FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

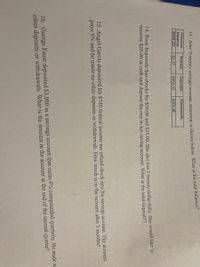

Transcribed Image Text:. Alec Tomita's savings account statement is shown below What is his new balance?

Previous

Balance

S568.23

Interest

Deposits

Withdrawals

$2.37

$562.32

S874.36

14. Rosa Izquierdo has checks for $50.00 and $35.00. She also has 2 twenty-dollar bills. She would like to

receive $25.00 in cash and deposit the rest in her saving account. What is the total deposiť??

15. Angel Garcia deposited his $750 federal income tax refund check into his savings account. The account

pays 5% and he made no other deposits or withdrawals. How much is in the account after 3 months?

16. George Faust deposited $3,000 in a savings account that earns 4% compounded quarterly. He made nc

other deposits or withdrawals. What is the amount in the account at the end of the second quarter?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cy loans Mookie The Beagle Concierge $1,000 at 6% annual interest. Record the transaction as a loan payable as follows. Required: 1. Complete a Deposit. a. Select (+) New icon > Bank Deposit b. Select Account: 1001 Checking c. Select Date: 01/12/2023 d. In Add Funds to This Deposit section, select Account: + Add New > Account Type: Other Current Liabilities > Detail Type: Loan Payable > Name: Loan Payable> Number: 2300 > Save and Close e. Select Payment Method: Check f. Enter Reference Number: 5002 g. Enter Amount: 1000.00 h. Select Save and close i. What is the Amount of the Loan Payable? Note: Answer this question in the table shown below. Round your answer to the nearest dollar amount. i. Amount of the loan payablearrow_forwardTable 2: Deposit Slip CHECKING DEPOSIT Name: Jamal Houston Date: May 17, 2021 Account Number: 1234 5678 9012 16. How much in checks are being deposited in the deposit slip above? C H E S CURRENCY COINS 2-36 8-97 10-87 SUBTOTAL LESS CASH TOTAL DEPOSIT DOLLARS CENTS 345 00 0 58 55 20 125 61 92 18 75 00 17. What is the total deposit amount in the deposit slip above?arrow_forwardA ____ is an interest-bearing checking account. Group of answer choices NOW account certificate of deposit Treasury bill regular checking account Series EE US savings bondarrow_forward

- Instructions: Calculate the following Reconciliation for Hancock, Reid, & Carson for the period ending March 31, 2021. Prepare the March bank reconciliation statement on the blank statement provided for Hancock, Reid, & Carson Ltd. according to the following information: • Royal Bank of Canada statement says the current balance is $17,864.12. • There was an NSF cheque #1706 from Peter Bartrum in the amount of $1,870.54. There are bank service charges of $60.00; there are overdraft interest charges of $86.90; there is a preauthorized loan payment charge of $617.44; the bank paid Hancock, Reid & Carson Ltd. $204.12 interest on a revolving T-bill investment, and there is a charge of $54.00 for the annual rental of a safety deposit box. Upon comparing the bank statement to the company's cheque register, you noted that the final balance in the cheque register was $16,627.01 and that cheques #588 for $198.27, #592 for $i,846.40, #596 for $374.80 and #599 for $1,320.40 are outstanding. You…arrow_forwardeBook Using the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $4,678 Book balance: $2,351 Deposits in transit: $325 Outstanding checks: $108 and $534 Bank service charges: $25 Notes receivable: $2,000; Interest income: $35 If an amount box does not require an entry, leave it blank.arrow_forward2. DETAILS rise BRECMBC9 4.11.TB.011. On May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. O $29.95 O $943.80 O $1,003.70 $1,108.88arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education