FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:16

21

17

18

22

13

14

15

19

20

23

10

11

12

24

25

26

27

6

7

29

30

2

4

5

8

28

3

9

6

7

8

9

5

#

1

2

3

4

Date

1/1/2023

1/1/2023

1/1/2023

1/1/2023

1/1/2023

1/18/2023

1/20/2023

Account Name

1/28/2023

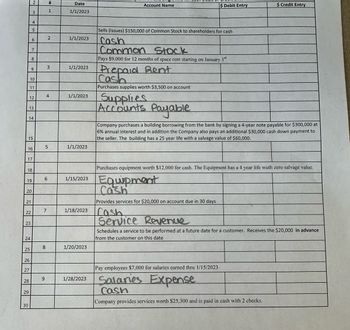

Sells (Issues) $150,000 of Common Stock to shareholders for cash

Cash

$ Debit Entry

Common Stock

Pays $9,000 for 12 months of space rent starting on January 1st

Prepaid Bent

Cash

Purchases supplies worth $3,500 on account

Supplies

Accounts Payable

1/15/2023 Equipment

Cash

Company purchases a building borrowing from the bank by signing a 4-year note payable for $300,000 at

6% annual interest and in addition the Company also pays an additional $30,000 cash down payment to

the seller. The building has a 25 year life with a salvage value of $60,000.

$ Credit Entry

Purchases equipment worth $12,000 for cash. The Equipment has a 4 year life wuth zero salvage value.

Provides services for $20,000 on account due in 30 days

Cash

Service Revenue

Schedules a service to be performed at a future date for a customer. Receives the $20,000 in advance

from the customer on this date

Pay employees $7,000 for salaries earned thru 1/15/2023

Salaries Expense

Cash

Company provides services worth $25,300 and is paid in cash with 2 checks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alabama A&M AppsAnywhere Content * CengageNOWv2 | Online teachin x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false E Apps M Gmail O YouTube A Maps a News E Reading list Bank Reconciliation and Entries The cash account for Stone Systems at July 31, 20Y5, indicated a balance of $12,700. The bank statement indicated a balance of $15,810 on July 31, 20Y5. Comparing the bank statement and the accompanying canceled checks and memos with the records reveals the following reconciling items: a. Checks outstanding totaled $5,690. b. A deposit of $5,930, representing receipts of July 31, had been made too late to appear on the bank statement. c. The bank had collected $3,080 on a note left for collection. The face of the note was $2,920. d. A check for $500 returned with the statement had been incorrectly recorded by Stone Systems as $550. The check was for the payment of an obligation to Holland Co. for the purchase of office…arrow_forwardFill in the blanks please !!arrow_forwardsanjuarrow_forward

- Marcus has a balance of $2,600 on his credit card. The credit card has an annual interest rate of 21%, compounded monthly (1.75% each month). Marcus uses his credit card for various expenses throughout month and, at the end of each month, makes a $275 payment. Use this information to complete the table below. Round to the nearest cent as needed. 1.75% Interest Month Prior Balance on Prior Balance 2 $2600 $ 4 $50.17 $2871.83 %24 %24 3.arrow_forwardOrearrow_forwardCalculate (a) the amount financed, (b) the total finance charge, and (c) APR by table lookup. (Use Table 14.1.) Purchase price of a used car $ Down payment 4,095 $ 95 Number of monthly payments 60 Amount financed Total of monthly payments $ 5,844 Total finance charge APRarrow_forward

- #9 O Item Prior year Current year Accounts payable 8,113.00 7,909.00 Accounts receivable 6,029.00 6,555.00 Accruals 999.00 1,352.00 Cash ??? ??? Common Stock 11,096.00 12,144.00 COGS 12,698.00 18,074.00 Current portion long-term 4,971.00 4,959.00 debt Depreciation expense 2,500 2,836.00 Interest expense 733 417 Inventories 4,232.00 4,816.00 Long-term debt 14,899.00 14,036.00 Net fixed assets 50,114.00 54,819.00 Notes payable 4,323.00 9,810.00 Operating expenses (excl. 13,977 18,172 depr.) Retained earnings 28,849.00 29,434.00 Sales 35,119 46,806.00 Таxes 2,084 2,775 What is the firm's cash flow from investing? Submit Answer format: Number: Round to: 0 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forwardChapter 5 Exercises i Saved 49 Required information Part 4 of 7 (The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Debit Credit 1 $ 26,100 14,700 Cash points Accounts Receivable Allowance for Uncollectible Accounts $ 3,000 Supplies Notes Receivable (6, due in 2 years) Land Skipped 3,600 15,000 80,000 Accounts Payable Conmon Stock Retained Earnings 7,900 95,000 33,500 eBook Totals $139,400 $139,400 Print During January 2021, the following transactions occur: 2 Provide services to customers for cash, $46,100. 6 Provide services to customers on account, $83,400. January January January 15 write off accounts receivable as uncollectible, $2,500. January 20 Pay cash for salaries, $32, 500. January 22 Receive cash on accounts receivable, $81,000. January 25 Pay cash on accounts payable, $6,600. January 30 Pay cash for utilities during January, $14,800. References…arrow_forwardC8 EHW Question 3 of 6 View Policies Current Attempt in Progress On May 10, Coronado Industries sold merchandise for $3, 100 and accepted the customer's Best Business Bank MasterCard. At the end of the day, the Best Business Bank. MasterCard receipts were deposited in the company's bank account. Best Business Bank charges a 4.00% service charge for credit card sales. Prepare the entry on Coronado Industries's books to record the sale of merchandise. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forward

- CengageNOWv2| Assignmer * CengageNOWv2 | Online tea QAccounting Ch. 12 Flashcards New Tab com The purchases journal for J. K. Insurance for the month of October is represented below. Accounts Payable is account number 202 and Purchases is account number 501. PURCHASES JOURNAL Page 5 Purchases Debit/ Accounts Payable Date Invoice No. From Whom Purchased Post Ref. Credit Oct. 2 3118 Express Florist 3,550.00 4 3119 T. C. S. Supplies 2,790.00 8 3120 Auto Body Repair 3,850.00 3121 Signs Unlimited 4,150.00 10 3122 Dynasty Limo 2,380.00 15 3123 T. C. S. Supplies 2,150.00 18,870.00 Required: 1. Post the information from the purchases journal to the appropriate general ledger and accounts payable ledger accounts. GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 202 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT Oct. 2 P5 ACCOUNT Purchases ACCOUNT NO. 501 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT P5arrow_forwardA potential employer needs Katie's permission to review her credit report. True False Previous Page #3 D C 54 $ L % 5 Next Page t acer 6 A 6 y & 7 Ö u *00 8 O ( 9 A O 0 3 L' Р Page 1 baarrow_forwards/ui/v2/assessment-player 80 F3 $ OCT 26 4 Q F4 Question 1 of 1 The statement from Jackson County Bank on December 31 showed a balance of $26,662. A comparison of the bank statement with the Cash account revealed the following facts. 1. 2 3. Your answer is incorrect. 4 The bank collected a note receivable of $2,500 for Sheffield Corp. on December 15 through electronic funds transfer. The December 31 receipts were deposited in a night deposit vault on December 31. These depasits were recorded by the bankid January Checks outstanding on December 31 totaled $1.200. On December 31, the bank statement showed an NSF charge of $630 for a check received by the company from L. Bryan, a customer on account Prepare a bank reconciliation as of December 31 based on the available information. (Hint: The cash balance per books is $26,292. This can be proved by finding the balance in the Cash account from parts (a) and (b)) (List items that increase cash balance first Reconcile cash balance per bank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education