Garage to acquire its business. Dynatech has agreed to sell if Ayayai assumes the mortgage on Dynatech's building as part of the sale. The fair value of Dynatech's identifiable assets and identifiable liabilities are: Inventory: 149000. Buildings: 949000. Land: 349000. Mortage payable (274000). Net identifiable assets: 1,173,000. Assuming Ayayai purchases the business for $Record the journal entry for the purchase by Ayayai Automotive. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles Debit Credit 1,324,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you