FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

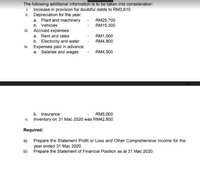

Transcribed Image Text:The following additional information is to be taken into consideration:

i. Increase in provision for doubtful debts to RM3,610

il. Depreciation for the year:

a. Plant and machinery

RM25,700

RM15,300

b. Vehicles

i. Accrued expenses:

a. Rent and rates

b. Electricity and water

iv. Expenses paid in advance:

a. Salaries and wages

RM1,000

RM4,800

RM4,500

b. Insurance

v. Inventory on 31 Mac 2020 was RM42,800.

RM5,000

Required:

a) Prepare the Statement Profit or Loss and Other Comprehensive Income for the

year ended 31 Mac 2020.

b) Prepare the Statement of Financial Position as at 31 Mac 2020.

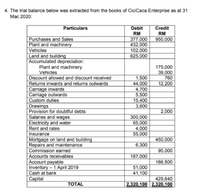

Transcribed Image Text:4. The trial balance below was extracted from the books of CiciCaca Enterprise as at 31

Мас 2020:

Particulars

Debit

Credit

RM

950,000

RM

Purchases and Sales

Plant and machinery

Vehicles

Land and building

|Accumulated depreciation:

Plant and machinery

Vehicles

Discount allowed and discount received

Returns inwards and returns outwards

|Carriage inwards

Carriage outwards

Custom duties

Drawings

Provision for doubtful debts

Salaries and wages

Electricity and water

Rent and rates

Insurance

Mortgage on land and building

Repairs and maintenance

Commission earned

Accounts receivables

Account payable

Inventory – 1 April 2019

Cash at bank

Capital

377,000

432,000

102,000

625,000

175,000

39,000

760

1,500

44,000

4,700

5,500

15,400

3,600

12,200

2,000

300,000

65,000

4,000

55,000

450,000

6,300

95,000

187,000

166,500

51,000

41,100

429,640

2,320,100 2,320,100

TOTAL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected accounts from Han Corporation’s trial balance are as follows. Prepare a partial balance sheet listing only the Fixed Assets section. Han Corporation Abbreviated Trial Balance December 31, 2020 Account Name (Acct. #) Debit Balances Credit Balances Cash 150,000 Short-term Marketable Securities 145,000 Accounts Receivable 26,000 Inventories 90,000 Other Current Assets 10,000 Land 350,000 Buildings 300,000 Accumulated Depreciation: Buildings 40,000 Equipment 145,000 Accumulated Depreciation: Equipment 150,000 Goodwill 40,000 Other Intangible Assets 20,000arrow_forwardharrow_forwardDon't answer in imagearrow_forward

- I need help with this question for accounting.arrow_forward3. The balance in Viray Company's accounts payable account at December 31, 2021 was P900,000, before any necessary year-end adjustment relating to the following: a. Goods in transit from a vendor to Viray on December 31, 2021. The invoice cost was P50,000, and the goods were shipped FOB Shipping point on December 29, 2021. The goods were received on January 4, 2022. b. Goods shipped FOB shipping point on December 20, 2021 from a vendor to Viray was lost in transit. The invoice cost was P25,000. On January 5, 2022, Viray filed a P25,000 claim against the common carrier. c. On December 31, 2021, Viray has a P20,000 debit balance in accounts payable to a supplier resulting from an advance payment for goods to be manufactured. What amount should be reported as accounts payable on its December 31, 2021 financial statement?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education