Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:44

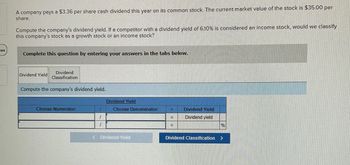

A company pays a $3.36 per share cash dividend this year on its common stock. The current market value of the stock is $35.00 per

share.

Compute the company's dividend yield. If a competitor with a dividend yield of 6.10 % is considered an income stock, would we classify

this company's stock as a growth stock or an income stock?

Complete this question by entering your answers in the tabs below.

Dividend Yield

Dividend

Classification

Compute the company's dividend yield.

Choose Numerator:

Dividend Yield

Choose Denominator:

=

Dividend Yield

Dividend yield

%

<Dividend Yield

Dividend Classification >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- am. 104.arrow_forwardS Suppose Wacken, Limited just issued a dividend of $2.61 per share on its common stock. The company paid dividends of $2.11, $2.18, $2.35, and $2.45 per share in the last four years. If the stock currently sells for $80, what is your best estimate of the company's cost of equity capital using arithmetic and geometric growth rates? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Cost of equity using arithmetic growth rate Cost of equity using geometric growth rate % %arrow_forwardVijayarrow_forward

- Sh5arrow_forwardAssuming the following: 1. 4mm outstanding shares 2. $40mm of pre-tax Net Income 3. $9mm of Depreciation 4. PE multiple of 16x 5. $1.75 quarterly dividend which is expected to grow by 4.23% 6. Book value of $115mm 7. Current share price of $125 8. Tax rate of 25% 9. EBITDA Multiple of 7x. What is the market value of equity? A form of the correct answer would be $53mm.arrow_forwardneed part barrow_forward

- Oweninc has a current stock price of $13.00 and is expected to pay a $0,85 dividend in one year. If Oweninc's equity cost of capital is 11%, what price would Oweninc's stock be expected to sell for immediately after it pays the dividend? OA. $9.51 OB. $13.58 OC. $14.43 OD. $10.86 Maytarrow_forward7arrow_forwardGiven the information of a stock: ROE (return on equity) is 10% Capitalisation rate (required rate of return or k) is 8% Earnings of $10 per share Company reinvests 40% of its earnings (i.e., plowback rate or b = 0.4) Expected year-end dividend is $6 per share Draw a timeline to identify the amount and timing of cash flows obtained with the stock. Next, calculate the stock value and the Present Value of Growth Opportunities (PVGO) of the stock.arrow_forward

- What effect would the calculation performed have in terms of shareholder value? In other words, suppose the company’s goal is to maximize shareholder value. How will increasing its dividend per share by 1.75 support or inhibit that goal? Be sure to justify reasoning.arrow_forwardThe expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Req A Req B If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective…arrow_forwardHere are data on two stocks, both of which have discount rates of 14%: Stock A Stock B Return on equity 14 % 10 % Earnings per share $ 1.50 $ 1.40 Dividends per share $ 1.20 $ 1.20 a. What are the dividend payout ratios for each firm? (Enter your answers as a percent rounded to 2 decimal places.) b. What are the expected dividend growth rates for each stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) c. What is the proper stock price for each firm?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education