Concept explainers

Predetermined

Norwall Company’s budgeted variable

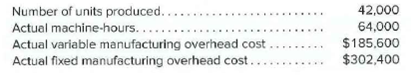

The following information is available for a recent month:

a. The denominator activity of 60,000 machine-hours is used to compute the predetermined overhead rate.

b. At a denominator activity of 60,000 machine-hours, the company should produce 40,000 units of product.

c. The company’s actual operating results were:

Required:

1. Compute the predetermined overhead rate and break it down into variable and fixe elements.

2. Compute the standard hours allowed for the actual production.

3. Compute the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Direct Materials and Direct Labor Variance Analysis Abbeville Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 40 employees. Each employee presently provides 32 hours of labor per week. Information about a production week is as follows: Standard wage per hr. $10.80 Standard labor time per faucet 10 min. Standard number of lb. of brass 1.30 lb. Standard price per lb. of brass $9.75 Actual price per lb. of brass $10.00 Actual lb. of brass used during the week 11,600 lb. Number of faucets produced during the week 8,700 Actual wage per hr. $11.10 Actual hrs. per week 1,280 hrs. Required: a. Determine the standard cost per faucet for direct materials and direct labor. Round the cost per unit to two decimal places. b. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus…arrow_forwardOverhead Variances, Two- And Three-Variance Analyses Oerstman, Inc., uses a standard costing system and develops its overhead rates from the current annual budget. The budget is based on an expected annual output of 121,500 units requiring 486,000 direct labor hours. (Practical capacity is 506,000 hours.) Annual budgeted overhead costs total $748,440, of which $544,320 is fixed overhead. A total of 119,200 units using 484,000 direct labor hours were produced during the year. Actual variable overhead costs for the year were $240,100, and actual fixed overhead costs were $555,300. Required: 1. Compute overhead variances using a two-variance analysis. Budget Variance $ Unfavorable Volume Variance $ Unfavorable 2. Compute overhead variances using a three-variance analysis. Spending Variance $ Unfavorable Efficiency Variance $ Unfavorable Volume Variance $ Unfavorablearrow_forwardOverhead Variances, Two- And Three-Variance Analyses Oerstman, Inc., uses a standard costing system and develops its overhead rates from the current annual budget. The budget is based on an expected annual output of 120,000 units requiring 480,000 direct labor hours. (Practical capacity is 500,000 hours.) Annual budgeted overhead costs total $748,800, of which $532,800 is fixed overhead. A total of 119,500 units using 478,000 direct labor hours were produced during the year. Actual variable overhead costs for the year were $241,900, and actual fixed overhead costs were $555,000. Required: 1. Compute overhead variances using a two-variance analysis. Budget Variance Volume Variance 2. Compute overhead variances using a three-variance analysis. Spending Variance Efficiency Variance Volume Variancearrow_forward

- .arrow_forwardPlease help me with show all calculation thankuarrow_forwardA company uses a standard costing system with direct labor hours (DLHS) as the allocation base for fixed manufacturing overhead (FMOH) and a standard of 3 DLHS per unit. For the most recent period, the company reported the following data: FPOHR Actual DLHS Actual FMOH FMOH Budget Variance FMOH Volume Variance $2.5 per DLH 10,500 hours $36,000 $3.000 Unfavorable $1.500 Favorable Q. What was the actual number of units produced for the period? ANS. unitsarrow_forward

- Required: 1. For direct materials: a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month’s production. c. Compute the standard hours allowed per unit of product.arrow_forwardNonearrow_forwardDirect Materials and Direct Labor Variance Analysis Abbeville Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 70 employees. Each employee presently provides 40 hours of labor per week. Information about a production week is as follows: $17.40 20 min. 1.20 lb. Standard wage per hr. Standard labor time per faucet Standard number of lb. of brass Standard price per lb. of brass Actual price per lb. of brass Actual lb. of brass used during the week Number of faucets produced during the week Actual wage per hr. Actual hrs. for the week Required: $11.50 $11.75 7,400 lb. 6,000 $17.90 2,800 hrs. a. Determine the standard cost per unit for direct materials and direct labor. Do not round your intermediate calculations and round the cost per unit to two decimal places. Direct materials standard cost per unit Direct labor standard cost per unit Total standard cost per unit materials cost variance. Do not round your intermediatearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education