FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:PART AWhich of the following is a current asset? A. Insurance paid in advance B. Accrued salary C.

Prepald commission revenue D. Accrued Interest expenses A machine was bought for RM150,000 on 1

January 2021. The business decided to use a polcy of a 20% straight-Ine method for depreciation.

Calculate the carrying value for machinery as at 31 December 2022. A. RM30,000 B. RM60,000 C. RM

90,000 D. RM120,000 A decrease in allowance for doubtrul debts will result in A. a decrease in net proft B

an increase in revenues C. an increase in expenses D. an increase in llabilities On 1 June 2022, one of

the credit customers, Danlel was no longer able to repay his debts worth RM4,500 and the business

decided to write off the amount. The adjustment to record this transaction for the year ended 31 December

2022 will require a A. credit to Allowance for doubtful debts account B. debit to Bad debts account C.

deblt to Allowance for doubtiul debts account D. credit to Account recelvable This part consists of 10

multiple-choice questions. Choose the most sultable answers. A deblt note sent to a seler for damaged

goods is to be recorded in A. return outwards journal B. sales journal C. purchases journal D. return

Inwards journal A purchase of a motor van on credit is to be recorded in A. general Journal B. cash

payments journal C. purchases journal D. cash receipts Journal Which of the following is correct regarding

the calculation of the cost of goods soid? A. Opening Inventory + net purchases - carriage inwards -

closing Inventory. B. Opening inventory - net purchases + carriage inwards - closing Inventory. C.

Opening inventory + net purchases + carriage Inwards - closing Inventory. D. Opening inventory + net

purchases + carriage inwards + closing inventory. Al of the following statements about an accrued

revenue is not true? A. Goods or services have been provided to a customer, but no payment has been

received from the customer. B. It is treated as a current asset. C. It is treated as a current llability. D. It is

recognised as an earned revenue. Which of the following is true regarding a prepald expense? A. must be

recorded as an expense in the accounting period in which the expense is pald. B. refers to an expenditure

that has incurred during the current period but not yet pald. C. exists when payment is received in advance

from customers for goods or services that have not yet been delivered. D. must be reported as an expense

in the following accounting period when it is incurred. Which of the following items is not a capital

expenditure? A. Purchase of delivery van for warehouse B. Warehouse renovation costs C. Repair costs

for machine D. Machine Installation costs

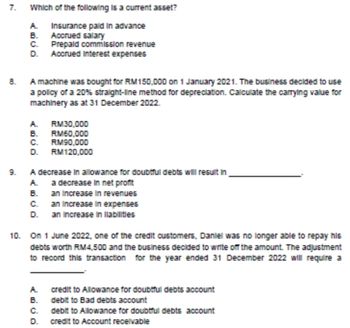

Transcribed Image Text:7. Which of the following is a current asset?

A. Insurance paid in advance

B. Accrued salary

C. Prepaid commission revenue

D. Accrued Interest expenses

8. A machine was bought for RM150,000 on 1 January 2021. The business decided to use

a policy of a 20% straight-line method for depreciation. Calculate the carrying value for

machinery as at 31 December 2022.

A. RM30,000

B.

RM60,000

C. RM90,000

D. RM120,000

9. A decrease in allowance for doubtful debts will result in

A. a decrease in net profit

B.

an increase in revenues

C.

D.

an increase in expenses

an Increase in Ilabilities

10. On 1 June 2022, one of the credit customers, Daniel was no longer able to repay his

debts worth RM4,500 and the business decided to write off the amount. The adjustment

to record this transaction for the year ended 31 December 2022 will require a

A.

credit to Allowance for doubtful debts account

debit to Bad debts account

B.

C.

debit to Allowance for doubtful debts account

D. credit to Account receivable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- what type of account accumulated depreciation? and depreciation expense is and on what statement each account goes?arrow_forward4. Which of the following is not an element of a statement of comprehensive income? a. Interest Payable b. Rent Expense c. Interest Expense d.Service Feearrow_forwardAccrued revenues would appear on the balance sheet as A. assets B. liabilities C. capital D. prepaid expenssesarrow_forward

- B4.arrow_forwardWhich item below is not a current liability? Select one: O O a. Unearned revenue b. Trade accounts payable c. cash dividends d. The currently maturing portion of long-term debtarrow_forwardThe monetary value of the net assets is reported at its historical cost on the balance sheet? a. physical capital b. excess capital c. net capital d. financial capitalarrow_forward

- In which of the following types of accounts are increases recorded by credits? Question 8 options: Revenue, Dividends Liability, Revenue Dividends, Asset Expense, Liabilityarrow_forwardWhich of the following is a current asset? Question 3 options: goodwill prepaid expenses accrued liabilities deferred revenuearrow_forwardCommunication (income statement): The balance of Interest Expense from accruing interest to be paid has what effect on the income statement in the current year? Multiple Choice A. Decreases net income. B. No effect. C. Increases net income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education