Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

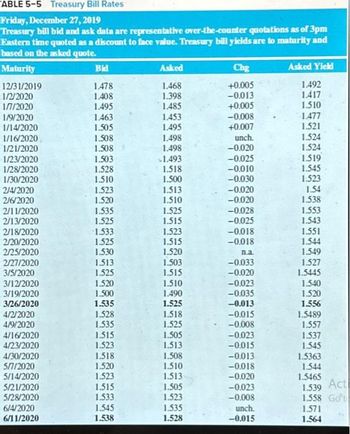

Transcribed Image Text:ABLE 5-5 Treasury Bill Rates

Friday, December 27, 2019

Treasury bill bid and ask data are representative over-the-counter quotations as of 3pm

Eastern time quoted as a discount to face value. Treasury bill yields are to maturity and

based on the asked quote.

Maturity

12/31/2019

1/2/2020

1/7/2020

1/9/2020

1/14/2020

1/16/2020

1/21/2020

1/23/2020

1/28/2020

1/30/2020

2/4/2020

2/6/2020

2/11/2020

2/13/2020

2/18/2020

2/20/2020

2/25/2020

2/27/2020

3/5/2020

3/12/2020

3/19/2020

3/26/2020

4/2/2020

4/9/2020

4/16/2020

4/23/2020

4/30/2020

5/7/2020

5/14/2020

5/21/2020

5/28/2020

6/4/2020

6/11/2020

Bid

1.478

1.408

1.495

1.463

1.505

1.508

1.508

1.503

1.528

1.510

1.523

1.520

1.535

1.525

1.533

1.525

1.530

1.513

1.525

1.520

1.500

1.535

1.528

1.535

1.515

1.523

1.518

1.520

1.523

1.515

1.533

1.545

1.538

Asked

1.468

1.398

1.485

1.453

1.495

1.498

1.498

1.493

1.518

1.500

1.513

1.510

1.525

1.515

1.523

1.515

1.520

1.503

1.515

1.510

1.490

1.525

1.518

1.525

1.505

1.513

1.508

1.510

1.513

1.505

1.523

1.535

1.528

Chg

+0.005

-0.013

+0.005

-0.008

+0.007

unch.

-0.020

-0.025

-0.010

-0.030

-0.020

-0.020

-0.028

-0.025

-0.018

-0.018

n.a.

-0.033

-0.020

-0.023

-0.035

-0.013

-0.015

-0.008

-0.023

-0.015

-0.013

-0.018

-0.020

-0.023

-0.008

unch.

-0.015

Asked Yield

1.492

1.417

1.510

1.477

1.521

1.524

1.524

1.519

1.545

1.523

1.54

1.538

1.553

1.543

1.551

1.544

1.549

1.527

1.5445

1.540

1.520

1.556

1.5489

1.557

1.537

1.545

1.5363

1.544

1.5465

Act

1.539

1.558 Go t

1.571

1.564

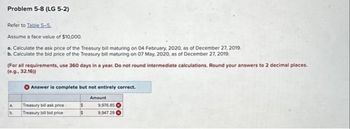

Transcribed Image Text:Problem 5-8 (LG 5-2)

Refer to Table 5-5.

Assume a face value of $10,000.

a. Calculate the ask price of the Treasury bill maturing on 04 February, 2020, as of December 27, 2019.

b. Calculate the bid price of the Treasury bill maturing on 07 May, 2020, as of December 27, 2019.

(For all requirements, use 360 days in a year. Do not round intermediate calculations. Round your answers to 2 decimal places.

(e.g., 32.16))

a

b.

Answer is complete but not entirely correct.

Amount

Treasury bill ask price

Treasury bill bid price

$

$

9.976.85 O

9,947 290

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- May 2024 บ M Tu W Th F 8 29 30 1 2 3 5 6 7 8 9 10 12 13 15 14 16 17 19 20 21 22 23 24 26 27 28 29 30 31 Su June 2024 M Tu W Th F Seth 6-3 1-2 2.3 Brendyn 9-6 34 mod 194 v lifiv T T F 7479 139 ..... Saturday, May 11 Friday, May 24 Saturday, May 25 Sunday, May 26 Monday, May 27arrow_forwardAtlanta Nashville 51140 51720 53266 44721 51640 37428 46430 51538 53016 45369 51486 42094 50527 46485 53329 46382 50453 48729 50793 39082 54128 49598 47195 44898 50716 46644 48061 48002 50396 51977 51785 51484 51940 49696 52761 47568 44403 44429 47681 44862 53890 40744 48296 50419 53179 48397 51066 47135 54052 43176 49708 44619 49947 48468 50268 52096 46947 49513 52345 41278 The worksheet shows the salaries for 30 new teachers in Atlanta and 30 new teachers in Nashville. In a report, use the sample information to determine whether the average salary in Atlanta is greater than Nashville's average salary. Use a reasonable level of significance for the tests. Discuss any assumptions that you made for the analysis. (Note: You might need to investigate some additional information about Atlanta or Nashville!) the report must have a statistical analysis with at least one visual support (table or graph).arrow_forwardQuestion 40 At March 1, 2019, Cookie purchased supplies of $1,90 report what balance in the su 008'T$ O 009'T$0 006 $1.9arrow_forward

- x M Question 6-QUIZ- CH 18-C X Gran Project 6 education.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%252Fw... Saved Help Exercises 18-41 (Algo) Allocation of Central Costs; Profit Centers [LO 18-3] Woodland Hotels Incorporated operates four resorts in the heavily wooded areas of northern California. The resorts are named after the predominant trees at the resort: Pine Valley, Oak Glen, Mimosa, and Birch Glen. Woodland allocates its central office costs to each of the four resorts according to the annual revenue the resort generates. For the current year, the central office costs (000s omitted) were as follows: Front office personnel (desk, clerks, etc.) Administrative and executive salaries Interest on resort purchase Advertising Housekeeping Depreciation on reservations computer Room maintenance Carpet-cleaning contract Contract to repaint rooms $ 12,100 5,700 4,700 600 3,700 80 1,210 50 570 $ 28,710 Revenue (000s) Pine Valley $ 9,150…arrow_forward(The chart included is figure 3)arrow_forwardImagine an emerging market with only 15 years of data. Compute the historical ERP using the geometric mean. (Hint: Compute the annual ERP=Rm- Rrf first and then calculate the geometric mean of it). Save the data to answer Question 2. Rm Rrf 0.100 0.035 0.120 0.045 3 0.300 0.068 4 0.200 0.060 5 0.050 0.030 6 -0.030 0.020 7 0.050 0.010 0.100 0.030 0.450 0.060 10 0.230 0.050 11 0.150 0.040 12 0.100 0.030 13 0.060 0.020 14 0.020 0.020 15 -0.100 0.010 1 2arrow_forward

- uni 403 a Cha Pra (Ch Preview File Edit View Go Tools Window Help mgt120h-j17.pdf Page 7 of 10 0 CC Search b. Company B has current assets of $234,000, total assets of $459,000, and equity of $100,000. The company wants to reorganize its liabilities so that is current ratio is 2: 1. If it does, what will its noncurrent liabilities be? S QSun Apr 16 1:23 PMarrow_forwardCapital Rationing Decsion Involving Four Proposals Kopecky Industries Inc. Is considering allocating a limited amount of capital Investment funds among four proposals. The amount of proposed Investment, estimated income from operations, and net cash flow for each proposal are as follows: Project Uniform victor Sierra Tango Name Investment $900,000 Investment $2,770,865 Investment $1,762,515 Investment $1,040,013 Income Income Income Income Net Cash Net Cash Net Cash Net Cash from from from from Flows Flows Flows Flows Year Operations Operations Operations Operations $84,000 $240,000 $294,500 $950,000 $207,000 $450,000 $109,000 $390,000 84,500 240,000 294,775 950,000 207,000 450,000 109,000 390,000 85,000 240,000 295,050 950,000 207,000 450,000 109,000 390,000 85,500 240,000 295,325 950,000 207,000 450,000 109,000 390,000 5. 86,000 240,000 295,600 950,000 207,000 450,000 109,000 390,000 Total $425,000 $1,200,000 $1,475,250 $4,750,000 S1,035,000 $2,250,000 $545,000 $1,950,000 Present…arrow_forwardBermuda Cruises issues only common stock and coupon bonds. The firm has a debt-equity ratio of 1.41. The cost of equity is 13.5 percent and the pretax cost of debt is 7.6 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 25 percent?arrow_forward

- Lignin is a basic component of almost any plant that grows, so it is one of the most abundant organic compounds in the world. Almost anything derived from oil can be made out of lignin. The question is "can we do it cost-effectively and consistently?" A startup company has developed a process to derive plastics, carbon fiber and other advanced materials from lignin. The cash flow diagram for this process is shown below (in $ millions). If the company's hurdle rate (MARR) is 20% per year, is this a profitable undertaking? Click the icon to view the diagram for cash flows. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 20 per year. The present worth of the venture is $ million. (Round to two decimal places.)arrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education